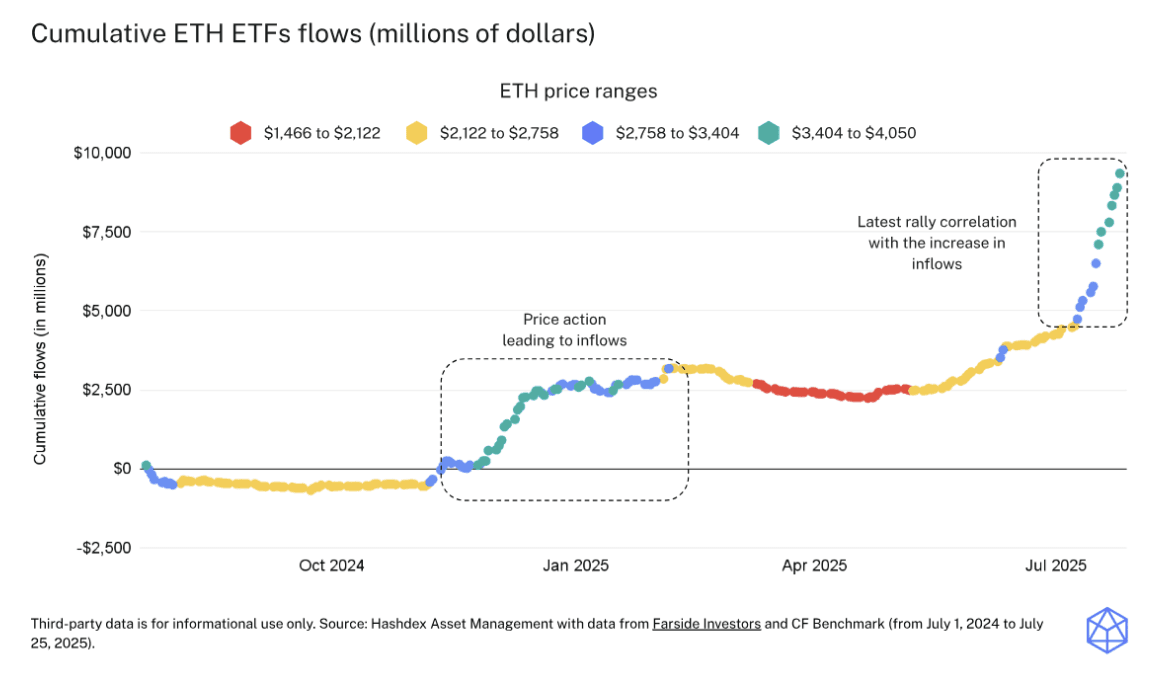

Chart of the week

This week, U.S. ETH ETFs marked a 16-day streak of inflows, surpassing $9 billion in total inflows. This positive momentum for Ether (ETH) comes as a breath of fresh air, given that Ethereum’s native token previously faced volatile price movements.

It seems fair to link said inflows to ETHs recent stellar performance, as strong price action can naturally foster a more optimistic environment. Since the launch of U.S. ETH ETFs in July 2024, ETH performance has been moving as similar as the flows that are funneled into such regulated products.

With key regulatory developments in 2025—such as the approval of the GENIUS Act—ETH appears to be entering a self-reinforcing growth cycle, solidifying its position as the second-largest crypto asset.

Market Highlights

Binance integrates Circle’s USYC as collateral

Binance has partnered with Circle to integrate the yield-bearing USYC asset as an off-exchange collateral option for its institutional clients.

This collaboration expands institutional access to tokenized financial products. This move could drive broader adoption of stablecoin-linked assets in institutional markets, fostering greater liquidity and capital efficiency in the crypto ecosystem.

U.S. ETH ETFs surpassed the $9B in inflows

U.S. ETH ETFs have exceeded $9 billion in total inflows, with over $5 billion of that amount recorded this month.

This rapid growth underscores Ethereum’s increasing acceptance among institutional investors, signaling a shift in capital from BTC to ETH and highlights the rising demand for regulated crypto investment vehicles.

BNY and Goldman tokenized MMF

BNY and Goldman Sachs have launched a blockchain-based system to tokenize money market fund (MMF) shares, enabling institutional investors to trade tokens.

This pioneering effort by major financial institutions to tokenize MMF shares signals a significant step toward modernizing traditional finance through blockchain technology.