Chart of the week

In 2025, regulatory progress—reinforced by the approval of the GENIUS Act in July and the adoption of strategic bitcoin reserves by states such as New Hampshire and Arizona—helped set the stage for broader crypto adoption through regulated products like ETFs.

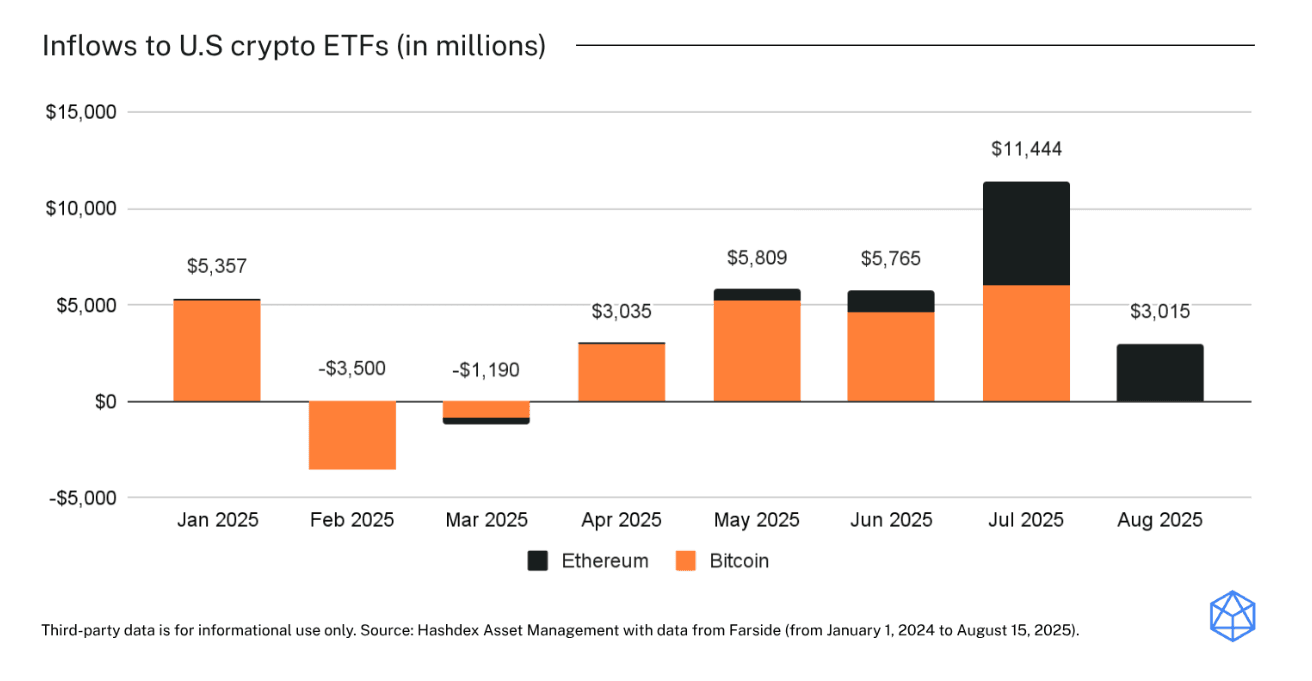

Bitcoin ETFs have maintained steady inflows throughout the year. Ethereum ETFs, by contrast, struggled early in the year with weak inflows, reflecting softer price performance.

That dynamic shifted in July, when bitcoin and ether ETFs recorded a record $11.4 billion in inflows, marking a new high for the current uptrend. During this surge, Ethereum’s price strengthened sharply, pushing its ETF inflows beyond Bitcoin’s and positioning Ethereum as a new driver of market momentum.

Market Highlights

DeFi lending segments hits $100 billion

The decentralized finance (DeFi) lending market, spearheaded by Aave has reached a total value locked (TVL) tally of $100 billion.

Such a number showcases the increasing trust and utility of DeFi platforms, helping decentralized finance emerge as an alternative to traditional institutions.

FED shutters crypto bank supervision program

The Federal Reserve is ending its "Novel Activities Supervision Program,” which was created to oversee banks' involvement in crypto and fintech.

This is yet another move towards a more integrated approach to crypto regulation, with the accrual of similar storylines acting as an important factor to reduce the perceived risk when it comes to digital assets.