Dear Investor,

The phrase “Beware the Ides of March!” is often used to warn about a potential misfortune, but on the Roman calendar this date was known for something else—the deadline for settling debts.

March might have been more about creating new debts than settling old ones, but the Ides of March 2023 may be remembered as the spark for a Bitcoin revival. Our CIO Samir Kerbage wrote about why Bitcoin was built for this moment.

The month wasn’t all good news for crypto. A White House report dismissed the value of digital assets and US regulators continued their steady march against the industry. This came as more big steps in crypto’s acceptance took place, including Amazon moving forward with its NFT platform, Telegram accepting Tether (USDT) payments, and a new Citi report suggesting that blockchain technology will soon see “billions of users and trillions of dollars in value.”

March 15 was a memorable day for our team, as we rang the opening bell at the New York Stock Exchange. Read our CEO Marcelo Sampaio’s speech from this special day here.

Finally, on Wednesday, April 19, our investment and research teams will host a webinar to review our first quarter Market Pulse, a new initiative that will look at the most important ecosystem developments impacting crypto’s investment case.

As always, our team is here to answer any questions you have about these markets.

-Your Partners at Hashdex

NCI PERFORMANCE (USD) SINCE INCEPTION 63.9%

MARCH NCI PERFORMANCE 18.0%

Market Review

The Nasdaq Crypto IndexTM (NCITM) posted its third consecutive monthly increase in March. The index was up 18.0%, accumulating a return of 63.9% for the year. The month was also positive for other risk assets, with the S&P 500 and Nasdaq 100 rising 3.5% and 9.5%, respectively.

However, the early part of the month was negative for crypto prices as US regulators' actions against crypto-related companies caused concern. The main shock, however, came from the US banking sector, as problems faced by Silvergate and Signature—two of the main banks used by crypto companies—were uncovered. This led the NCITM to fall more than 13%.

The middle of March delivered a strong recovery. This was driven by the strengthening of the Bitcoin thesis as a store of value in the face of widespread distrust of banks, especially after the Silicon Valley Bank situation, as well as a reduction in US interest rate expectations. Toward the end of the month, the crypto market traded mostly sideways. The exception to this flat performance was a decline, which quickly reversed, after the announcement of the US Commodity Futures Trading Commission's (CFTC) lawsuit against Binance.

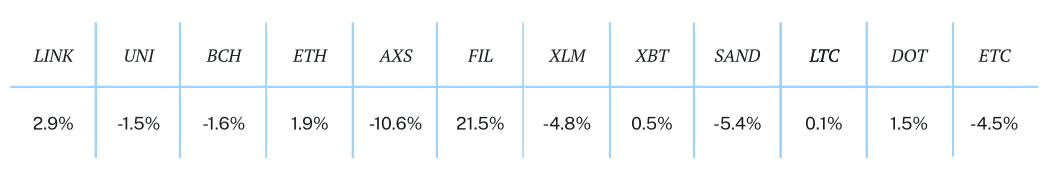

Although it was a positive month for the NCITM overall, results for individual assets were mixed, with five of the 10 index constituents posting losses for the month. Bitcoin (21.8%) and Ethereum (11.9%) had the second and third best performances, respectively, behind Stellar Lumens (26.2%).

The NCI’sTM strong outperformance was not shared by other Hashdex product benchmarks. Among CF Benchmarks sectoral indices, DeFi and Digital Culture had drops of 5.8% and 8.0%, respectively, while Smart Contracts rose 2.2%, helped by the appreciation of Cardano (11.9%). The Vinter Hashdex Risk Parity Momentum Index rose 2.9%, with Ripple standing out, rising more than 40%.

The third consecutive month of NCITM gains is an important signal of a regime change from last year. Despite the strong first quarter results, we always emphasize to our investors our belief that crypto assets are most suitable for long-term investments.

Top Stories

Ethereum’s next upgrade will activate next week

The Shapella network upgrade, which combines changes to Ethereum’s execution layer (Shanghai) and changes to its consensus layer (Capella) is set to activate on April 12, 2023. This will allow users to withdraw staked ETH from the network. This upgrade is highly anticipated and could potentially impact ETH’s performance in the coming weeks.

White House report blasts digital assets

The White House’s annual Economic Report of the President included a grim view on crypto, including a statement that many crypto assets “have no fundamental value.” This actions are a further sign of a coordinated effort against crypto businesses in the US.

Nasdaq to launch custody services for crypto

Nasdaq said it will offer crypto custody services for Bitcoin and Ethereum by the end of the second quarter of this year. Given its size and reputation, this new service is an important one for the crypto industry’s development and adoption.

Visa's crypto strategy remains intact despite crypto winter

Despite rumors Visa was pulling back on its crypto plans, a spokesperson for the payments company told CoinDesk that “the recent failures do not change our crypto strategy and focus to serve as a bridge, helping connect both platforms and technologies emerging in the crypto ecosystem.”

_________________________________

This material expresses Hashdex Asset Management Ltd. and its subsidiaries and affiliates (“Hashdex”)'s opinion for informational purposes only and does not consider the investment objectives, financial situation or individual needs of one or a particular group of investors. We recommend consulting specialized professionals for investment decisions. Investors are advised to carefully read the prospectus or regulations before investing their funds. The information and conclusions contained in this material may be changed at any time, without prior notice. Nothing contained herein constitutes an offer, solicitation or recommendation regarding any investment management product or service. This information is not directed at or intended for distribution to or use by any person or entity located in any jurisdiction where such distribution, publication, availability or use would be contrary to applicable law or regulation or which would subject Hashdex to any registration or licensing requirements within such jurisdiction. No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of Hashdex. By receiving or reviewing this material, you agree that this material is confidential intellectual property of Hashdex and that you will not directly or indirectly copy, modify, recast, publish or redistribute this material and the information therein, in whole or in part, or otherwise make any commercial use of this material without Hashdex’s prior written consent.

Investment in any investment vehicle and cryptoassets is highly speculative and is not intended as a complete investment program. It is designed only for sophisticated persons who can bear the economic risk of the loss of their entire investment and who have limited need for liquidity in their investment. There can be no assurance that the investment vehicles will achieve its investment objective or return any capital. No guarantee or representation is made that Hashdex’s investment strategy, including, without limitation, its business and investment objectives, diversification strategies or risk monitoring goals, will be successful, and investment results may vary substantially over time. Nothing herein is intended to imply that the Hashdex s investment methodology or that investing any of the protocols or tokens listed in the Information may be considered “conservative,” “safe,” “risk free,” or “risk averse.”

Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Hashdex, and Hashdex does not assume responsibility for the accuracy of such information. Hashdex does not provide tax, accounting or legal advice. Certain information contained herein constitutes forward-looking statements, which can be identified by the use of terms such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” “believe” (or the negatives thereof) or other variations thereof. Due to various risks and uncertainties, including those discussed above, actual events or results, the ultimate business or activities of Hashdex and its investment vehicles or the actual performance of Hashdex, its investment vehicles, or digital tokens may differ materially from those reflected or contemplated in such forward-looking statements. As a result, investors should not rely on such forward- looking statements in making their investment decisions. None of the information contained herein has been filed with the U.S. Securities and Exchange Commission or any other governmental or self-regulatory authority. No governmental authority has opined on the merits of Hashdex’s investment vehicles or the adequacy of the information contained herein.