Every so often, an evolutionary leap occurs in the investment space. Today’s formal rebranding of the Nasdaq Crypto™ Index to the Nasdaq CME Crypto™ Index marks such a milestone for crypto investors—one that we believe will change how institutions think about crypto allocations.

This strengthened flagship index celebrates a trusted partnership between Nasdaq and derivatives financial services heavyweight Chicago Mercantile Exchange (CME) Group.

In merging their respective brands to strengthen this institutional-grade digital asset benchmark, the Nasdaq CME Crypto™ Index (NCI™) builds on its transparency and governance across the US, Europe, and Latin America. Exchange-traded products (ETPs) and other instruments tracking NCI™ can benefit from increased liquidity, tighter spreads, and smoother execution. And by leveraging decades of collective experience building modern financial infrastructure, NCI™ pairs traditional market expertise with digital asset innovation. For investors building crypto exposure for the first time, a benchmark like the NCI™ provides the same type of foundation that an index like the Nasdaq-100 or S&P 500 offers for equities.

Creating an institutional benchmark: Methodology matters

The Nasdaq and CME partnership is a clear sign that the NCI™ is becoming the definitive benchmark for the emerging crypto asset class. Why does this matter? Benchmarks enable portfolio construction, performance attribution, and allow institutions to allocate at scale. The NCI™ is providing the necessary criteria for these institutions to get exposure to the crypto market, including a replicable methodology, increased liquidity via ETPs and other instruments, and the institutional acceptance that comes along with two firms with extensive experience building sophisticated financial infrastructure.

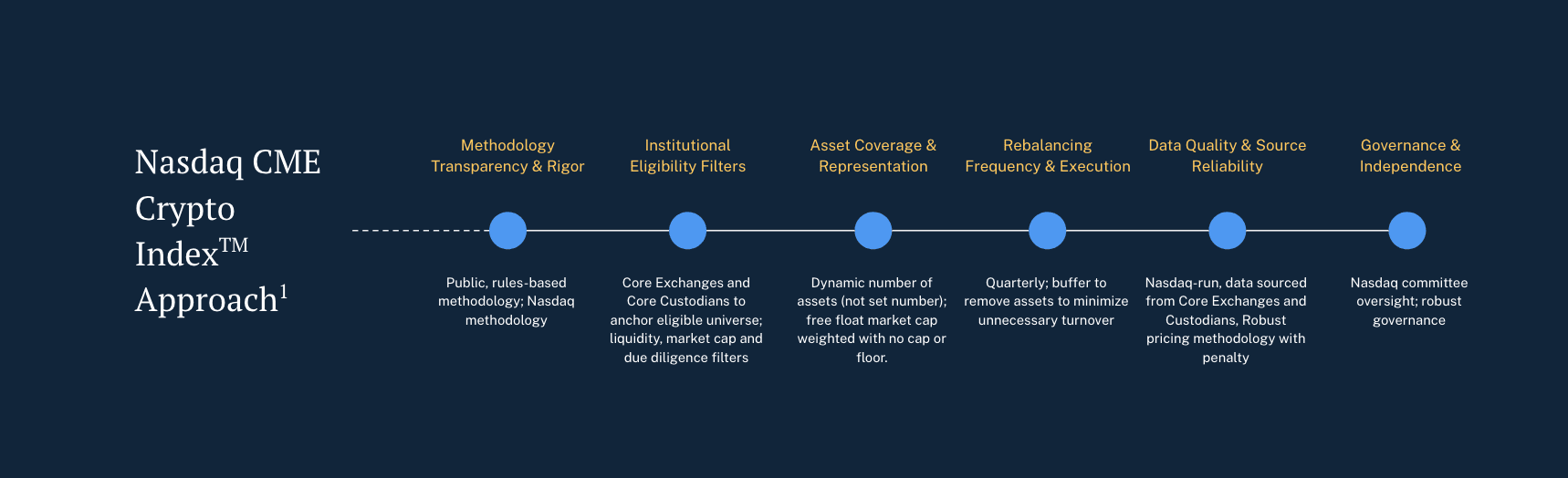

When it comes to fortifying a category-defining index like the NCI™, a measured approach to curating a list of constituent companies is vital to reflecting trends in the broader crypto market. This is why, since 2020, Hashdex has taken a hands-on role in building this benchmark, co-developing the NCI™ in partnership with Nasdaq Global Indexes.

NCI’s™ methodology is designed to bring the same high standards for traditional market indexes to crypto. The benchmark’s quarterly reconstitution practices support a long-term culture of folding promising and emergent crypto assets into the mix. Only crypto assets that meet the requisite liquidity, exchangeability, and fungibility standards are eligible for inclusion. Candidates must likewise trade on at least two major exchanges for the entire period since the last index readjustment and prospective newcomers must be supported by reputable custodians with demonstrably efficient operational controls.

The Nasdaq CME Crypto™ Index: Key differentiators and institutional-grade criteria

Nasdaq, Nasdaq Crypto Index - Factsheet, accessed January 19, 2026.

Effective January 20, 2026, the index changed its name from Nasdaq Crypto Index (NCI) to Nasdaq CME Crypto™ Index.

Fortunately, the pool of crypto assets runs deep. And what does NCI’s™ constituent breakdown look like today? As you might imagine, industry stalwarts Bitcoin (BTC) and Ethereum (ETH) factor prominently as the index’s two largest assets. And while their foundational roles will likely keep these names around for a while, NCI™ additionally features evolving set of crypto assets, presently including XRP (XRP), Solana (SOL), Cardano (ADA), Chainlink (LINK), and Stellar (XLM). Of course, these weightings are subject to change every quarter, to keep their representations on track amid macroeconomic changes and evolving investment theses.

