Chart of the week

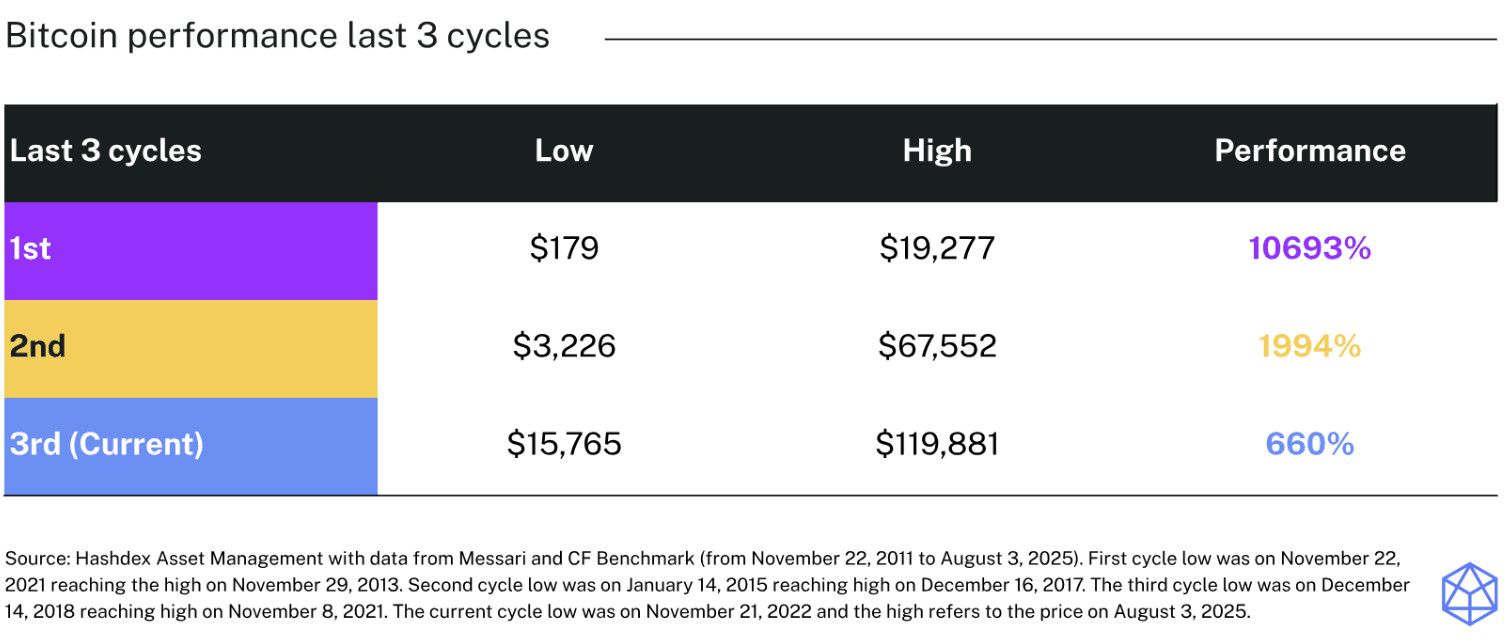

Investors and analysts alike are asking what could be the next major catalyst to extend bitcoin’s (BTC) bull run. While it’s still unclear whether this cycle’s peak has already been reached, prices have already increased nearly eightfold since the last four-year cycle low. For most assets, that kind of rally might suggest limited upside ahead—but in bitcoin’s case, past cycles suggest this could still be a relatively modest move, with further room to grow.

With US states like New Hampshire and Arizona now adopting BTC as a strategic reserve asset and corporate treasury tool, and global stablecoin adoption accelerating, one question remains top of mind: what will be the next major driver to push BTC toward a new all-time high?

Market Highlights

Crypto to back tokenized carbon credits

DevvStream Corp., a Nasdaq-listed firm, has purchased $10 million in BTC and SOL to strengthen its balance sheet and facilitate the large-scale tokenization of environmental assets, such as carbon credits.

The use of crypto to tokenize carbon credits underscores the growing integration of digital assets into a suite of sectors and could pave the way for other real-world initiatives using crypto.

UK to open retail access to crypto ETNs

The UK's Financial Conduct Authority (FCA) is set to allow retail investors to access crypto exchange-traded notes (ETNs), a move that was previously restricted to professional investors.

This provides a new, regulated avenue for UK retail investors to gain exposure to the crypto market and positions the UK as a potential global hub for digital assets.