1. CHART OF THE WEEK

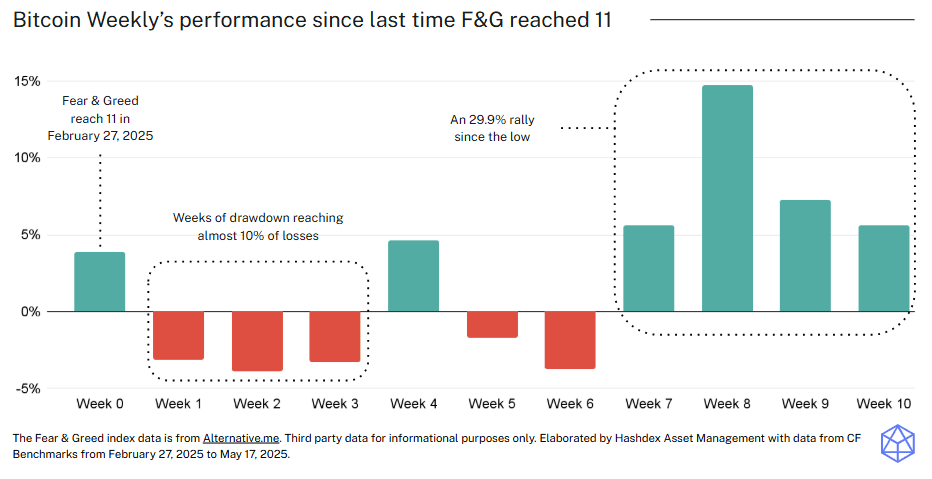

The Fear & Greed Index, an important market sentiment metric for crypto assets, reached 11 on November 21st—one of its lowest levels on record—and remained in "Extreme Fear" territory for 18 consecutive days. This marks the second time this year we've seen such extreme fear.

The first occurred in February because of Trump's tariff rhetoric, which triggered a drawdown followed by a rally of almost 30% in the next weeks. Current conditions appear potentially similar, after Bitcoin experienced sharp downward price action last Sunday, potentially setting up for a comparable recovery pattern.

For investors, this inflection point may present asymmetric entry opportunities. Notably, even during this capitulation phase, Bitcoin ETFs sustained over $50 billion in inflows since inception while regulatory frameworks continued to advance, which is why this should be a moment for investors to pay attention to crypto’s long-term value.

2. MARKET HIGHLIGHTS

Visa expands stablecoin settlement to CEMEA

-

Visa partnered with Aquanow to enable USDC settlement across Central/Eastern Europe, Middle East, and Africa, with $2.5B in annualized settlement volume.

-

This institutional integration could accelerate regulatory acceptance and drive broader stablecoin adoption, reinforcing USDC's position as a critical settlement layer.

Ethereum upgrades throughput ahead of update

-

Ethereum raised its block gas limit to 60M ahead of its latest upgrade (named Fusaka), enabling record throughput of 31,000 transactions per second across its scaling solutions.

-

Combined with Fusaka's data availability improvements, this positions ETH well for renewed institutional DeFi activity and could narrow the performance gap with higher-throughput chains.

Coinbase reveals 2026 investment priorities

-

Coinbase Ventures outlined its top investment priorities for 2026, highlighting asset tokenization as a key area of focus.

-

Institutional capital flowing toward RWA and DeFi infrastructure signals these sectors are approaching product-market fit, which—combined with improving regulatory clarity—could catalyze further institutional development in the crypto ecosystem.