Chart of the week

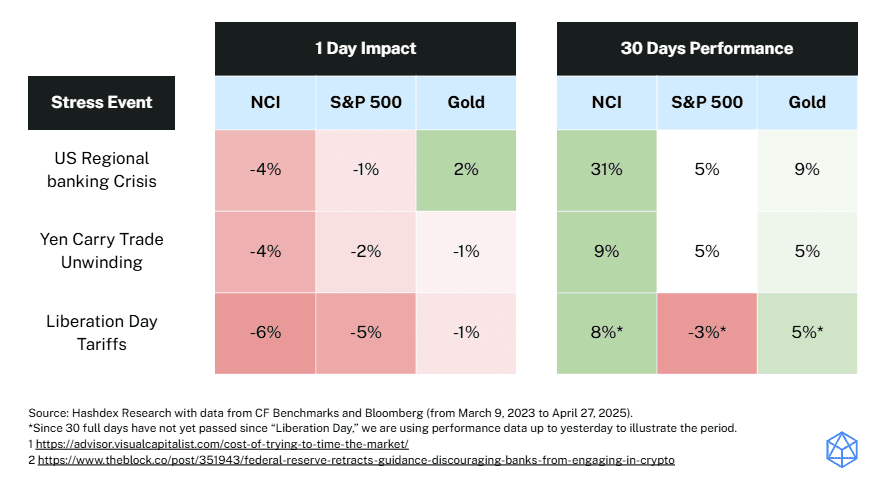

Crypto assets have been approached with caution by some investors given their volatility during periods of market stress and this year has reflected this perspective, as crypto has struggled amid macroeconomic uncertainty.

However, as we highlighted in previous editions of the Hash Insider, maintaining exposure is critical across most asset classes — for example, missing only the 10 best days in the S&P 500 over a 20-year period would significantly reduce your overall returns. In crypto, this effect is even more pronounced: missing the 10 best days can actually turn a positive performance into a negative one.

Once again, following a new wave of crypto-related tailwinds, such as the recent withdrawal of the crypto guidance for banks by the Federal Reserve, crypto has demonstrated resilience, recovering from the shock of Trump’s “Liberation Day” much faster than other asset classes.

We have seen this pattern before, and it reinforces the idea that stress events could present valuable investment opportunities in the crypto space.

Market Highlights

Federal Reserve withdraws crypto guidance

The Federal Reserve has withdrawn previous guidance that discouraged banks from engaging in crypto activities such as custody and trading.

This move, part of a broader regulatory shift under the Trump administration, is poised to foster innovation in the crypto space by reassessing regulatory frameworks and easing restrictions.

SEC advocates for clear crypto regulations

SEC Chair Paul Atkins has emphasized the need for a robust regulatory framework for digital assets after taking office last week.

This highlights Atkins effort to provide clarity and stability in the marketplace, signaling a significant shift in the SEC's approach to the growing digital asset sector, the effects of which should be beneficial to the whole asset class throughout the current administration.