Last week, Hashdex released its 2026 Crypto Investment Outlook. In the report, we cover the major themes we expect to drive adoption of digital assets as 2026 takes shape.

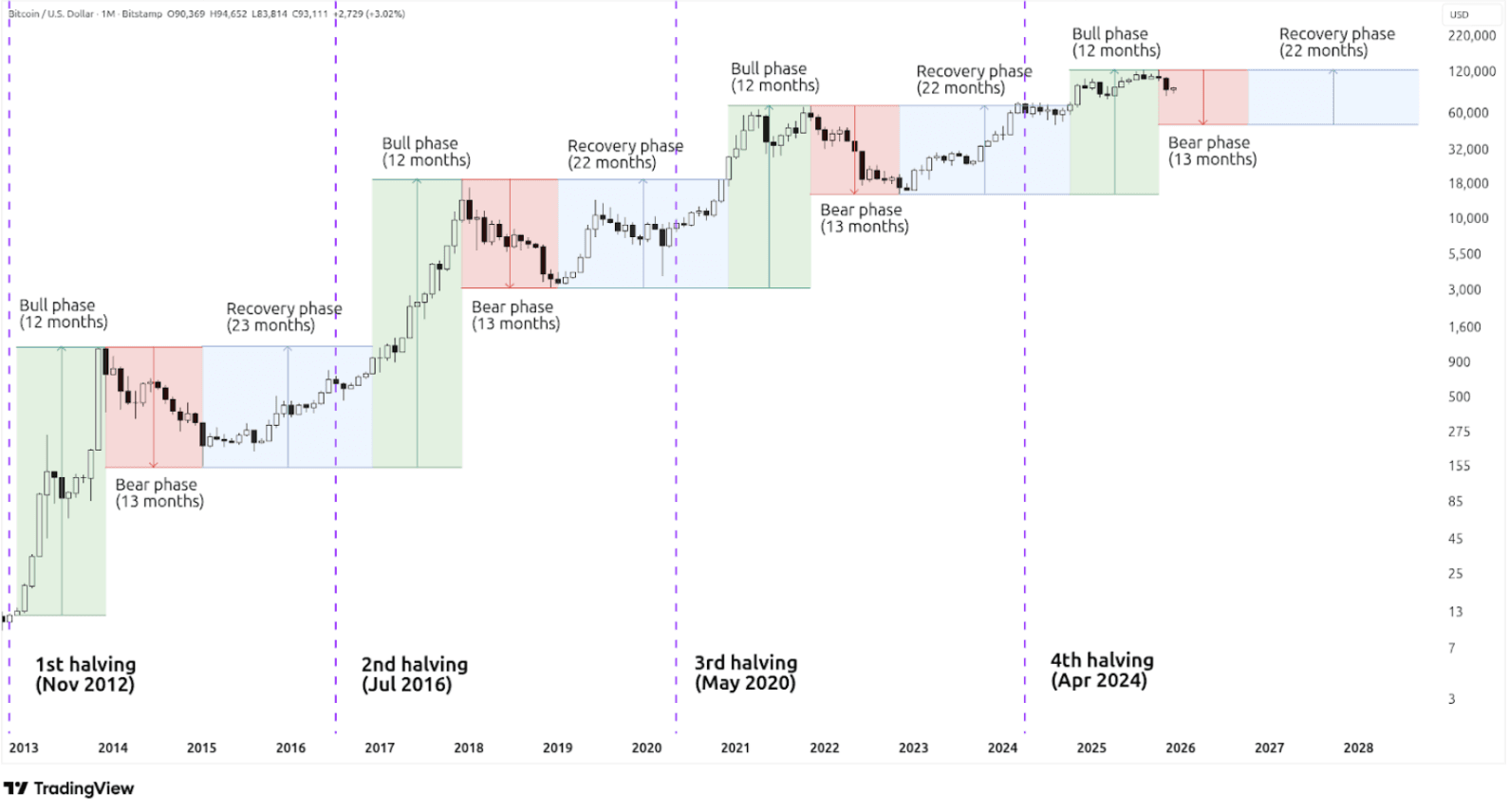

One of the topics many investors are grappling with going into the new year is what the price volatility we have seen since October means for the investment case for crypto in 2026. Crypto has historically followed a four-year cycle that includes roughly a year of a bull market, followed by a bear market, and then about two years of a recovery period.

Is this pattern repeating?

