La divergence dorée

L'or bondit de 13,3 % en janvier tandis que le NCI recule de 13,5 %. Tensions géopolitiques et enquête Powell favorisent métaux traditionnels, mais l'infrastructure réglementaire crypto reste résiliente

Macro crosscurrents mask potential emerging regulatory tailwinds

NCI fell 8.6% amid macro headwinds and $2.1B in liquidations. Meanwhile, US stablecoin talks and CLARITY Act discussions signal regulatory momentum, even as China tightens crypto restrictions

Bitcoin's role in the "debasement trade" is being tested: A note on recent market developments

Investors are faced with challenges across asset classes, as this uncertainty bleeds across markets, including crypto.

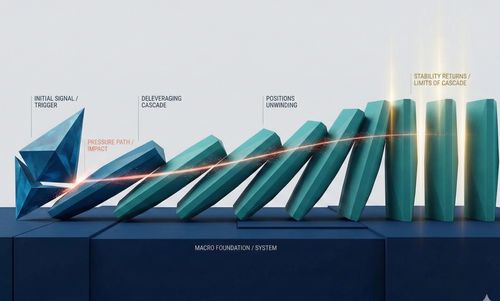

When macro bites: BOJ signals trigger crypto deleveraging

BOJ hawkish signals triggered a 12% crypto selloff and $1.7B in liquidations. Yet on-chain activity hit ATH as SEC-CFTC launch Project Crypto for regulatory clarity.

Davos reinforces adoption amid pullback

Crypto markets pulled back 10.7% amid geopolitical tensions, but Davos signals strong institutional demand. Explore key developments from UBS, Ethereum, and Kansas reserve proposals.

Nasdaq-CME : un partenariat qui consolide le pont crypto-finance

Le partenariat Nasdaq-CME marque un tournant pour les crypto actifs. Découvrez ce que cela signifie pour les investisseurs institutionnels.

Nasdaq and CME Group Deepen Partnership to Advance New Era of Crypto Investing

Nasdaq and CME Group are responding to that demand by deepening their long-standing partnership and reintroducing the Nasdaq Crypto™ Index as the Nasdaq CME Crypto™ Index

Rejoignez notre communauté.

Samir Kerbage

Samir Kerbage est directeur des investissements (Chief Investment Officer) chez Hashdex depuis 2018, supervisant les stratégies d’investissement mondiales, le développement de produits et la recherche de la société. Il fait partie de l’équipe fondatrice de Hashdex et dirige ses initiatives de gestion d’actifs crypto à travers des ETF, ETP et autres véhicules d’investissement. Samir est actif dans le domaine des actifs numériques depuis 2016 et possède plus de 15 ans d’expérience dans l’infrastructure des marchés financiers et le trading quantitatif. Il est diplômé en ingénierie informatique de l’Institut Militaire d’Ingénierie (IME).

Samir Kerbage est directeur des investissements (Chief Investment Officer) chez Hashdex depuis 2018, supervisant les stratégies d’investissement mondiales, le développement de produits et la recherche de la société. Il fait partie de l’équipe fondatrice de Hashdex et dirige ses initiatives de gestion d’actifs crypto à travers des ETF, ETP et autres véhicules d’investissement. Samir est actif dans le domaine des actifs numériques depuis 2016 et possède plus de 15 ans d’expérience dans l’infrastructure des marchés financiers et le trading quantitatif. Il est diplômé en ingénierie informatique de l’Institut Militaire d’Ingénierie (IME).