Dear Investor,

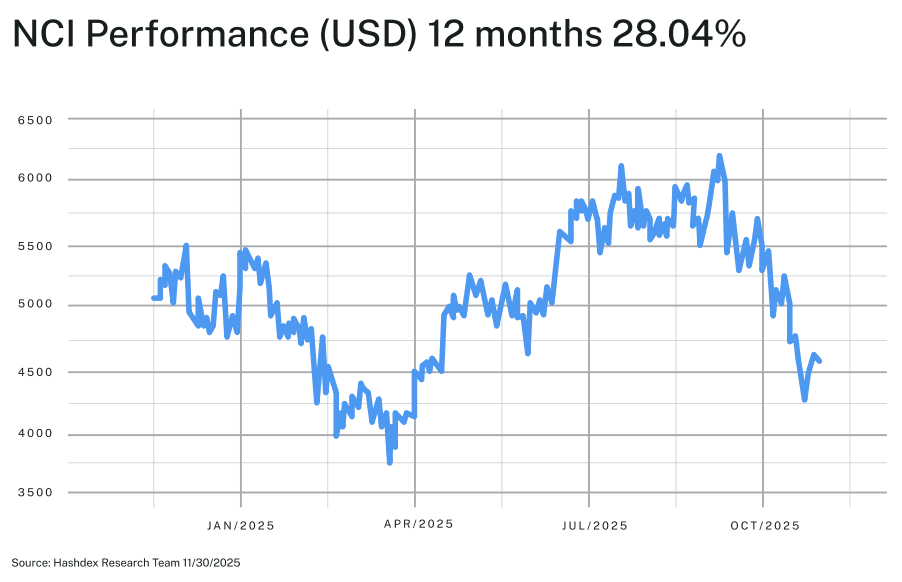

November was the worst month for crypto assets in over three years, following a volatile October in which bitcoin (BTC) touched a new all-time high before ending the month down close to 4%. That negative momentum carried through November, with the Nasdaq Crypto IndexTM (NCITM) falling over 18% and BTC dropping nearly 17%, driven in part by ETF outflows.

December, however, started off strong as a series of announcements have helped draw attention to the ongoing institutional adoption of this asset class. Vanguard, a firm that has historically prevented crypto ETFs from being available to its clients, moved to allow these products on its platform while Bank of America announced it would begin to allow its advisors to recommend up to a 4% crypto allocation, following a similar move by Morgan Stanley in October.

This trend of adoption will be a key factor driving performance in the new year, which we cover in our recently released 2026 Crypto Investment Outlook.

As always, we are greatly appreciative of your trust in us and are here to answer any questions you may have.

