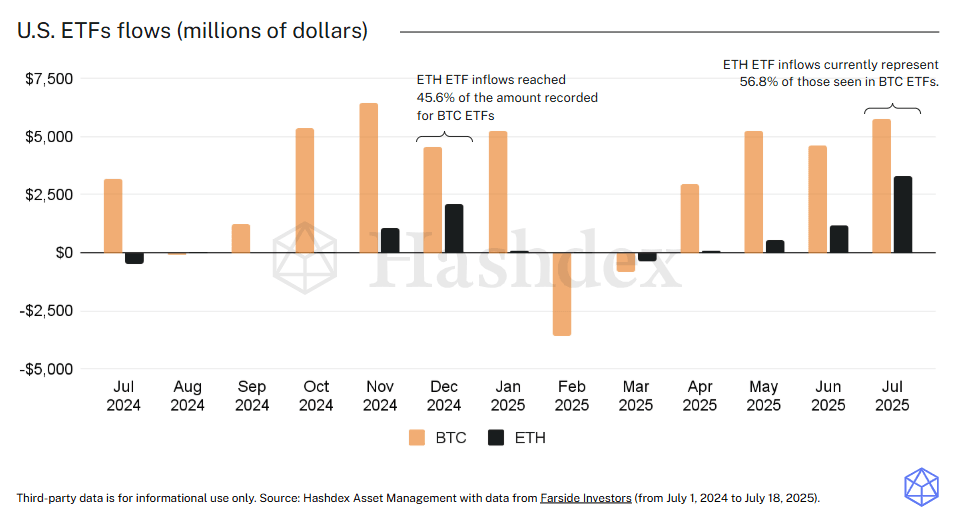

Chart of the week

US-listed spot Bitcoin ETFs have attracted strong institutional demand since their January 2024 launch, recently surpassing $50 billion in cumulative inflows. While Ethereum ETFs initially faced outflows earlier this year—partly due to underwhelming price performance—recent inflows suggest renewed investor interest and a more constructive outlook for ETH.

This growing attention toward Ethereum may reflect a broader market shift, where allocators begin looking beyond bitcoin to include other high-conviction assets. As institutional comfort with crypto deepens, it could open the door for increased interest in additional protocols like Solana or applications such as Uniswap.

Over time, this may support the case for expanded ETF offerings and help accelerate the adoption of diversified, index-based investment strategies in the crypto space.

Market Highlights

Solana ETFs surge with $222M in volume

The SSK Solana ETF, an ETF with fully integrated staking mechanism, has recorded over $222 million in trading volume.

The strong investor interest in ETFs with staking features highlights their appeal and could encourage regulators to approve more ETFs incorporating this mechanism, leading to a more sophisticated suite of crypto investment alternatives.

US stablecoin framework created

PresidentTrump signed the GENIUS Act, creating the first major U.S. federal regulatory framework for stablecoins.

The GENIUS Act marks a pivotal step in legitimizing and regulating stablecoins, which are critical to DeFi and global transactions. This could foster innovation while addressing concerns about financial stability and national security accelerating stablecoin and crypto’s adoption.