Dear Investor,

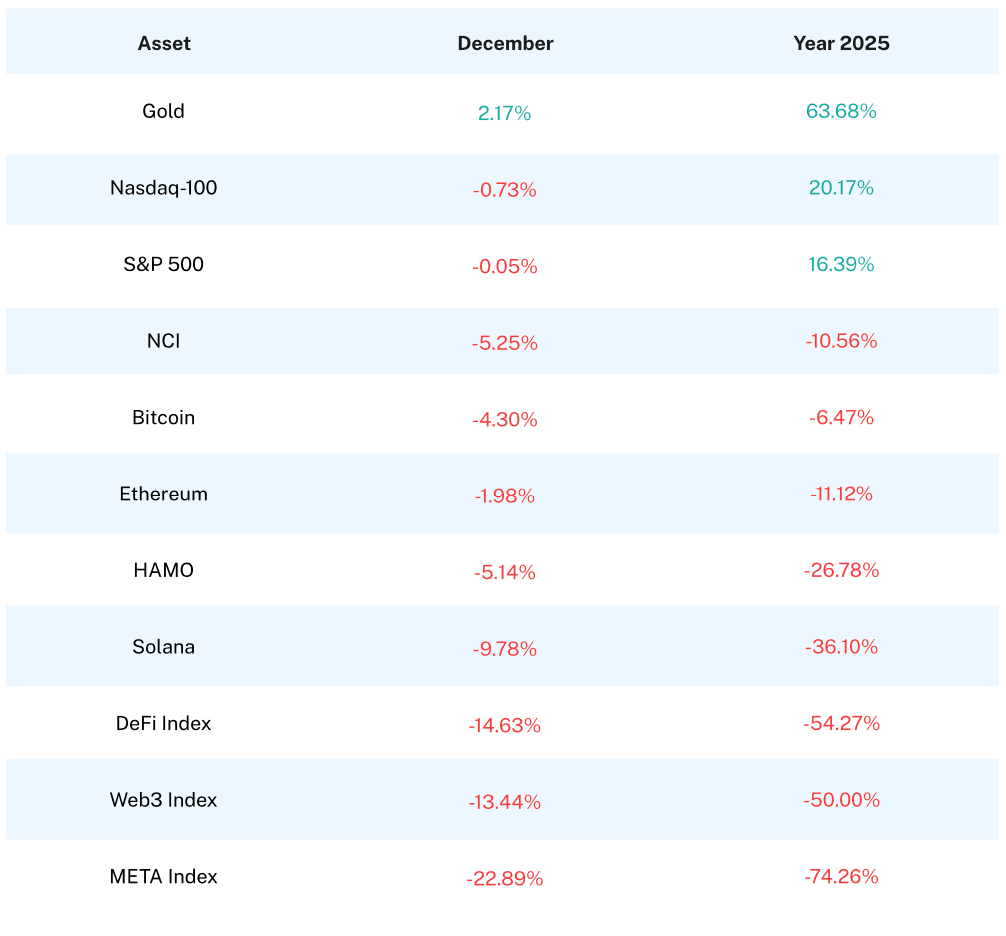

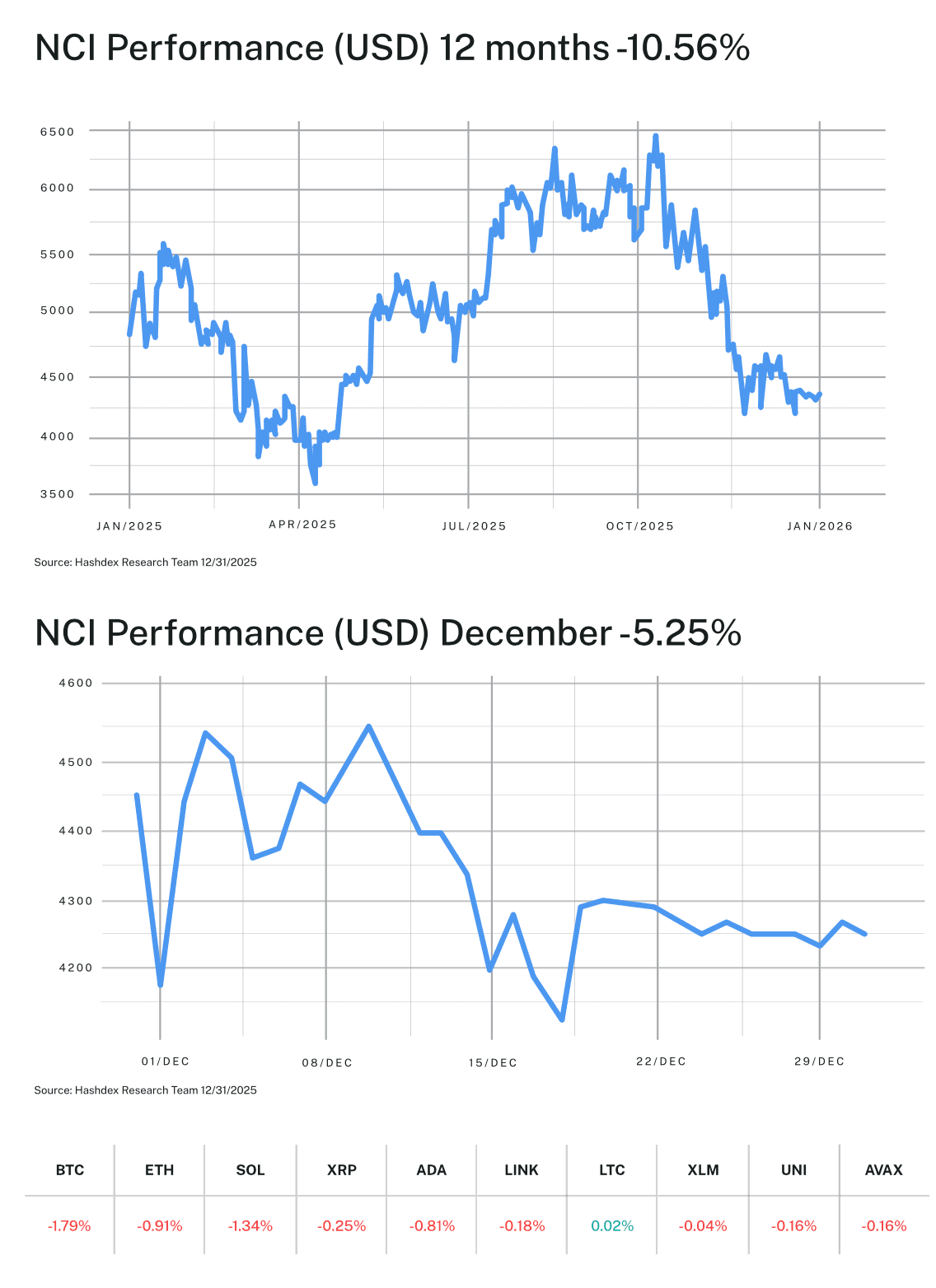

Volatility might have seemed the headline story for crypto in 2025, as tariff turmoil took hold before bitcoin and ether breached new all-time highs, only to face significant selling pressure in the fourth quarter of the year. Prices stabilized in December, with the Nasdaq Crypto IndexTM (NCITM) rising 3.87%, but the index ended up in negative territory for the year, falling 1.95%.

In the volatile 2025 environment, crypto assets underperformed nearly every traditional benchmark. But this underperformance and overall price volatility obscure what we think was one of the most important years in crypto’s history—2025 was a year of incredible infrastructure developments that support the long term investment case for crypto.

This infrastructure buildout, including increased regulatory clarity, custody solutions, ETFs, and institutional products is setting up a much stronger and sustainable investment case for this emerging asset class in 2026 and beyond.

We believe these developments will help drive positive performance this year. In our 2026 Crypto Investment Outlook we do a deep dive into how exactly we see the year playing out, including some predictions for the areas that will see the most growth.

As always, we are greatly appreciative of your trust in us and are here to answer any questions you may have.

