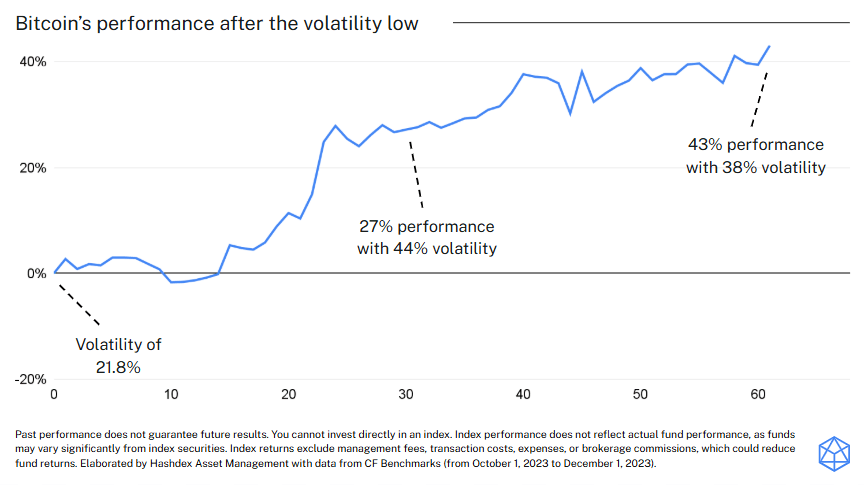

Chart of the week

Volatility is commonly used in finance as a proxy for risk, which is why the Sharpe ratio often becomes a key metric in portfolio allocation. While this framework makes sense in many contexts, it may not be the most appropriate way to think about volatility in crypto. Historically, the asymmetric potential of this asset class has been tied to the fact that spikes in Bitcoin’s (BTC) volatility often coincided with periods of significant price appreciation.

This “benign volatility” has naturally diminished over time, as BTC now has a market capitalization above $2 trillion and its price movements are less extreme than in earlier years. Still, even after a recent stretch of low volatility, the latest surges haven’t been a negative signal for investors—quite the opposite. Maybe this suggests that we should approach volatility with a different lens, when it comes to crypto investing.

Market Highlights

Hester Peirce signals urges swift progress

SEC Commissioner Hester Peirce has signaled a significant shift in the agency's approach to crypto regulation, switching gears from the SEC's previous stance and expressing hope for a future of regulatory clarity.

This shift in regulatory tone suggests a potentially collaborative approach for crypto in the US, bringing more stability and incentives to the ecosystem.

UK banks to launch tokenized deposits pilot

Major UK banks are running a live pilot for tokenized sterling deposits until mid-2026.

This marks a significant step in integrating blockchain into the UK's mainstream financial system, showcasing the growing crypto approval around the world.

Ethereum reclaims top spot for USDT supply

Ethereum has overtaken Tron as the top network for USDT, now carrying more than $80 billion worth of the stablecoin.

This shift indicates a preference for Ethereum's established DeFi ecosystem and institutional infrastructure, and it brings even more liquidity to the ecosystem, potentially resulting in demand surges for both the native token and Ethereum’s DeFI protocols.