Dear Investor,

The relative price stability of BTC and ETH in December masked an unignorable truth that will persist in 2023: the FTX fallout continues to impact crypto assets in many ways.

However, we remain as committed as ever to giving investors regulated access to this emerging ecosystem, and in our 2023 Crypto Investment Outlook, we cover the major areas we believe are providing the most promise in the new year. This report and other insights regarding recent events can be found on our Research Center.

On Wednesday, our team will host a call to drill down into a few of the major themes we see emerging in the new year. They will discuss the evolving outlook for Bitcoin and Ethereum, including how developments in scaling solutions will strengthen the investment case for these “old guard” networks. You can register for the call here.

In the meantime, our team is here to answer any questions you have about these markets.

-Your Partners at Hashdex

NCI PERFORMANCE (USD) YTD -65.4%

DECEMBER NCI PERFORMANCE -4.7%

Market Review

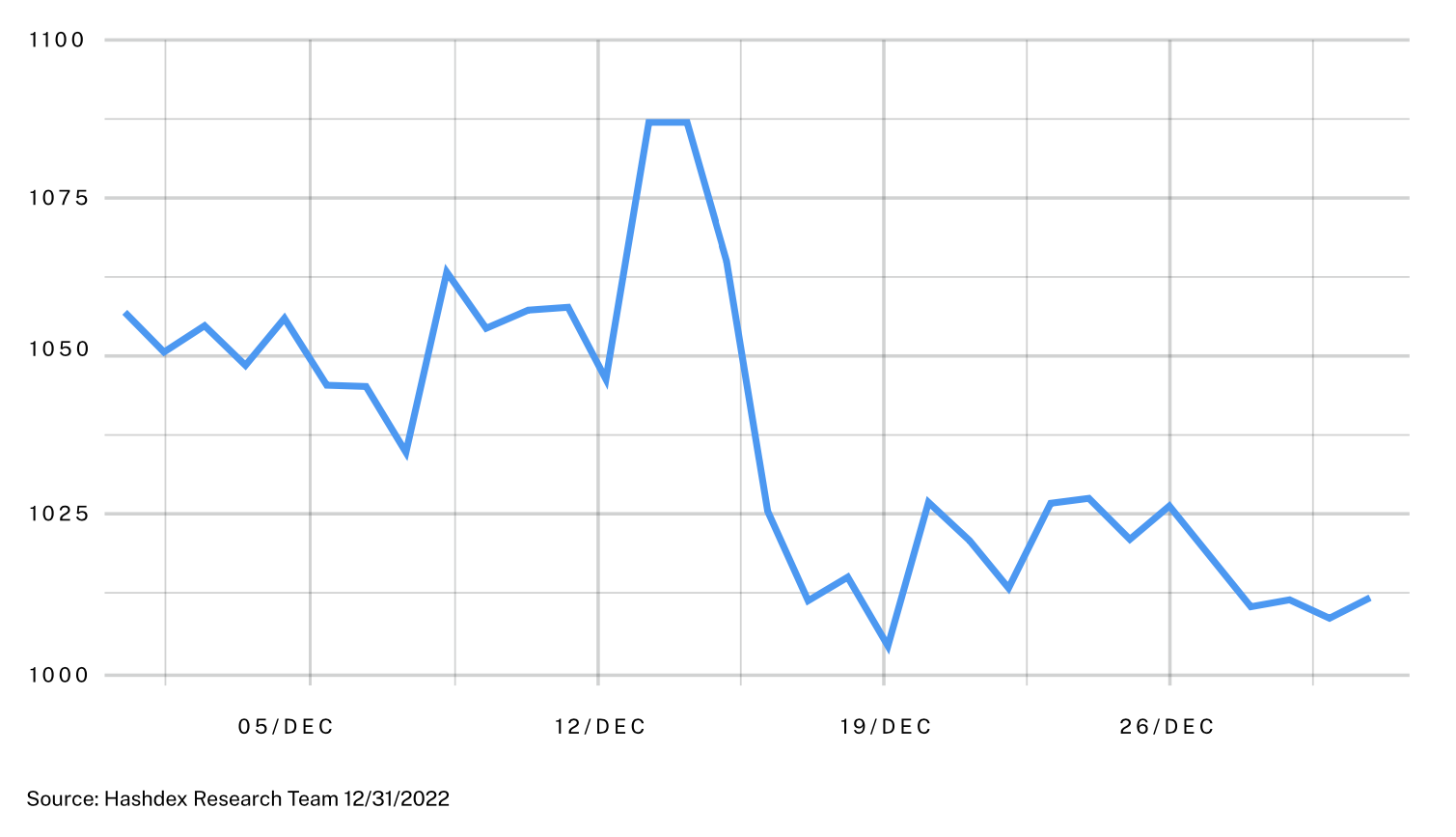

At first glance, December seemed like a mild month for crypto assets in general. The Nasdaq Crypto index (NCI) held relatively steady, closing the month with a drop of just 4.7%, which was better than the S&P 500 (-5.9%) and Nasdaq 100 (-9.1%). After the FTX turmoil in November, a relatively calm month would have been especially welcome.

However, a closer examination of the data reveals a different story. Among NCI constituents, only Bitcoin (-2.9%) and Ethereum (-6.6%) saw single digit drops. Five other cryptos (Chainlink, Filecoin, Stellar Lumens, The Sandbox, and Ethereum Classic) experienced declines of 20% or more. For these smaller coins, there was no December calm. This phenomenon can partly be attributed to a sell-off of assets related to Digital Currency Group (DCG),1 including Filecoin and Ethereum Classic, which also impacted other crypto assets.

As a result, the CF Benchmarks Sector indices followed by Hashdex products underperformed the NCI. The DeFi index dropped 14.4%, followed by the Smart Contract Platforms (-17.4%) and the Digital Culture (-17.5%) indices. Despite high exposure to smaller crypto assets, the Risk Parity Momentum Index, co-developed by Vinter and Hashdex, fell only 10.5%.

The NCI closed 2022 down 65.4%. In spite of the substantial price decline across the board, the year also brought some very significant advances in adoption, technology, and regulation. We remain very optimistic for the future of crypto assets and blockchain. More of our perspectives on what this year will bring for crypto assets can be found in our Crypto Investment Outlook.

[1] DCG is one of the most prominent investors in the crypto ecosystem, and has faced significant pressures stemming from uncertainty around its subsidiary Genesis Global Capital.

Top Stories

Core Scientific files for Chapter 11

Core Scientific, one of the largest bitcoin miners by computing power, filed for chapter 11 bankruptcy. The combination of low BTC prices and increasing energy costs has exerted significant pressure on mining companies. Bitcoin’s hashrate (the network’s combined computational power), however, has continued to trend upwards.

Visa unveils plans to introduce autopayments to Ethereum

Visa has divulged plans to introduce recurring payments to self custodial wallet users through StarkNet, a layer-2 scaling solution built on top of Ethereum. If successful, the initiative has the potential to increase crypto’s usage as a means of payment.

Goldman Sachs looks to scoop up crypto companies on the cheap

Goldman Sachs is interested in purchasing crypto companies on the cheap and plans to spend “tens of millions of dollars'' in the crypto ecosystem. Despite sentiment reaching a new low after FTX, this is another signal that big traditional finance firms still see value in the crypto market.