Dear Investor,

Investors oscillated between optimism and anxiety in August, as uncertainty over the Fed’s rate policy plans hung over markets.

Crypto markets, however, seemed less concerned about macro headlines, a notable shift from earlier patterns. Both Bitcoin (BTC) and Ethereum (ETH) hit new all-time highs during the month as regulatory and institutional adoption tailwinds continued to blow.

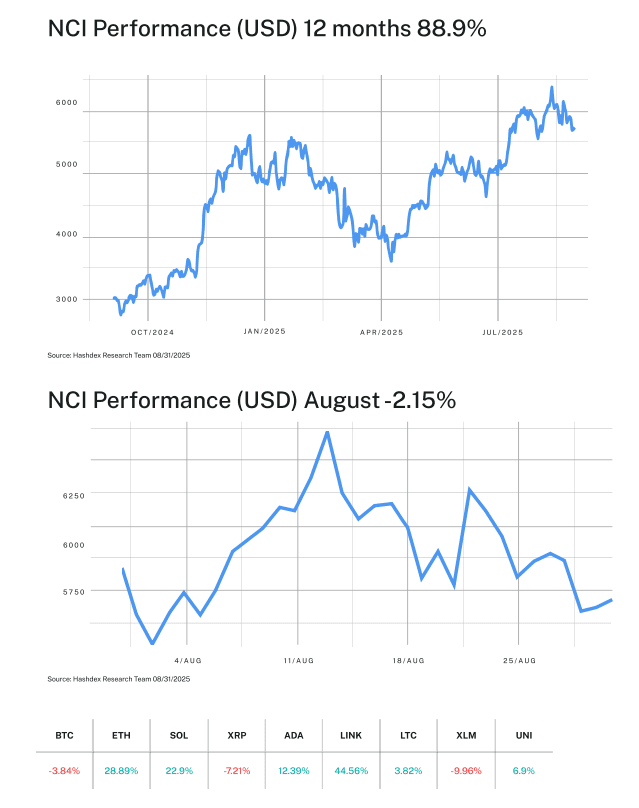

The Nasdaq Crypto IndexTM (NCITM) fell 2.15% in August, with ETH posting the strongest performance, rising 19.4%, spurred on by flows into ETH ETFs. In his latest Notes from the CIO, Samir Kerbage writes about Ethereum’s resurgence and how the smart contract platform is set up for longer term success.

As always, we are greatly appreciative of your trust in us and are here to answer any questions you may have.

-Your Partners at Hashdex

Market Review

August delivered a masterclass in market dynamics as crypto assets navigated the crosscurrents of macroeconomic uncertainty and technological advancement. The Nasdaq Crypto IndexTM (NCITM) posted a decline of 2.15%, with Ethereum surging 19.4% while Bitcoin retreated 6.72%. This performance dispersion, occurring amid Jackson Hole anticipation and uncertainty around Fed policy, revealed crypto's evolution from monolithic risk asset to nuanced ecosystem with distinct investment narratives.

The Federal Reserve's decision to maintain rates at 4.25%-4.50% on July 30, with two dissenting governors voting for cuts, set an uncertain tone that persisted through August. Markets oscillated between optimism and anxiety as investors parsed every economic datapoint for clues about September's FOMC meeting. The CME FedWatch tool showed 67% probability of a September cut by month's end, yet crypto markets seemed more focused on protocol-specific developments than macro headlines, a notable shift from earlier patterns.

Bitcoin's 6.72% decline, and intramonth price action from peaks near $124,000 to August lows around $108,000, reflected profit-taking after July's rally and uncertainty ahead of Jackson Hole. Yet this correction felt orderly rather than panicked. Over $500 million in leveraged long liquidations occurred during the month, but spot accumulation continued, exchanges recorded 72,000 BTC daily outflows as institutions quietly built positions. The divergence between derivatives deleveraging and spot accumulation suggested a market maturing beyond speculative excess.

Ethereum emerged as August's star performer with a 19.4% gain, driven by massive institutional ETF inflows exceeding $4 billion. The CLARITY Act's formal implementation and Ethereum's reclassification as a utility token catalyzed this institutional rush. Perhaps more significantly, nine crypto whales acquired $450 billion worth of ETH during August, while 48 new institutional wallets emerged holding $4.16 billion combined. With staking yields between 3.8%-6% and annual supply contracting 0.5%, Ethereum offered a compelling value proposition even as technical indicators flashed overbought warnings.