-Your Partners at Hashdex

Market Review

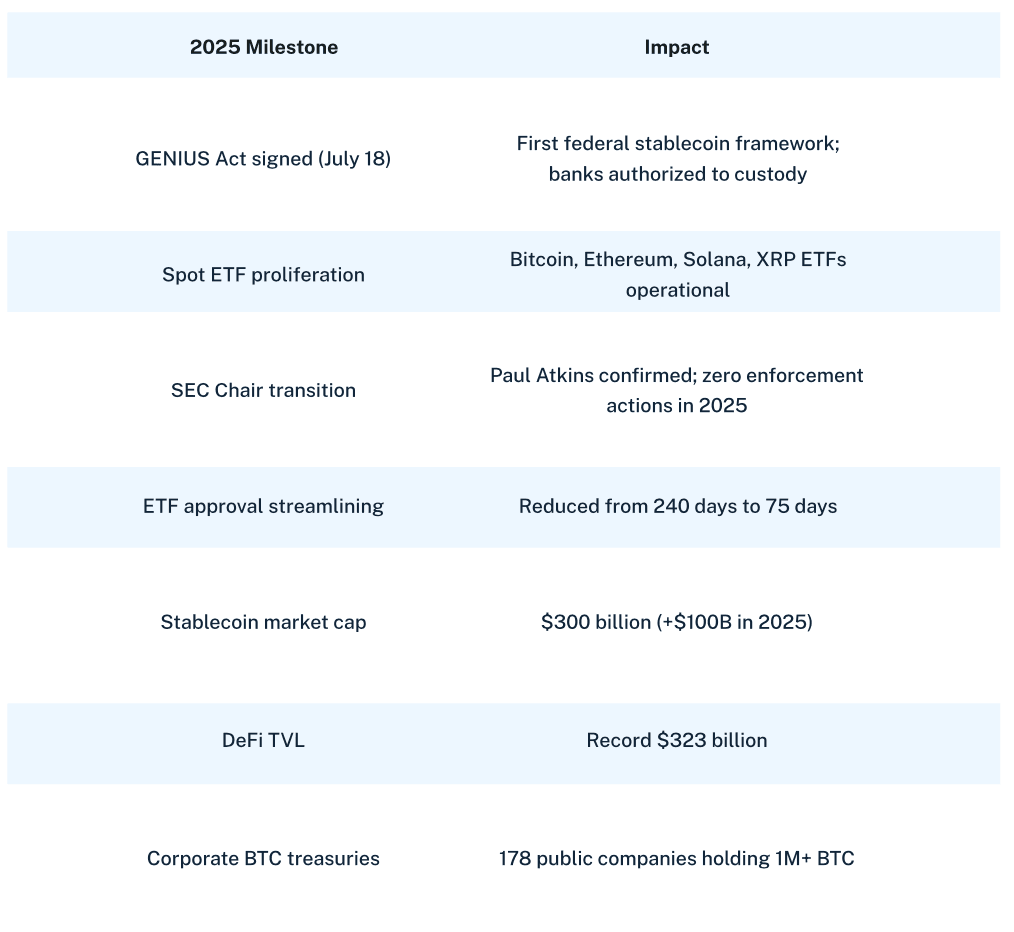

December brought measured stabilization after November's capitulation, as the Nasdaq Crypto IndexTM (NCITM) gained 3.87%—a modest recovery that nonetheless left 2025 returns in negative territory at -1.95%. The year that began with tariff turmoil and saw Bitcoin touch $126,000 concluded with crypto assets underperforming nearly every traditional benchmark. Yet, focusing solely on price obscures 2025's true significance: this was the year crypto's institutional infrastructure matured from aspiration to reality. The GENIUS Act became law, spot ETFs proliferated across Bitcoin, Ethereum, Solana, and XRP, and regulatory clarity transformed from perpetual promise to concrete framework.

The Federal Reserve's December 9-10 rate cut—25 basis points to 3.50%-3.75%—came with unexpected hawkishness that rattled markets. Three governors dissented (the first triple dissent since September 2019), and Chairman Powell signaled just one additional cut expected in 2026. Traditional markets absorbed this guidance with remarkable resilience: the S&P 500 hit a record 6,945 on December 27, finishing 2025 up 17.7%, while the Nasdaq-100 gained 21.0%. Gold extended its dominance with a staggering 68.4% annual return, reaching an all-time high near $4,500 per ounce—its strongest performance since the late 1970s.

Ethereum emerged as December's clear winner, gaining 8.12% following the successful Fusaka upgrade activation on December 3. The implementation of PeerDAS (Peer Data Availability Sampling) delivered meaningful improvements: validators now verify small data samples rather than full blobs, reducing bandwidth requirements by up to 80% for full nodes and cutting Layer 2 transaction fees by 40-60%. This technical milestone—featuring 13 EIPs including passkey signature support—drove 190,000 new wallet creations within 24 hours, 35% above average. Despite December's strength, Ethereum finished 2025 down 4.21%, highlighting the disconnect between network advancement and price appreciation.

