Chart of the week

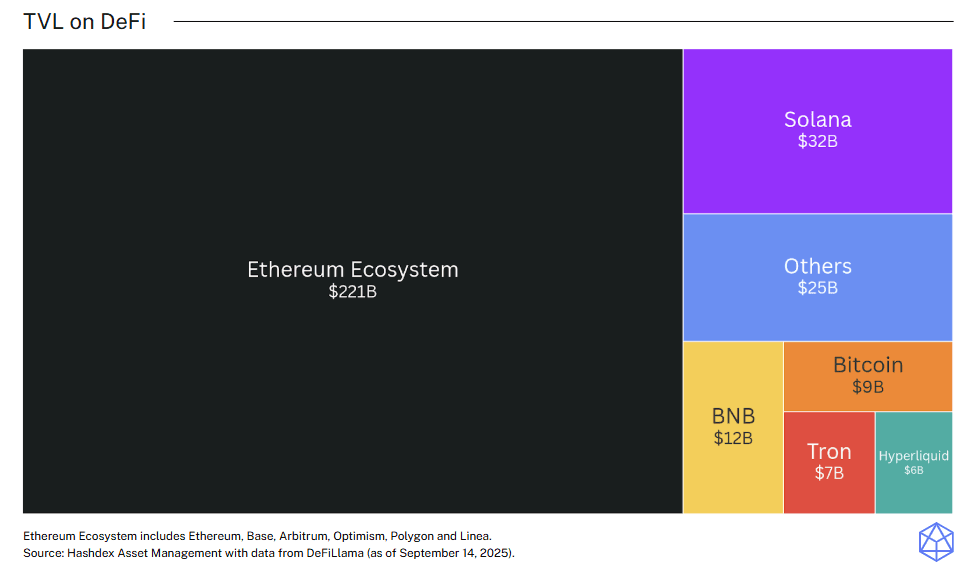

Stablecoins provide critical liquidity to the crypto ecosystem, and understanding their impact is essential to evaluating its applications. The Ethereum ecosystem, as a prime example, hosts a significant share of the total stablecoin supply, which appears to be a key driver of its massive Total Value Locked (TVL) in DeFi.

With an astonishing $221 billion in TVL, Ethereum holds nearly $200 billion more than its closest competitor, Solana. The vast liquidity from stablecoins is a likely cause for this difference, proving crucial for the growth and stability of decentralized networks.

Whilst development around what many consider crypto's "killer app" continues, stablecoins are likely to stay paving the way for a more trustworthy environment with increased demand for crypto’s ecosystem.

Market Highlights

SEC Chair for clear on-chain capital raising rules

SEC Chair Paul Atkins has stated that entrepreneurs should be able to raise capital on-chain "without endless legal uncertainty."

A clearer, more supportive framework could encourage innovation and investment to remain within the U.S., rather than moving overseas due to regulatory ambiguity. It sets the stage for "Project Crypto," which aims to modernize securities rules for the on-chain environment.

Hong Kong softer bank capital rules for crypto

Hong Kong Monetary Authority has drafted guidance proposing more lenient capital requirements for banks to hold certain regulated crypto.

By easing the capital burden on banks involved with digital assets, regulators aim to encourage greater institutional participation and integrate crypto more deeply into the mainstream financial system, aligning with global standards from the Basel Committee.

Senate unveil crypto market framework

Senate Democrats have introduced a comprehensive seven-pillar framework for regulating the U.S. crypto markets.

The framework sets the stage for bipartisan negotiations and signals a growing consensus in Washington that the crypto market is too significant to exist in a state of regulatory uncertainty.