Solana continued its impressive 2025 trajectory with a 16.85% August gain, benefiting from $1.72 billion in infrastructure investment and growing enterprise adoption. The network processed record transaction volumes as major corporations deployed production applications, validating Solana's high-performance architecture. This wasn't speculative enthusiasm but fundamental adoption, a critical distinction in crypto's maturation journey.

Thematic indices painted an encouraging picture of sectoral recovery. The Smart Contract Platform (Web3) index gained 9.09%, while Decentralized Finance (DeFi) rose 7.92%, notable given DeFi's challenging year with a 7.09% YTD decline. The Digital Culture (META) index added 4.67%, though its crushing 38.87% YTD loss highlighted the challenges facing speculative sectors. The Vinter Hashdex Risk Parity Momentum (HAMO) index's 3.02% gain demonstrated the value of systematic strategies during volatile periods.

The Early Signs of Intra-Class Decorrelation

August brought important signs of maturity in the crypto market. More and more, digital assets are responding to their own fundamentals rather than moving as one. This differentiation is healthy and marks a step forward in the evolution of the asset class.

Three factors help explain this shift. First, regulatory clarity provided by the GENIUS Act has reduced political uncertainty and allowed protocols to be assessed for what they deliver rather than global risk sentiment. Second, institutional adoption has introduced new investor profiles with distinct objectives, whether seeking yield through staking, building payment infrastructure, or accumulating digital gold. Finally, use cases have expanded well beyond speculation. Stablecoins, for instance, processed $27.6 trillion in annual volume, surpassing traditional payment networks. This maturity is strengthening the market and is already attracting institutional allocators searching for uncorrelated returns, evidenced by 23% of corporate CFOs planning to adopt crypto within the next two years.

Looking Forward: September's Critical Inflection

As we enter September, multiple catalysts position crypto at a critical juncture:

Federal Reserve Decision: The September 17-18 FOMC meeting looms large. A rate cut could unleash risk appetite, while a hawkish hold might trigger further consolidation. Yet August's decorrelation suggests crypto may chart its own course regardless.

Ethereum's Scaling Moment: The Dencun upgrade's full effects are materializing, with Layer 2 transaction costs approaching zero. This infrastructure breakthrough could catalyze the long-awaited DeFi renaissance, particularly as institutional products launch.

Stablecoin Supercycle: With annual volume exceeding $27 trillion and regulatory clarity established, stablecoins are poised for explosive growth. Amazon's rumored payment token and JPMorgan's expanded JPM Coin could add hundreds of billions to the ecosystem.

The contrast with traditional markets remains striking. Gold's 31.38% YTD gain reflects persistent inflation concerns and geopolitical uncertainty. Yet the NCI’s 18.67% return, achieved amid far greater volatility and regulatory evolution, demonstrates crypto’s remarkable resilience. As institutional infrastructure matures and use cases proliferate, the asset class appears positioned for its next growth phase.

August's mixed performance, slight index decline masking dramatic individual gains, exemplifies crypto's complex evolution. This isn't the speculative frenzy of 2021 or the existential crisis of 2022. It's measured progress toward mainstream adoption, with occasional volatility reminding us that transformation rarely follows a straight line. For investors seeking exposure to this digital revolution, market cap-weighted indices like the NCI offer the optimal balance of participation and protection.

The future of finance continues being written in code, law, and market dynamics simultaneously. August 2025 proved that crypto's journey toward institutional legitimacy proceeds despite, or perhaps because of, its growing independence from traditional market narratives.

Top Stories

US Government data on public blockchains

The US Department of Commerce is now publishing key macroeconomic data on public blockchains like Ethereum and Solana. This initiative embraces blockchain technology for data distribution, enhancing transparency and accessibility. It reflects a broader trend of integrating digital assets into governmental routines.