What lies ahead for crypto in 2026?

With the Nasdaq/CME partnership signaling crypto’s shift from a speculative, niche ecosystem into a sophisticated asset class, digital assets may offer uncorrelated returns that complement traditional investments. This is one of the reasons why Hashdex is now endorsing increasing crypto allocations to 5%-10% for most investors, as we outlined in our 2026 Crypto Investment Outlook. Many predictive metrics support this recalibration:

-

The rise of the “cryptodollar”: Stablecoins—digital assets linked to fiat currencies like the US dollar or the euro may spike in global market cap from $295 billion to $500 billion or more this year, and into the trillions of dollars within five years.

-

AI catalyzing crypto: As blockchains rise in prominence to buttress the increased verification, coordination, and economic autonomy AI demands, so too will rise investment opportunities in the AI crypto space.

-

Scaling tokenization: Financial services behemoths like BlackRock and JPMorgan have begun using blockchain technology to overhaul their infrastructure and more efficiently compete for capital. This could spike tokenized assets tenfold this year alone.

-

Demand outpacing supply: This fundamental economic principle may materially influence crypto asset pricing. As demand for these assets increases while supply remains limited, prices tend to rise—a benefit to those who opt in early.

Final thoughts

Hashdex has nearly $1B in global products that track the NCI™ and we’re excited to continue to help drive investor interest in the crypto asset class. Effective today, the names of Hashdex’s products that track the NCI™ will be updated to reflect the index rebranding. For more information on how this rebranding will impact specific products, please see this recent Q&A.

As crypto continues to mature from a once-niche technology play into an indispensable building block of the global economic food chain, institutional investors seeking diversified and dynamic exposure to non-traditional investments can no longer overlook this asset class. And without question, tradable and transparent indexes like the Nasdaq CME Crypto™ Index will continue to help facilitate the adoption of this asset class for investors big and small.

____________________________

NCIQ: Effective January 20, 2026, the Fund changed its name from Hashdex Nasdaq Crypto Index US ETF (NCIQ) to Hashdex Nasdaq CME Crypto Index ETF (NCIQ)

Effective January 20, 2026, the index changed its name from Nasdaq Crypto Index (NCI) to Nasdaq CME Crypto™ Index.

This material expresses Hashdex Asset Management Ltd. and its subsidiaries and affiliates (“Hashdex”)'s opinion for informational purposes only and does not consider the investment objectives, financial situation or individual needs of one or a particular group of investors. We recommend consulting specialized professionals for investment decisions. Investors are advised to carefully read the prospectus or regulations before investing their funds.

The information and conclusions contained in this material may be changed at any time, without prior notice. Nothing contained herein constitutes an offer, solicitation or recommendation regarding any investment management product or ser vice. This information is not directed at or intended for distribution to or use by any person or entity located in any jurisdiction where such distribution, publication, availability or use would be contrary to applicable law or regulation or which would subject Hashdex to any registration or licensing requirements within such jurisdiction.

These opinions are derived from internal studies and do not have access to any confidential information. Please note that future events may not unfold as anticipated by our team’s research and analysis. No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of Hashdex.

By receiving or reviewing this material, you agree that this material is confidential intellectual property of Hashdex and that you will not directly or indirectly copy, modify, recast, publish or redistribute this material and the information therein, in whole or in part, or other wise make any commercial use of this material without Hashdex’s prior written consent.

Investment in any investment vehicle and crypto assets is highly speculative and is not intended as a complete investment program. It is designed only for sophisticated persons who can bear the economic risk of the loss of their entire investment and who have limited need for liquidity in their investment. There can be no assurance that the investment vehicles will achieve its investment objective or return any capital. No guarantee or representation is made that Hashdex’s investment strategy, including, without limitation, its business and investment objectives, diversification strategies or risk monitoring goals, will be successful, and investment results may var y substantially over time.

Nothing herein is intended to imply that the Hashdex s investment methodology or that investing any of the protocols or tokens listed in the Information may be considered “conservative,” “safe,” “risk free,” or “risk averse.” These opinions are derived from internal studies and do not have access to any confidential information. Please note that future events may not unfold as anticipated by our team’s research and analysis.

Certain information contained herein (including financial information) has been obtained from published and unpublished sources. Such information has not been independently verified by Hashdex, and Hashdex does not assume responsibility for the accuracy of such information. Hashdex does not provide tax, accounting or legal advice. Certain information contained herein constitutes for ward-looking statements, which can be identified by the use of terms such as “may,” “ will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” “believe” (or the negatives thereof ) or other variations thereof. Due to various risks and uncertainties, including those discussed above, actual events or results, the ultimate business or activities of Hashdex and its investment vehicles or the actual performance of Hashdex, its investment vehicles, or digital tokens may differ materially from those reflected or contemplated in such for ward-looking statements.

As a result, investors should not rely on such for ward- looking statements in making their investment decisions. None of the information contained herein has been filed with the U.S. Securities and Exchange Commission or any other governmental or self-regulator y authority. No governmental authority has opined on the merits of Hashdex’s investment vehicles or the adequacy of the information contained herein.

Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular digital asset or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any digital asset or any representation about the financial condition of a digital asset. Statements regarding Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate assets before investing. ADVICE FROM A FINANCIAL PROFESSIONAL IS STRONGLY ADVISED.