Dear Investor,

Risk assets, including crypto, have had a rough few months. But in September, crypto broke away from the abysmal performance of the stock market, a great signal for crypto’s long-term investment case.

The Merge is now behind us, and in September a second decoupling took place: Ethereum from other crypto assets. This short-term event was mostly due to trading activity, but if you’d like to know more about what the successful implementation of Ethereum’s shift to Proof-of-Stake means for investors, read our analysis here.

We have a few upcoming events to kick off 4Q:22 that we think you’ll enjoy. On Thursday, our CTO Samir Kerbage and Head of Global Expansion Bruno Sousa will join the team at ETF Think Tank for an informal discussion about how investors should be viewing the crypto markets today. Sign up here.

This month marks the 14th anniversary of the Bitcoin whitepaper. While Ethereum has dominated crypto discussions this year, we believe Bitcoin remains the primary protagonist when it comes to crypto’s long-term investment case. On October 19, join us to discuss its future as an investable asset and how investors should view the world’s first cryptocurrency going forward.

As always, our team is here to answer any questions you might have about these markets.

-Your Partners at Hashdex

NCI PERFORMANCE (USD) YTD -59.5%

SEPTEMBER NCI PERFORMANCE -5.1%

Market review

Traditional risk assets had a rough September. The S&P 500 and Nasdaq 100 dropped 9.3% and 10.6%, respectively. Although these returns are not that scary for crypto investors, they are significant for stock indices. To put things in perspective, this was the worst month for the S&P 500 since March 2020 (COVID turmoil) and its eighth largest plunge in four decades. Under these circumstances, and considering the high correlation between crypto and traditional assets observed this year, it would be reasonable to expect a double-digit devaluation of the Nasdaq Crypto Index (NCI), but this didn’t happen.

The month started with optimism prevailing in the risk asset markets. The expectation for a substantial acceleration of the CPI in the US drove the S&P 500 and Nasdaq 100 close to a 4% rise by September 12 while the NCI peaked above 11%, boosted by expectations around the Ethereum update known as The Merge. But the CPI announcement the following day disappointed markets and triggered a mood change.

The Merge was successfully completed on September 15 and during the second half of the month we witnessed two interesting decouplings. One was between crypto and traditional risk assets. While both stock indices dropped more than 8%, the NCI was more resilient, losing only 3.4% in apparently unrelated paths. The second decoupling was Ethereum from other cryptos, notably Bitcoin. The former lost nearly 10% of its value while the latter slipped only 0.4%. Most of the movement can be attributed to Ethereum sales from traders that were trading The Merge event.

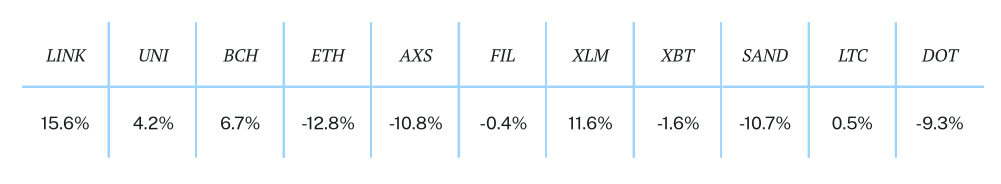

Ethereum ended the month as the worst performing asset among NCI constituents (-12.3%). The best was Chainlink (+15.6%), which announced a promising partnership with the international interbank messaging system SWIFT. The NCI finished September down 5.1%, outperformed by all three sector benchmark indices tracked by Hashdex products: CF DeFi (-4.6%), CF Smart Contracts (-2.0%), and CF Digital Culture (-4.5%).

We believe the resilience of crypto assets in such a challenging environment and especially these first signs of its correlation with traditional assets shrinking are excellent news. We understand that some factors that drive traditional risk asset prices should have influence over crypto assets. But this influence seems exacerbated when considering that these macro events have very limited impact on the chances of success of the underlying technology behind crypto.

Top Stories

A research report from Bank of America highlighted the growing influence of DeFi (decentralized finance) and stablecoins. The continued attention from traditional financial institutions strengthens the case for crypto’s role as an industry that is disrupting financial services.

Cardano developers implemented a successful hard fork, an upgrade that will bring about a suite of improvements to its blockchain, including reducing its transaction costs and improving its scalability. Read more about what this means for investors here.

An SEC suit against the founder of a crypto investment research company argues Ethereum should be under the US regulator’s jurisdiction. Separately, SEC Chair Gary Gensler noted in a Wall Street Journal interview that Ethereum’s transition to PoS made it more similar to a security than a commodity. The lack of regulatory clarity for crypto assets in the US remains a challenge for adoption and investment.

The White House published a report expressing concerns about the impact of PoW mining on climate change. The environmental impact of crypto remains a hot button issue for many policymakers. Read more about Bitcoin’s energy impact here.

________________________________