Today marks the first anniversary of “The Merge,” Ethereum’s transition from Proof-of-Work, a computation-heavy security model, to a pledged capital security framework, Proof-of-Stake (PoS). The past year has been defined by developments in Ethereum’s scalability roadmap and—more recently—news around filings for several ETH futures ETFs in the US. Here we share five charts that demonstrate how Ethereum has evolved over the past year and how the investment case for its token ETH is strengthening.

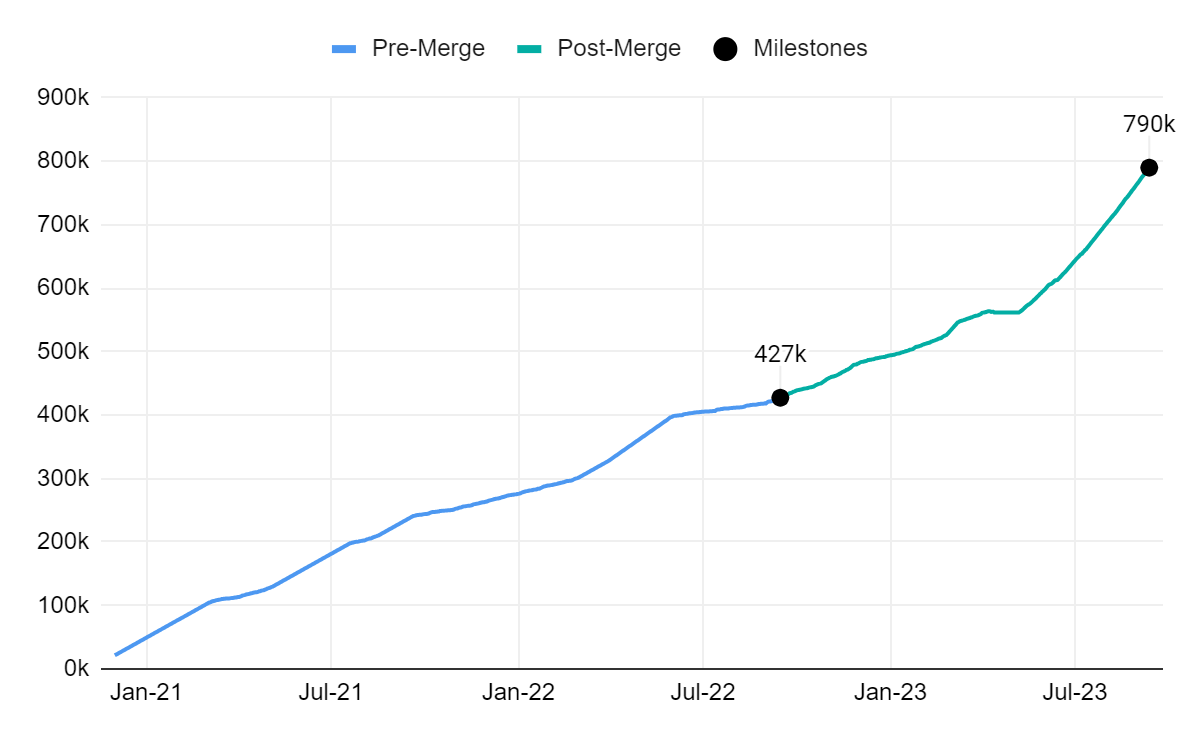

1. The number of active validators1 on Ethereum has increased by 85% since The Merge2.

Description

Now, ~790,000 validators are active on the network, against ~427,000 when the switch to PoS took place (an 85% increase).

Why does it matter?

These players have now more than $40 billion3 in capital locked for security purposes on the network (way above any other smart contracts platform in crypto2), significantly diminishing major threats to Ethereum’s security due to the high capital cost of taking over a majority stake on the network.

2. The share of transaction fees in validator income is above 20% even during the bear market5.

Description

With the removal of mining after the switch to PoS, Ethereum has drastically decreased its energy consumption and also significantly reduced the issuance of new ETH as a reward to active validators.

Why does it matter?

As a consequence, immediately after the upgrade, the share of transaction fees as a percentage of validator income was brought back up above the 20% threshold, a level only previously seen in the 2020-2021 bull run. As a new crypto cycle approaches, and on-chain activity ramps back up, this reduced reliance on ETH issuance to incentivize validators will most likely continue to take place, consolidating Ethereum as the first profitable blockchain in the crypto space and making ETH a sustainable native token.

3. Staking interest increased by 260% after Shanghai activated withdrawals.6

Description

Description

The Shanghai upgrade, which was successfully activated in April of this year and enabled ETH withdrawals, concluded Ethereum’s transition to Proof-of-Stake and brought a lot more predictability for ETH investors to start engaging with staking.

Why does it matter?

This reassured confidence led to the number of daily deposits by stakers7 increasing from an average of ~20,000 ETH per day before Shanghai to ~72,000 ETH on a daily basis after the upgrade. This whopping 260% rise shows that, after the significant derisking coming from the successful activations of The Merge and Shanghai, investors are steadily becoming more interested in providing security to Ethereum in exchange for “crypto’s risk free-rate,” that is, an interest rate paid to stakers in ETH—the native token of the most consolidated smart contracts platform in crypto—which, rather than relying on a decentralized application and this potentially incurring additional smart contract risk, is solely due to security provision of the blockchain itself.

