Dear Investor,

Crypto assets, as measured by the Nasdaq Crypto IndexTM (NCITM), were down 7% in May after four consecutive months of positive performance.

Last week’s resolution of the US debt ceiling debate helped the asset class recover from a larger decline earlier in the month. Despite the underperformance, crypto’s institutional adoption and integration into traditional industries continued. Apple expanded its App Store crypto offerings, Nike launched its NFT sneaker collection, and PayPal was added as a payment method to the MetaMask platform.

May was an active month for our team. We hosted a lively discussion on Bitcoin’s outlook with MicroStrategy founder Michael Saylor. Nik Bhatia, professor and author of Layered Money, joined CIO Samir Kerbage for an informative discussion on the macro environment and our COO Bruno Caratori was at the NYSE to talk about the prospects for a spot bitcoin ETF in the US. Samir wrote an update on Bitcoin’s store-of-value thesis in his latest Notes from the CIO.

On Wednesday, June 7, Alogorand Foundation CEO Staci Warden will join our Head of Research Pedro Lapenta and Head of Global Content Gerry O’Shea for a webinar to discuss how decentralization is changing the financial services landscape and is being adopted by institutions. Sign up for the event here.

As always, the Hashdex team is here to answer any questions you have about these markets.

-Your Partners at Hashdex

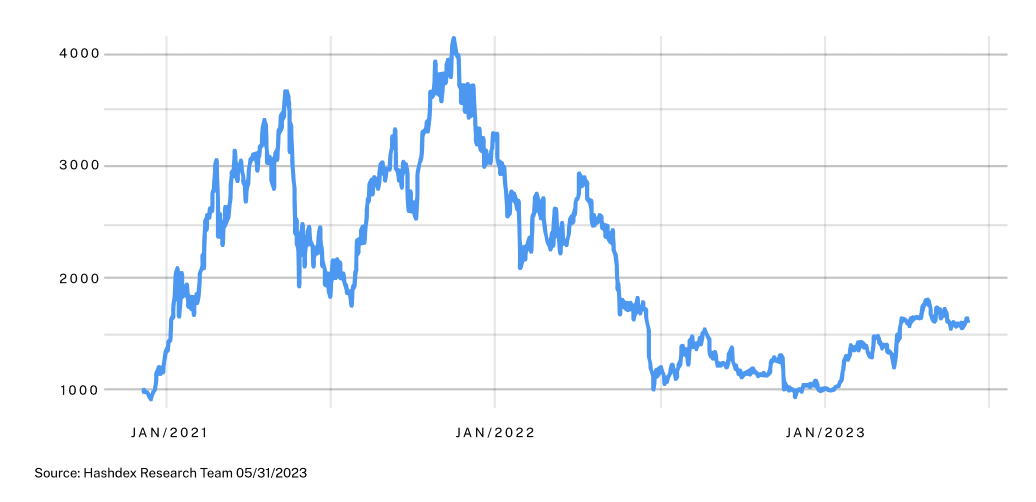

NCI PERFORMANCE (USD) SINCE INCEPTION 59.2%

MAY NCI PERFORMANCE -7.0%

Market Review: NCI's consecutive gains halted

After four months of growth, the NCITM closed May down 7.0%, diverging from the performance of traditional risk assets. The S&P 500 experienced a slight appreciation of 0.4% while the Nasdaq 100 rose by 7.7%, heavily influenced by NVIDIA, which surged over 40% and became the third-largest stock in the index in the wake of the artificial intelligence boom. In recent months, crypto assets have shown a very low correlation with traditional assets, which increases their diversification power in portfolios. Nevertheless, crypto assets still respond to certain macroeconomic shocks.

The month began with a negative fluctuation that was quickly reversed. However, the NCITM dropped over 10% during the second week of May, driven by a suspension of bitcoin withdrawals on Binance and the news that Jane Street and Jump Trading were retreating from their crypto trading activities in the US due to the regulatory environment. In the following days, the NCITM partially recovered the losses before again dipping 10% due to concerns about the US debt ceiling. The resolution of this issue brought optimism to the markets and an impetus for the NCITM to reduce its losses for the month, ultimately closing with a decline of 7.0%.

All constituents of the NCITM recorded losses in May. The smallest loss was seen in Litecoin (-0.9%), which experienced a significant increase in transaction volume on its network and is approximately two months away from its next halving. The second-best performing asset was Ethereum (-3.0%), while Bitcoin ranked only fifth, with a loss of 8.7%.

