1. CHART OF THE WEEK

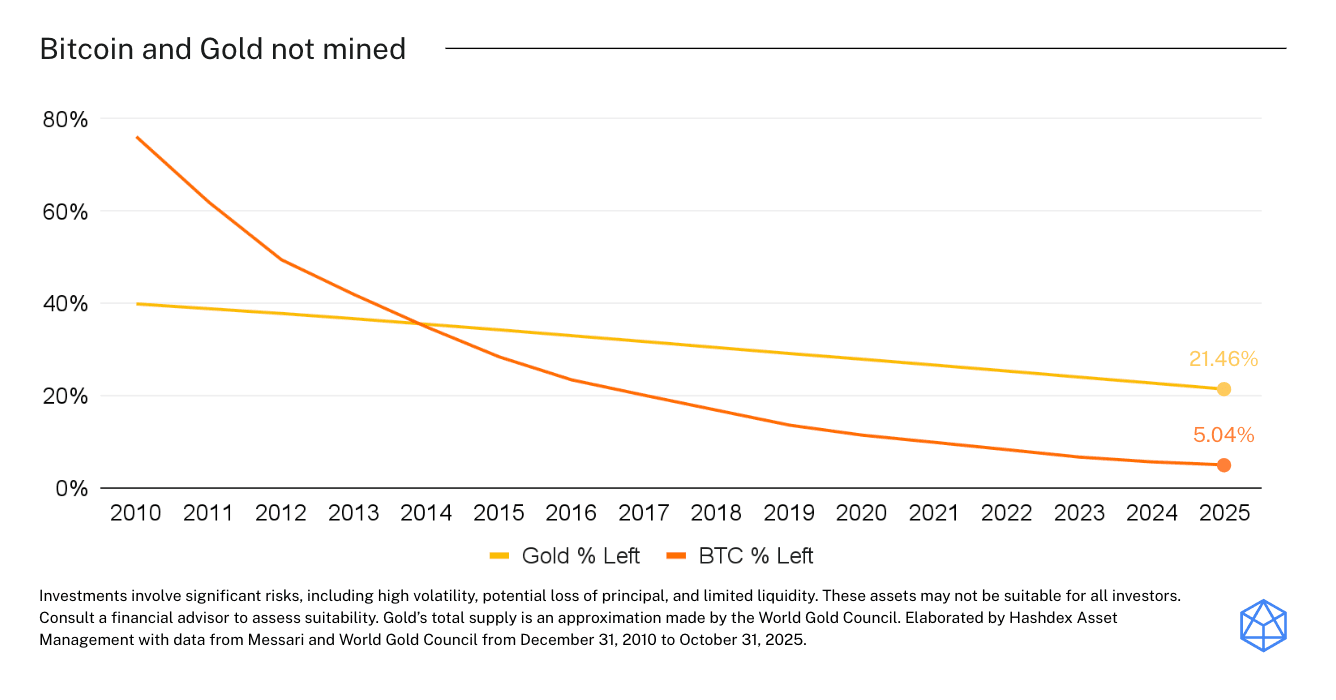

Following our previous Hash Insider, in which we explored the tandem between gold and Bitcoin as safe-haven assets, one of the key traits they share is scarcity.

While both assets have limited supply, Bitcoin’s hard-coded scarcity—with a fixed cap of 21 million coins—makes the case for an even stronger store of value asset than gold, despite its shorter history.

As crypto adoption accelerates, particularly through Bitcoin’s growing role as a reserve asset for sovereign states (many of which have publicly stated no intention to sell) and as part of corporate treasuries, the available supply becomes even tighter.

This dynamic could trigger a self-reinforcing loop: the more Bitcoin is accumulated, the stronger the fear of missing out among investors seeking exposure to such a finite asset. This, in turn, could fuel further demand and price appreciation—not only for Bitcoin but also for other crypto assets that historically benefit from broader market cycles.

2. MARKET HIGHLIGHTS

EU eyes SEC-style supervision for crypto

-

The European Commission plans to give the European Securities and Markets Authority (ESMA) authority to oversee major stock and crypto exchanges under a unified EU framework.

-

A single supervisor would potentially bring a long-awaited regulatory clarity to Europe’s crypto market, reducing compliance uncertainty — a net positive for liquidity and long-term adoption.