-Your Partners at Hashdex

Market Review

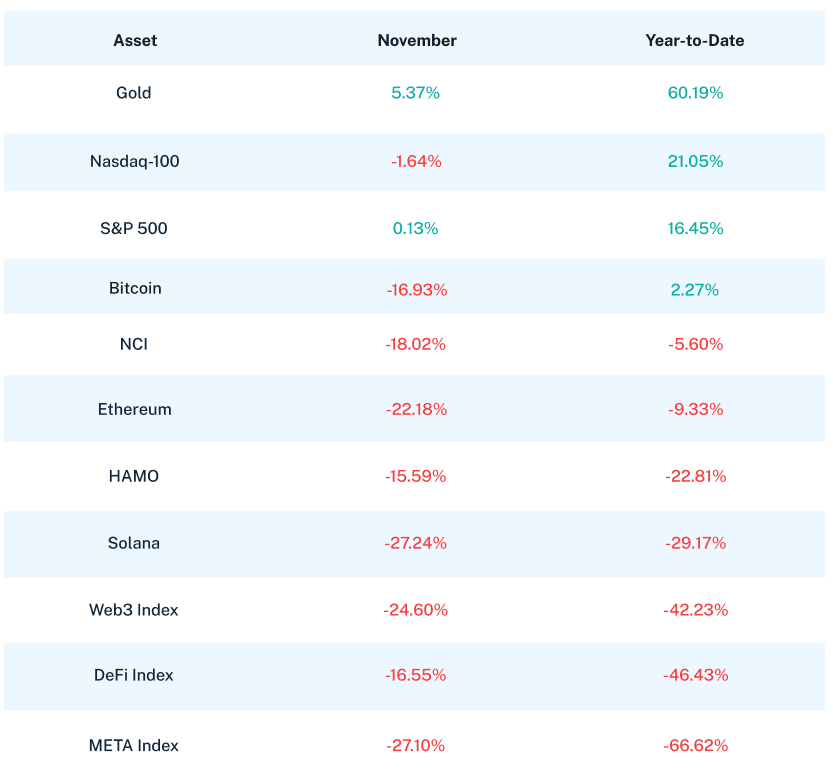

November marked crypto's harshest reckoning of the year, as cascading ETF outflows collided with macroeconomic uncertainty to produce the worst monthly performance since June 2022. The Nasdaq Crypto IndexTM (NCITM) plunged 18.02%, pushing 2025 returns into negative territory at -5.60%. This dramatic reversal—occurring just one month after BTC touched a new all-time high of $126,000—demonstrated how quickly sentiment can shift when institutional flows reverse direction. Traditional markets barely flinched by comparison: the S&P 500 eked out a 0.13% gain while the Nasdaq-100 declined 1.64%.

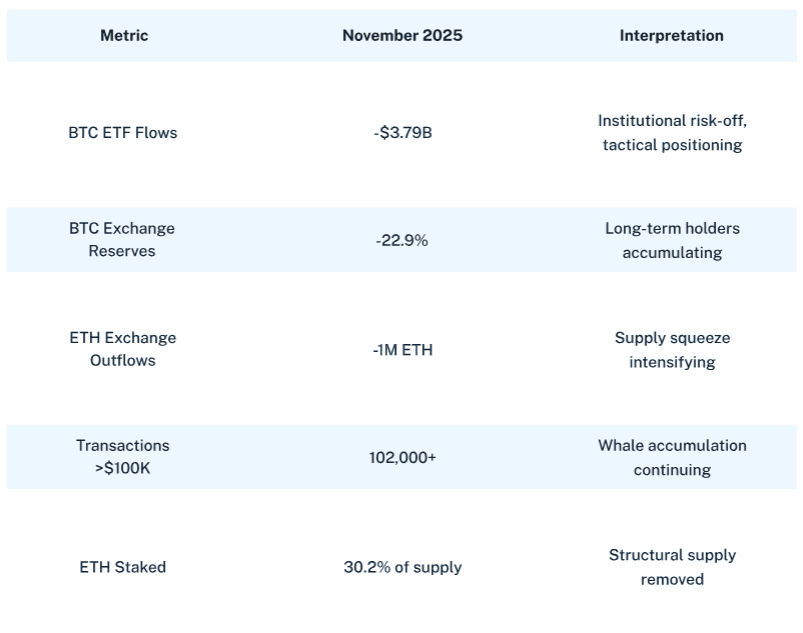

The month's defining dynamic was an unprecedented ETF exodus. Bitcoin spot ETFs hemorrhaged $3.79 billion in November—their largest monthly outflow since launch. Ethereum ETFs suffered $1.5 billion in outflows, their worst month ever. The November 20 single-day outflow of $903 million across bitcoin products underscored the velocity of institutional repositioning. This wasn't panic selling by retail traders; it was systematic risk reduction by the same institutions that had driven crypto's summer rally.

The Federal Reserve's divided stance on further rate cuts amplified uncertainty. November FOMC minutes revealed deep disagreement among policymakers, with December cut probability whipsawing from 96% to 40% before stabilizing near 90% after NY Fed President Williams signaled support on November 21. The 43-day government shutdown—the longest in US history—finally ended on November 12, but not before distorting October economic data and rattling consumer confidence to its lowest level since June 2022.

Bitcoin's 16.93% decline brought its year-to-date return to just 2.27%, trailing both the S&P 500's 16.45% and Gold's extraordinary 60.19%. The “digital gold” narrative faced its sternest test as physical gold surged 5.37% in November to record highs near $4,400 per ounce, while Bitcoin declined sharply. MicroStrategy's 650,000 BTC position—representing 3% of total supply—came under scrutiny as MSCI index exclusion threats emerged, with a January 15 decision potentially triggering $2.8-11.6 billion in forced outflows. CEO Michael Saylor's hint at potential sales if the stock's premium to net asset value falls below 1.0 further unnerved markets.

Ethereum suffered a 22.18% decline despite significant positive catalysts buried beneath the selling pressure. The confirmation of its newest upgrade, aimed at improved scaling, went largely unnoticed. S&P's November 26 downgrade of Tether to its lowest rating—citing "persistent gaps in disclosure"—added regulatory uncertainty to an already fragile market. Solana's 27.24% decline reflected ongoing FTX/Alameda token unlocks, with 193,000 SOL released on November 11 as part of the $1+ billion distribution to creditors that has weighed on the token since November 2023.