Bitcoin declined 5.83% in December as year-end tax-loss harvesting triggered sustained ETF outflows—approximately $1.9 billion across mid-December alone. Yet long-term accumulation continued unabated. Strategy (formerly MicroStrategy) purchased 22,498 BTC ($2.05 billion) during December, bringing total holdings to 672,497 BTC valued at over $60 billion. The U.S. Strategic Bitcoin Reserve now holds approximately 198,000 BTC, institutionalizing Bitcoin as a sovereign reserve asset. Despite December's decline, Bitcoin's -3.47% annual return marks its first negative year since 2022.

Thematic indices showed mixed December performance. The Smart Contract Platform (Web3) index gained 5.24% on Ethereum's Fusaka momentum, while the Decentralized Finance (DeFi) index rose 3.15% as total value locked reached a record $237 billion. The Vinter Hashdex Risk Parity Momentum (HAMO) index added 2.08%, its systematic approach capturing the stabilization. The Digital Culture (META) index declined 1.82%, extending its -67.23% annual loss—a stark reminder of speculation's perils.

2025 in Review: Infrastructure Over Price

The numbers tell one story; the infrastructure tells another. While the NCI finished 2025 down 1.95% and Bitcoin declined 3.47%, the year fundamentally transformed crypto's institutional foundation:

This infrastructure buildout—regulatory frameworks, custody solutions, ETF vehicles, institutional products—creates the foundation for sustainable adoption. The divergence between declining prices and accelerating institutional commitment mirrors the internet's trajectory in the late 1990s, when usage metrics exploded years before valuations reflected underlying value.

Gold's extraordinary 68.42% gain—outperforming Bitcoin by over 70 percent—demands honest assessment of the "digital gold" narrative. When the original significantly outperforms its digital counterpart during a year of monetary policy uncertainty and geopolitical tension, the thesis requires recalibration. Bitcoin's unique properties—programmability, transportability, divisibility, verifiable scarcity—remain intact, but 2025 demonstrated that narrative alone cannot sustain valuations when institutional flows reverse.

The thematic indices' struggles reveal market structure evolution. The META index's 67.23% decline, DeFi's 44.74% drop, and Web3's 39.21% loss occurred despite fundamental adoption metrics reaching all-time highs. This price-adoption divergence suggests either opportunity or structural change—thematic indices may require clearer value accrual mechanisms to compete for institutional capital.

Market Cap-Weighted Indices: The Anchor in Stormy Seas

The NCI's -1.95% annual return, while disappointing in absolute terms, significantly outperformed every thematic index. The methodology's heavy Bitcoin allocation (approximately 75% weight) provided crucial downside protection when smaller-cap sectors collapsed. An investor holding equal weights across all crypto sectors would have suffered drawdowns exceeding 30%, while the NCI's systematic approach limited losses to under 2%.

This isn't about celebrating modest losses—it's about understanding how market cap weighting preserves capital during adverse conditions, enabling participation in eventual recoveries. The mathematics of compounding favor limiting drawdowns over maximizing gains during bull markets. A portfolio down 50% requires a 100% gain to recover; a portfolio down 2% requires just 2.04%.

Looking Ahead: The Convergence Continues

As we enter 2026, crypto markets face a transformed landscape:

Institutional Infrastructure: Five spot XRP ETFs launched in late 2025, with Solana ETFs (Bitwise BSOL, 21Shares TSOL) attracting $750 million in assets. The SEC's streamlined 75-day approval process positions additional products for rapid launch. Every major asset manager now offers crypto exposure.

Monetary Policy Trajectory: The Fed's hawkish December guidance—signaling just one 2026 cut to 3.25%-3.50%—creates a higher-for-longer rate environment that historically challenges risk assets. Yet crypto's decreasing correlation with traditional markets (0.42 NCI-Nasdaq correlation in August 2025 versus 0.91 in March) suggests the asset class may chart its own course.

Supply Mechanics: Exchange reserves remain at 2018 lows, 30% of Ethereum supply is staked, and long-term holder accumulation continues despite ETF outflows. When institutional flows stabilize—whether through new products, clearer regulation, or simple mean reversion—constrained supply could drive outsized price responses.

Regulatory Evolution: Zero SEC enforcement actions in 2025 represents a dramatic shift from prior years. With Paul Atkins leading the SEC through 2026, the regulatory environment favors continued innovation and institutional adoption.

2025 will not be remembered for its returns but for what it built. The GENIUS Act provided stablecoin clarity. ETF proliferation democratized access. Regulatory frameworks solidified. Institutional custody matured. Corporate treasuries accumulated. These developments—invisible to price charts—create the infrastructure supporting crypto's next growth phase.

