1. CHART OF THE WEEK

Last week, President Trump floated the idea of a tariff rebate check, a policy that could inject meaningful liquidity into the economy. The last time a similar measure was implemented was during the pandemic, when stimulus flows ultimately supported risk assets — including crypto.

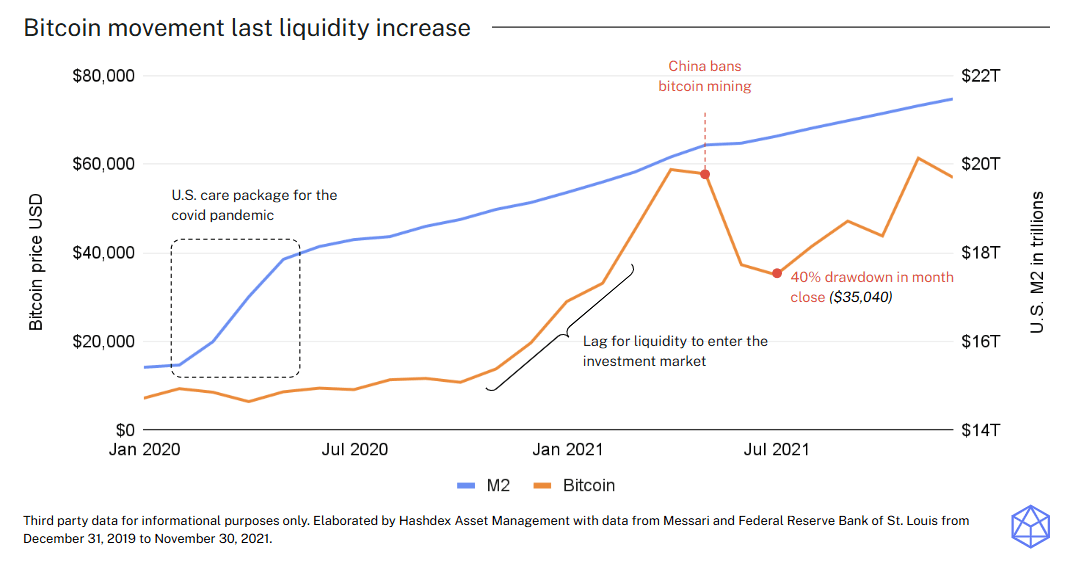

History shows that when liquidity increases, crypto often responds strongly, even when sentiment is weak or the market faces sector-specific headwinds. In previous cycles, as illustrated in our chart covering price action from 2020 to 2022, crypto recovered from setbacks and went on to set new all-time highs as liquidity entered the system.

Today, the backdrop is even more supportive: institutional adoption is accelerating, regulatory clarity is improving, and tokenization and stablecoins are gaining traction. Despite the current cautious sentiment, if history rhymes, additional liquidity could catalyze a final leg higher toward new highs.

2. MARKET HIGHLIGHTS

Czech National Bank digital asset test portfolio

-

The CNB has created its first on-chain test portfolio, allocating $ 1 million across bitcoin, stablecoins and a tokenized deposit.

-

The goal is to gain hands-on experience with custody, operations, settlement and risk controls for digital assets.

-

Although they make it very clear that this move does not constitute a national reserve, to see central banks preparing operational readiness increases legitimacy, and strengthens the case for crypto’s future integration into mainstream financial infrastructure.

Harvard triples BTC exposure via spot ETFs

-

Harvard Management Company, which oversees the world’s largest academic endowment, has significantly increased its bitcoin exposure by adding more spot BTC ETF positions.

-

One of the world’s most conservative institutional allocators increasing its BTC position sends a powerful signal: bitcoin is increasingly being treated as a strategic long-term asset, which should be monitored as a strategic play for pension funds, foundations and sovereign wealth funds.

Hong Kong pilots tokenization framework

-

Hong Kong launched a RWAs tokenization pilot under a new framework, focusing on management, protections, and interoperability.

-

This could intensify global competition among financial centers racing to capture tokenized capital markets, increasing investors flows to the crypto ecosystem.