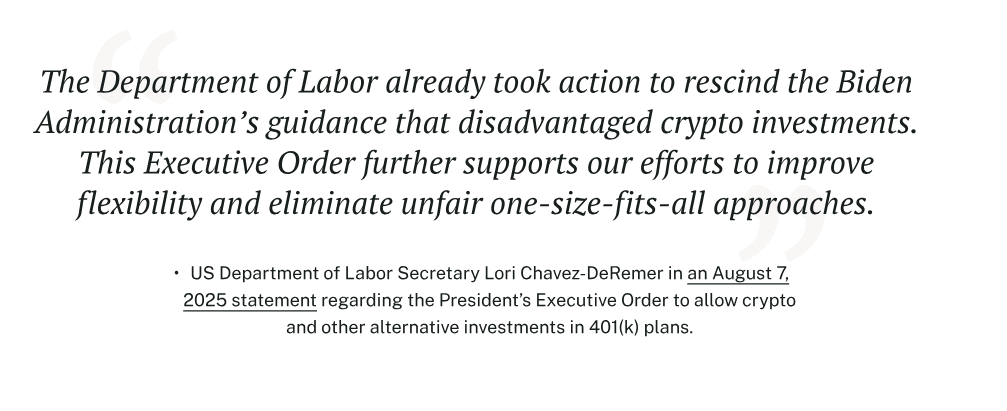

US opens door to 401(k) crypto allocations

The US Secretary of Labor will review regulations and guidance to allow 401(k) investors access to a broader range of alternative assets in the US, including digital assets.

This aims to provide everyday investors with the same opportunities as wealthier individuals, potentially fostering crypto’s adoption.

Harvard makes significant investments in BTC

The Harvard Management Company (HMC) purchased $116.7 million of bitcoin ETF products during the second quarter of 2025. This highlights a growing trend among institutional investors to use ETFs to gain exposure to alternative assets like Bitcoin.

_________________________

This material expresses Hashdex Asset Management Ltd. and its subsidiaries and affiliates (“Hashdex”)'s opinion for informational purposes only and does not consider the investment objectives, financial situation or individual needs of one or a particular group of investors. We recommend consulting specialized professionals for investment decisions. Investors are advised to carefully read the prospectus or regulations before investing their funds.

The information and conclusions contained in this material may be changed at any time, without prior notice. Nothing contained herein constitutes an offer, solicitation or recommendation regarding any investment management product or ser vice. This information is not directed at or intended for distribution to or use by any person or entity located in any jurisdiction where such distribution, publication, availability or use would be contrary to applicable law or regulation or which would subject Hashdex to any registration or licensing requirements within such jurisdiction.

These opinions are derived from internal studies and do not have access to any confidential information. Please note that future events may not unfold as anticipated by our team’s research and analysis. No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of Hashdex.

By receiving or reviewing this material, you agree that this material is confidential intellectual property of Hashdex and that you will not directly or indirectly copy, modify, recast, publish or redistribute this material and the information therein, in whole or in part, or other wise make any commercial use of this material without Hashdex’s prior written consent.

Investment in any investment vehicle and crypto assets is highly speculative and is not intended as a complete investment program. It is designed only for sophisticated persons who can bear the economic risk of the loss of their entire investment and who have limited need for liquidity in their investment. There can be no assurance that the investment vehicles will achieve its investment objective or return any capital. No guarantee or representation is made that Hashdex’s investment strategy, including, without limitation, its business and investment objectives, diversification strategies or risk monitoring goals, will be successful, and investment results may var y substantially over time.

Nothing herein is intended to imply that the Hashdex s investment methodology or that investing any of the protocols or tokens listed in the Information may be considered “conservative,” “safe,” “risk free,” or “risk averse.” These opinions are derived from internal studies and do not have access to any confidential information. Please note that future events may not unfold as anticipated by our team’s research and analysis.

Certain information contained herein (including financial information) has been obtained from published and unpublished sources. Such information has not been independently verified by Hashdex, and Hashdex does not assume responsibility for the accuracy of such information. Hashdex does not provide tax, accounting or legal advice. Certain information contained herein constitutes for ward-looking statements, which can be identified by the use of terms such as “may,” “ will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” “believe” (or the negatives thereof ) or other variations thereof. Due to various risks and uncertainties, including those discussed above, actual events or results, the ultimate business or activities of Hashdex and its investment vehicles or the actual performance of Hashdex, its investment vehicles, or digital tokens may differ materially from those reflected or contemplated in such for ward-looking statements.

As a result, investors should not rely on such for ward- looking statements in making their investment decisions. None of the information contained herein has been filed with the U.S. Securities and Exchange Commission or any other governmental or self-regulator y authority. No governmental authority has opined on the merits of Hashdex’s investment vehicles or the adequacy of the information contained herein.

Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular digital asset or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any digital asset or any representation about the financial condition of a digital asset. Statements regarding Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate assets before investing. ADVICE FROM A FINANCIAL PROFESSIONAL IS STRONGLY ADVISED.