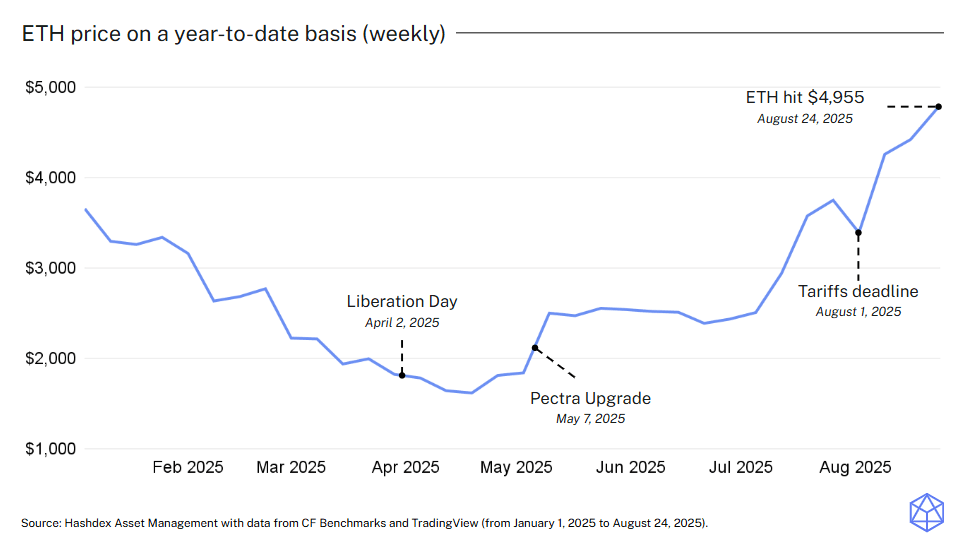

Chart of the week

Ether’s (ETH) price performance this year has been shaped by two contrasting phases. In the first four months, skepticism dominated, with many questioning whether the second-largest crypto asset was “finished.”

Weak demand for its regulated products, combined with heightened macroeconomic and geopolitical pressures, drove ETH to its lowest point shortly after Donald Trump’s Liberation Day.

Since then, momentum has shifted dramatically. Growing optimism around stablecoins in the U.S., easing geopolitical tensions, and accelerating inflows into ETH spot ETFs have fueled a powerful rally — lifting ETH from below $2,000 to nearly $5,000 last week, a new all-time high.

Market Highlights

DBS to tokenize and distribute structured notes

DBS is now tokenizing structured atop of the Ethereum blockchain, making them accessible to eligible investors through third-party digital investment platforms.

By tokenizing structured notes, DBS-the largest bank in Southern Asia is increasing accessibility for institutional investors, expanding asset tokenization, making complex financial instruments more accessible.

Japan opts toward stock-like taxation for crypto

Japan's Financial Services Agency (FSA) is planning to revise the tax code for crypto, proposing a tax rate for crypto gains, similar to stocks.

The proposed tax reduction could stimulate more crypto trading and investment while also enabling the launch of domestic crypto ETFs, providing new regulated investment vehicles.