Thematic indices faced steep declines across the board. The Digital Culture index fell 27.10%, extending its year-to-date decline to -66.62%. Smart Contract Platforms (Web3) dropped 24.60%, while Decentralized Finance (DeFi) declined 16.55% despite total value locked remaining near $170 billion. The Vinter Hashdex Risk Parity Momentum (HAMO) index lost 15.59%, its systematic approach unable to escape the broad-based selloff. The consistency of losses across all thematic indices—from -15% to -27%—highlighted November's indiscriminate risk reduction rather than sector-specific weakness.

November's most instructive lesson lies in understanding what the headlines didn't capture. While ETF outflows dominated financial media, on-chain metrics told a different story. Bitcoin exchange reserves fell 22.9% from November 19-25, dropping from 2.37 million to 1.83 million BTC—the lowest since 2018. Over 102,000 transactions exceeding $100,000 occurred during November, as patient capital accumulated while institutional products shed assets.

This divergence reveals a crucial structural dynamic: ETF investors and on-chain holders represent fundamentally different capital bases with distinct time horizons.

The implications are significant. ETF flows reflect asset allocation decisions by wealth managers responding to macro conditions, client redemptions, and portfolio rebalancing. On-chain accumulation represents conviction-based positioning by participants with longer horizons. When these forces diverge as dramatically as November, it often precedes inflection points—either continued deterioration if on-chain conviction breaks, or recovery if ETF flows stabilize while supply remains constrained.

Year-to-date returns through November 30 reveal gold's dominance and crypto's struggles:

Gold's 60.19% year-to-date gain—its strongest annual performance since the late 1970s—stands in stark contrast to BTC's meager 2.27%. The "digital gold" thesis requires re-examination when the original outperforms its digital counterpart by 58%. Yet crypto's fundamental infrastructure—regulatory frameworks, ETF products, institutional custody, stablecoin systems—remains more developed than at any point in history.

Market Cap-Weighted Indices: Limiting Damage During Drawdowns

November validated the protective qualities of market cap-weighted exposure during severe drawdowns. While the NCI declined 18.02%, individual sectors suffered far worse: Digital Culture Index fell 27.10%, Smart Contract Platforms dropped 24.60%, and Solana crashed 27.24%. The NCI's heavy Bitcoin allocation (approximately 75% weight) provided meaningful downside protection—Bitcoin's 16.93% decline was substantially better than nearly every other constituent.

This isn't about avoiding losses entirely—no diversified exposure could escape November's broad selloff. It's about capital preservation that enables compounding during recoveries. An investor holding equal weights in BTC, ETH, SOL, and thematic indices would have suffered significantly worse than the NCI's market cap-weighted methodology.

Looking Ahead: Catalysts for Stabilization

Despite November's challenges, multiple developments position crypto for potential stabilization:

Fed Clarity: The December 9-10 FOMC meeting should provide definitive direction on near-term monetary policy. Markets currently price 90% probability of a 25-basis-point cut, which would bring rates to 3.50%-3.75% and potentially halt the risk-off rotation.

Ethereum Upgrade: The December 3 activation (“Fusaka”) introduces PeerDAS, dramatically improving Layer 2 scaling efficiency. This technical catalyst arrives at depressed valuations, potentially catalyzing renewed developer and institutional interest.

XRP ETF Momentum: Five spot XRP ETFs listed on DTCC as "active and pre-launch" on November 10, with accelerated 20-day approval guidance from the SEC. Expanded ETF product availability could attract capital back to the broader crypto ecosystem.

Supply Mechanics: With exchange reserves at 2018 lows, 30% of ETH supply staked, and long-term holder accumulation continuing, the supply side offers favorable asymmetry. Any stabilization in ETF flows could rapidly shift market dynamics given constrained available supply.

November 2025 might be remembered as crypto's great reset—the month when year-to-date gains evaporated and institutional conviction faced its sternest test. Yet the infrastructure built over the past year remains intact: regulatory frameworks are clearer, ETF products are operational, institutional custody is robust, and fundamental adoption continues. Gold's dominance this year challenges the digital gold narrative, but doesn't invalidate crypto's role as a distinct asset class with unique properties.

For investors with conviction in crypto's long-term potential, November's drawdown—while painful—occurs within an asset class that has recovered from far worse. The NCI's market cap-weighted methodology provided meaningful protection during the decline and positions investors to participate in eventual recovery without requiring perfect timing. Patient capital rarely regrets staying the course during capitulation events.