For investors with conviction in digital assets' long-term potential, 2025's modest losses pale against the institutional foundation now in place. The NCI's market cap-weighted methodology provided meaningful protection during the downturn and positions investors to participate in eventual recovery without requiring perfect timing. Patient capital that stayed the course through 2025's volatility maintains full exposure to whatever 2026 delivers.

The year of infrastructure has concluded. What follows depends on whether the foundation built in 2025 proves sufficient to support the weight of institutional ambition. History suggests it will.

Top Stories

Vanguard opens platform to crypto ETFs

The world's second-largest asset manager ($11 trillion AUM) reversed its longstanding anti-crypto stance, allowing 50 million brokerage customers to trade Bitcoin, Ethereum, XRP, and Solana ETFs. The decision is notable given both Vanguard’s scale and its previous opposition to crypto products.

Stablecoin market hits $310B

Global stablecoin market capitalization reached a record $310B in December 2025, up roughly 70% year-over-year, with many projections pointing toward multi-trillion-dollar scale by 2028. The growth highlights stablecoins as core crypto infrastructure, reinforcing demand for the networks where they settle and transact, including Ethereum and Solana.

China allows yield-bearing stablecoins

China now allows banks to offer interest-bearing accounts on stablecoin deposits, legitimizing stablecoin holdings within its financial system. This marks a significant policy reversal for China, creating new demand for stablecoins outside the US and potentially driving innovation as competition grows in this environment.

__________________________

This material expresses Hashdex Asset Management Ltd. and its subsidiaries and affiliates (“Hashdex”)'s opinion for informational purposes only and does not consider the investment objectives, financial situation or individual needs of one or a particular group of investors. We recommend consulting specialized professionals for investment decisions. Investors are advised to carefully read the prospectus or regulations before investing their funds.

The information and conclusions contained in this material may be changed at any time, without prior notice. Nothing contained herein constitutes an offer, solicitation or recommendation regarding any investment management product or ser vice. This information is not directed at or intended for distribution to or use by any person or entity located in any jurisdiction where such distribution, publication, availability or use would be contrary to applicable law or regulation or which would subject Hashdex to any registration or licensing requirements within such jurisdiction.

These opinions are derived from internal studies and do not have access to any confidential information. Please note that future events may not unfold as anticipated by our team’s research and analysis. No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of Hashdex.

By receiving or reviewing this material, you agree that this material is confidential intellectual property of Hashdex and that you will not directly or indirectly copy, modify, recast, publish or redistribute this material and the information therein, in whole or in part, or other wise make any commercial use of this material without Hashdex’s prior written consent.

Investment in any investment vehicle and crypto assets is highly speculative and is not intended as a complete investment program. It is designed only for sophisticated persons who can bear the economic risk of the loss of their entire investment and who have limited need for liquidity in their investment. There can be no assurance that the investment vehicles will achieve its investment objective or return any capital. No guarantee or representation is made that Hashdex’s investment strategy, including, without limitation, its business and investment objectives, diversification strategies or risk monitoring goals, will be successful, and investment results may var y substantially over time.

Nothing herein is intended to imply that the Hashdex s investment methodology or that investing any of the protocols or tokens listed in the Information may be considered “conservative,” “safe,” “risk free,” or “risk averse.” These opinions are derived from internal studies and do not have access to any confidential information. Please note that future events may not unfold as anticipated by our team’s research and analysis.

Certain information contained herein (including financial information) has been obtained from published and unpublished sources. Such information has not been independently verified by Hashdex, and Hashdex does not assume responsibility for the accuracy of such information. Hashdex does not provide tax, accounting or legal advice. Certain information contained herein constitutes for ward-looking statements, which can be identified by the use of terms such as “may,” “ will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” “believe” (or the negatives thereof ) or other variations thereof. Due to various risks and uncertainties, including those discussed above, actual events or results, the ultimate business or activities of Hashdex and its investment vehicles or the actual performance of Hashdex, its investment vehicles, or digital tokens may differ materially from those reflected or contemplated in such for ward-looking statements.

As a result, investors should not rely on such for ward- looking statements in making their investment decisions. None of the information contained herein has been filed with the U.S. Securities and Exchange Commission or any other governmental or self-regulator y authority. No governmental authority has opined on the merits of Hashdex’s investment vehicles or the adequacy of the information contained herein.

Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular digital asset or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any digital asset or any representation about the financial condition of a digital asset. Statements regarding Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate assets before investing. ADVICE FROM A FINANCIAL PROFESSIONAL IS STRONGLY ADVISED.