4. Total stake as a percentage of the ETH supply has surpassed 20%.8

Description

The ramp-up in staking interest after Shanghai led the stake on Ethereum to recently surpass 20% of the total ETH supply, implying that 1 out of every 5 ETH in existence is now pledged as collateral by stakers for security purposes.

Why does it matter?

This trend is likely to continue until the stake ratio as a percentage of total supply falls within the range from 30% to 50% akin to other PoS networks. With less of the ETH supply staying liquid while demand for ETH continues to grow as users interact with decentralized applications on the network, price appreciation for ETH is likely to be expected.

5. ETH was net deflationary in the four quarters following the switch to PoS.9

Description

The drastic reduction in issuance after the switch to PoS, together with the existing burning mechanism for ETH (which subtracts from the total supply part of the ETH paid in transaction fees on the network), has led Ethereum to be net deflationary in the four quarters following “The Merge.”

Why does it matter?

This leads to an additional scarcity driver for ETH, and, similar to tokens locked on stake, can potentially drive prices higher as demand for the token grows with the dawn of a new bull cycle.

Conclusion

The Merge was a major milestone for Ethereum, and it is still too early to say what its long-term impact will be. However, the positive trends seen in the past year are encouraging.

One year after its transition to Proof-of-Stake, Ethereum is showing strong signs of progress. The number of active validators has increased by 85%, and the share of transaction fees in validator income is above 20% even during the bear market. Staking interest has increased by 260% after the Shanghai upgrade, and total stake as a percentage of the ETH supply has surpassed 20%. Finally, ETH has been net deflationary in the four quarters following the switch to PoS.

These metrics suggest that Ethereum is becoming more secure, decentralized, and sustainable. As the crypto market recovers and on-chain activity ramps back up, Ethereum is well-positioned to continue to grow and thrive.

______________________________________________

1Network participants that are proposing and attesting to blocks at a specific point in time.

2Hashdex Research with data from beaconcha.in (accessed September 14, 2023).

3According to https://www.stakingrewards.com/ (accessed September 14, 2023).

4Validator revenue in every block consists of newly issued ETH and part of the transaction fees paid by users that had their transactions included in that block.

5Hashdex Research with data from Etherscan and beaconcha.in (accessed September 14, 2023).

6Hashdex Research with data from Etherscan (accessed September 14, 2023).

7ETH holders that deposit capital to start participating in block validation.

8Hashdex Research with data from beaconcha.in (accessed September 14, 2023).

9Hashdex Research with data from Etherscan and CryptoQuant (accessed September 14, 2023). *Q3’23 is not complete as of this analysis.

_______________________________________________________________

This material expresses Hashdex Asset Management Ltd. and its subsidiaries and affiliates (“Hashdex”)'s opinion for informational purposes only and does not consider the investment objectives, financial situation or individual needs of one or a particular group of investors. We recommend consulting specialized professionals for investment decisions. Investors are advised to carefully read the prospectus or regulations before investing their funds. The information and conclusions contained in this material may be changed at any time, without prior notice. Nothing contained herein constitutes an offer, solicitation or recommendation regarding any investment management product or service. This information is not directed at or intended for distribution to or use by any person or entity located in any jurisdiction where such distribution, publication, availability or use would be contrary to applicable law or regulation or which would subject Hashdex to any registration or licensing requirements within such jurisdiction. No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of Hashdex. By receiving or reviewing this material, you agree that this material is confidential intellectual property of Hashdex and that you will not directly or indirectly copy, modify, recast, publish or redistribute this material and the information therein, in whole or in part, or otherwise make any commercial use of this material without Hashdex’s prior written consent.

Investment in any investment vehicle and cryptoassets is highly speculative and is not intended as a complete investment program. It is designed only for sophisticated persons who can bear the economic risk of the loss of their entire investment and who have limited need for liquidity in their investment. There can be no assurance that the investment vehicles will achieve its investment objective or return any capital. No guarantee or representation is made that Hashdex’s investment strategy, including, without limitation, its business and investment objectives, diversification strategies or risk monitoring goals, will be successful, and investment results may vary substantially over time. Nothing herein is intended to imply that the Hashdex s investment methodology or that investing any of the protocols or tokens listed in the Information may be considered “conservative,” “safe,” “risk free,” or “risk averse.”

Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Hashdex, and Hashdex does not assume responsibility for the accuracy of such information. Hashdex does not provide tax, accounting or legal advice. Certain information contained herein constitutes forward-looking statements, which can be identified by the use of terms such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” “believe” (or the negatives thereof) or other variations thereof. Due to various risks and uncertainties, including those discussed above, actual events or results, the ultimate business or activities of Hashdex and its investment vehicles or the actual performance of Hashdex, its investment vehicles, or digital tokens may differ materially from those reflected or contemplated in such forward-looking statements. As a result, investors should not rely on such forward- looking statements in making their investment decisions. None of the information contained herein has been filed with the U.S. Securities and Exchange Commission or any other governmental or self-regulatory authority. No governmental authority has opined on the merits of Hashdex’s investment vehicles or the adequacy of the information contained herein.