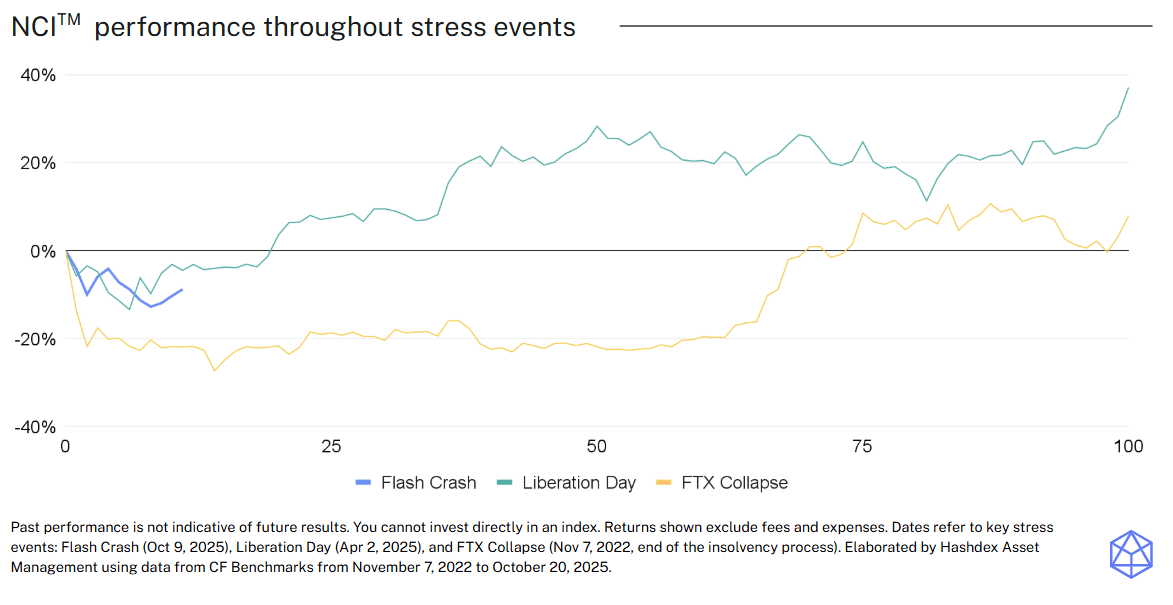

1. CHART OF THE WEEK

Periods of stress have often marked key turning points for crypto. Despite sharp drawdowns, the market has repeatedly shown its ability to recover once uncertainty fades. After the Liberation Day event on April 2 2025, losses peaked six days later but were fully recovered within 20 days. Following the FTX Collapse, the maximum drawdown occurred 14 days after the event, with recovery taking 70 days. Both cases highlight crypto’s resilience and capacity to rebuild momentum after severe shocks.

Each stress event stems from different causes—policy shifts, liquidity crunches, or institutional failures—but the pattern is consistent: crises reset valuations, clear excess leverage, and pave the way for new growth. For disciplined investors, they often create attractive entry points as innovation and adoption continue beneath the surface.

With stronger infrastructure, clearer regulation, and the rise of tokenization and stablecoin payments should help soften future shocks and support long-term growth. Volatility will persist, but history shows that crypto’s recoveries tend to reward patient, diversified investors.

2. MARKET HIGHLIGHTS

Hester Peirce about tokenization and privacy

-

SEC Commissioner Hester Peirce argued that tokenization is becoming a central focus for financial markets, emphasizing its potential to modernize settlement, transparency, and asset issuance.

-

Peirce’s stance suggests the SEC could move to a more constructive regulation of tokenized assets, which may reduce uncertainty and foster more innovation on the tokenized assets frontier.

Japan’s banks to launch stablecoins payments

-

Japan’s three biggest banks are developing a joint stablecoin framework to facilitate real-time corporate settlements and interbank payments.

-

As stablecoins become embedded in corporate and interbank payments, they expand on-chain liquidity, supporting broader adoption of cripto and strengthening the long-term investment case for the ecosystem.

Trexx launches purpose-built L1 on Tanssi

-

Trexx, a Brazilian gaming and social-finance startup, is building a dedicated layer-1 on Tanssi to let esports teams and brands monetize fan activity through tokenized rewards, loyalty programs, and collectibles.

-

The initiative expands crypto’s real-world utility beyond finance by linking gaming, AI, and digital fandom to tokenized incentives. It also highlights growing demand for customizable infrastructure like Tanssi to support consumer-facing use cases, which could strengthen value for infrastructure tokens.