1. CHART OF THE WEEK

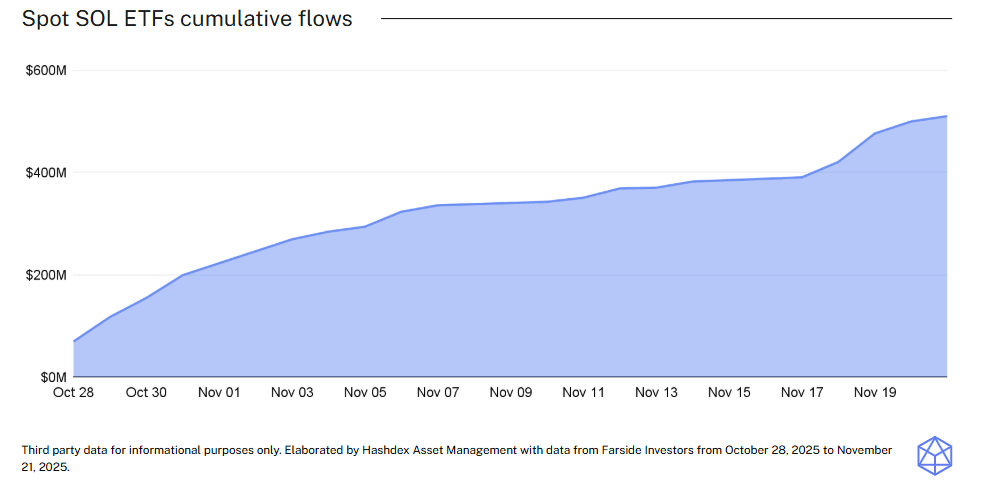

Solana ETFs have seen steady daily inflows since launching in late October, gathering more than $500 million through November despite SOL declining 30% during the same period. Such divergence between strong demand and weak price action contrasts sharply with Bitcoin and Ethereum ETFs, which together recorded $4.4 billion in outflows in November as crypto markets pulled back from their October highs.

The persistent appetite for Solana products indicates that institutions had a latent demand for a regulated SOL product, and suggests that they are building long-term exposure to smart-contract platforms, rather than reacting to short-term price swings.

This trend echoes the early days of Bitcoin ETF adoption, when institutional accumulation continued despite volatility — a dynamic that could support broader crypto adoption regardless of near-term price levels.

2. MARKET HIGHLIGHTS

Japan’s crypto tax shift

-

At least six major Japanese wealth managers are considering crypto investment products as regulators plan to cut taxes from 55% to 20%.

- By aligning crypto taxation with equities at 20%, Japan removes a critical barrier to mainstream adoption, signaling digital assets are no longer going to be treated as speculative outliers and setting a template for other Asian economies to follow.

Fed signals room for cuts

-

John Williams, the president of the Federal Bank of New York, signaled room for rate cuts on November 21, with December cut probability jumping from 35% to 70%.

- Lower interest rates increases overall market liquidity—a dynamic that have historically benefited crypto during monetary easing cycles. This could provide a potential catalyst for renewed institutional flows into digital assets as year-end positioning approaches.

China’s mining rebounds to 14% levels

-

China climbed back to 14% of global Bitcoin mining despite 2021 ban, driven by low cost electricity and excess data center capacity.

- This renewed activity in China adds meaningful geographic diversification to Bitcoin’s network, reducing concentration risk and reinforcing its core value as a decentralized system.