The three sectoral indices of CF Benchmarks also experienced declines in all constituents. The DeFi, Digital Culture, and Smart Contract Platforms (WEB311) indices registered losses of 9.0%, 7.0%, and 10.1% respectively. The Vinter Hashdex Risk Parity Momentum Index fell by 3.4%, but Tron and Ripple stood out positively, rising by 11.1% and 7.0%, respectively.

Despite the decline, the NCITM continues to show a year-to-date increase of 59.2%. A price drop after such a significant appreciation is natural. The main investment theses in crypto assets represented by Hashdex products continue to strengthen every day. We remain highly confident in the long-term growth potential of this emerging asset class.

Top Stories

Bitcoin addresses holding 1 BTC or more reach 1 million

The number of "wholecoiners," or individuals owning at least one bitcoin, reached one million. This milestone is significant for investors as it highlights the growing adoption and distribution of BTC ownership, potentially indicating a broader interest and trust in the flagship cryptocurrency.

Tether pledges to plow 15% of profits into Bitcoin

Tether, manager of the largest USD stablecoin, USDT, has pledged to allocate 15% of its profits toward purchasing BTC. This demonstrates Tether's confidence in bitcoin and its commitment to further investment in the cryptocurrency. Due to Tether’s size and relevance, this move could potentially impact Bitcoin’s ongoing growth and stability.

Coinbase opens offshore crypto derivatives exchange

Coinbase has launched an International Exchange, offering perpetual futures trading for BTC and ETH to institutional users in eligible non-US jurisdictions. The exchange aims to expand Coinbase's global reach and provide an alternative for users outside the US. The move comes amid Coinbase's criticism of the SEC's regulatory enforcement.

Apple’s App Store expands crypto offerings

The blockchain-based game Axie Infinity has been approved and listed on the Apple App Store. The listing opens up a broader market and user base for Axie Infinity, potentially leading to increased demand for its in-game assets and tokens, which could have a positive impact on its value and investment potential. Additionally, Stepn, a blockchain-based fitness app that creates NFT sneakers, announced iPhone users can now trade crypto assets within its app.

________________________________

This material expresses Hashdex Asset Management Ltd. and its subsidiaries and affiliates (“Hashdex”)'s opinion for informational purposes only and does not consider the investment objectives, financial situation or individual needs of one or a particular group of investors. We recommend consulting specialized professionals for investment decisions. Investors are advised to carefully read the prospectus or regulations before investing their funds. The information and conclusions contained in this material may be changed at any time, without prior notice. Nothing contained herein constitutes an offer, solicitation or recommendation regarding any investment management product or service. This information is not directed at or intended for distribution to or use by any person or entity located in any jurisdiction where such distribution, publication, availability or use would be contrary to applicable law or regulation or which would subject Hashdex to any registration or licensing requirements within such jurisdiction. No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of Hashdex. By receiving or reviewing this material, you agree that this material is confidential intellectual property of Hashdex and that you will not directly or indirectly copy, modify, recast, publish or redistribute this material and the information therein, in whole or in part, or otherwise make any commercial use of this material without Hashdex’s prior written consent.

Investment in any investment vehicle and cryptoassets is highly speculative and is not intended as a complete investment program. It is designed only for sophisticated persons who can bear the economic risk of the loss of their entire investment and who have limited need for liquidity in their investment. There can be no assurance that the investment vehicles will achieve its investment objective or return any capital. No guarantee or representation is made that Hashdex’s investment strategy, including, without limitation, its business and investment objectives, diversification strategies or risk monitoring goals, will be successful, and investment results may vary substantially over time. Nothing herein is intended to imply that the Hashdex s investment methodology or that investing any of the protocols or tokens listed in the Information may be considered “conservative,” “safe,” “risk free,” or “risk averse.”

Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Hashdex, and Hashdex does not assume responsibility for the accuracy of such information. Hashdex does not provide tax, accounting or legal advice. Certain information contained herein constitutes forward-looking statements, which can be identified by the use of terms such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” “believe” (or the negatives thereof) or other variations thereof. Due to various risks and uncertainties, including those discussed above, actual events or results, the ultimate business or activities of Hashdex and its investment vehicles or the actual performance of Hashdex, its investment vehicles, or digital tokens may differ materially from those reflected or contemplated in such forward-looking statements. As a result, investors should not rely on such forward- looking statements in making their investment decisions. None of the information contained herein has been filed with the U.S. Securities and Exchange Commission or any other governmental or self-regulatory authority. No governmental authority has opined on the merits of Hashdex’s investment vehicles or the adequacy of the information contained herein.