The crypto market enters December battered but not broken, with supply mechanics and upcoming catalysts offering pathways to stabilization. The great reset has concluded; what follows depends on whether institutional flows find equilibrium with the conviction capital that continued accumulating throughout November's storm.

Top Stories

Harvard triples BTC exposure via spot ETFs

Harvard Management Company, which oversees the world’s largest academic endowment, has significantly increased its bitcoin exposure by adding more spot BTC ETF positions. This sends a powerful signal: bitcoin is increasingly being treated as a strategic long-term asset, which should be monitored as a strategic play for pension funds, foundations, sovereign wealth funds and other large institutional investors.

Crypto czar to push regulatory clarity

David Sacks pushed for clear US rules backing a strategic Bitcoin Reserve using seized BTC and calling crypto the “Industry of the Future.” As the new US administration signals a pro-crypto shift and aims to make the US the global crypto leader, it could spark a more competitive global environment, driving crypto investments from countries worldwide.

Japan’s crypto tax shift

At least six major Japanese wealth managers are considering crypto investment products as regulators plan to cut taxes from 55% to 20%. By aligning crypto taxation with equities at 20%, Japan removes a critical barrier to mainstream adoption, signaling digital assets are no longer going to be treated as speculative outliers and setting a template for other Asian economies to follow.

_____________________________

This material expresses Hashdex Asset Management Ltd. and its subsidiaries and affiliates (“Hashdex”)'s opinion for informational purposes only and does not consider the investment objectives, financial situation or individual needs of one or a particular group of investors. We recommend consulting specialized professionals for investment decisions. Investors are advised to carefully read the prospectus or regulations before investing their funds.

The information and conclusions contained in this material may be changed at any time, without prior notice. Nothing contained herein constitutes an offer, solicitation or recommendation regarding any investment management product or ser vice. This information is not directed at or intended for distribution to or use by any person or entity located in any jurisdiction where such distribution, publication, availability or use would be contrary to applicable law or regulation or which would subject Hashdex to any registration or licensing requirements within such jurisdiction.

These opinions are derived from internal studies and do not have access to any confidential information. Please note that future events may not unfold as anticipated by our team’s research and analysis. No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of Hashdex.

By receiving or reviewing this material, you agree that this material is confidential intellectual property of Hashdex and that you will not directly or indirectly copy, modify, recast, publish or redistribute this material and the information therein, in whole or in part, or other wise make any commercial use of this material without Hashdex’s prior written consent.

Investment in any investment vehicle and crypto assets is highly speculative and is not intended as a complete investment program. It is designed only for sophisticated persons who can bear the economic risk of the loss of their entire investment and who have limited need for liquidity in their investment. There can be no assurance that the investment vehicles will achieve its investment objective or return any capital. No guarantee or representation is made that Hashdex’s investment strategy, including, without limitation, its business and investment objectives, diversification strategies or risk monitoring goals, will be successful, and investment results may var y substantially over time.

Nothing herein is intended to imply that the Hashdex s investment methodology or that investing any of the protocols or tokens listed in the Information may be considered “conservative,” “safe,” “risk free,” or “risk averse.” These opinions are derived from internal studies and do not have access to any confidential information. Please note that future events may not unfold as anticipated by our team’s research and analysis.

Certain information contained herein (including financial information) has been obtained from published and unpublished sources. Such information has not been independently verified by Hashdex, and Hashdex does not assume responsibility for the accuracy of such information. Hashdex does not provide tax, accounting or legal advice. Certain information contained herein constitutes for ward-looking statements, which can be identified by the use of terms such as “may,” “ will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” “believe” (or the negatives thereof ) or other variations thereof. Due to various risks and uncertainties, including those discussed above, actual events or results, the ultimate business or activities of Hashdex and its investment vehicles or the actual performance of Hashdex, its investment vehicles, or digital tokens may differ materially from those reflected or contemplated in such for ward-looking statements.

As a result, investors should not rely on such for ward- looking statements in making their investment decisions. None of the information contained herein has been filed with the U.S. Securities and Exchange Commission or any other governmental or self-regulator y authority. No governmental authority has opined on the merits of Hashdex’s investment vehicles or the adequacy of the information contained herein.

Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular digital asset or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any digital asset or any representation about the financial condition of a digital asset. Statements regarding Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate assets before investing. ADVICE FROM A FINANCIAL PROFESSIONAL IS STRONGLY ADVISED.