Well, as Mark Twain put it, “History doesn’t repeat itself, but it does rhyme.” In other words, I don’t believe we are seeing the same exact type of cycle we have seen in the past, but there are similarities.

For context, let’s step back to February 2023. At the time, I wrote about crypto’s recovery phase, suggesting that if history did indeed rhyme, we would see a two-year recovery period followed by a year-long bull market. In September 2024, I reiterated that historically the next phase should lead to a sharp 12-month rally in prices. These weren’t “predictions,” just observations of the strong behavioral patterns we had seen in a retail-driven market.

Bitcoin’s four-year cycle

So what has actually happened?

First, we have not seen a blow-off top in the last 12 months. Yes, prices have rallied strongly, with both bitcoin and the Nasdaq Crypto Index more than doubling over the 12 months leading to new all-time highs in early October.

And, relative to the 2021 all time highs, crypto is up only ~60%, which is roughly in line with the Nasdaq-100. In other words, this was not the speculative mania we saw in previous cycles and we haven’t seen the euphoric excess normally associated with these tops.

Shifting perceptions and demand drivers

One of the clearest signals that market structure is changing is the nature of conversations we’re having with wealth managers, family offices, and institutional allocators. These conversations remain constructive and forward-looking. While some retail investors have been taking profits—anticipating a familiar four-year correction—institutions have been adding exposure at a record pace.

Just as importantly, the questions institutions are asking have fundamentally shifted. They are no longer debating whether crypto deserves a place in a portfolio or attempting to predict short-term price direction. Instead, they’re focused on implementation: What is the most efficient vehicle to gain exposure? How should crypto be integrated into capital-market assumptions? How should they rebalance around it?

This shift is more than cultural; it’s structural. For years, crypto’s investor base was dominated by retail momentum traders—participants who tend to buy when prices are rising and sell when momentum fades. These behaviors intensified cycles and contributed to the strong boom-bust patterns of the past decade.

Institutional allocators behave differently. They are long-term rebalancers. They add exposure during periods of weakness and reduce exposure when prices run too far ahead. This countercyclical behavior naturally dampens volatility and smooths the extremes of crypto’s historical cycles. It is likely a major reason we haven’t seen the kind of blow-off top that characterized 2013, 2017, or 2021—and why volatility has remained unexpectedly muted in recent months.

Still, investors should not entirely dismiss the lessons of history. Waves of fear and greed are inherent to any emerging technology, and the past decade in crypto has been no exception. John Templeton’s famous warning still applies: “The four most dangerous words in investing are: This time it’s different.”

Today, crypto sits at the intersection of two competing lessons. The cyclical patterns of the past argue for caution and discipline. Meanwhile, the history of exponential technologies—personal computers, the internet, artificial intelligence—reminds us that stepping aside during structurally transformative periods can be costly. Advisors must navigate this balance thoughtfully.

What happens next?

The bear case, a cyclical correction, remains entirely possible. A further decline for bitcoin would be consistent with historical retracements, especially considering today’s lower volatility regime. Yet even in a correction, it’s possible that smart contract platforms and decentralized finance assets could decouple from bitcoin, supported by accelerating stablecoin adoption, tokenization initiatives, and AI-driven demand for decentralized data and compute. If the macro environment remains constructive for risk assets—particularly if the AI-driven equity trade continues—this segment of the market could remain resilient.

But the bull case has become even more compelling. Institutional inflows continue to reach new highs, while retail participation remains far below the levels seen in past manias. Combined with a supportive macro environment and the increasing geopolitical relevance of digital assets, these forces could push bitcoin to new all-time highs even before the next halving. A path toward $300,000 this cycle is mathematically consistent with current flow dynamics and historical elasticity. This is not a forecast, but a demonstration that such outcomes fall squarely within the realm of possibility.

Our guidance remains the same

Crypto remains a structural, multi-decade asset class, and its inherent volatility—while sometimes uncomfortable—is a source of long-term opportunity.

Since 2018, our portfolio guidance has been consistent: investors with zero crypto exposure should begin building a position gradually, using dollar-cost averaging to participate in potential upside while reducing timing risk. Should a bear market emerge, lower prices should be viewed as an opportunity to add exposure, not a reason to step away.

For investors who already hold their target allocation, crypto’s volatility can be used as a rebalancing dividend. Trim during periods of strong appreciation; add during periods of weakness. This disciplined approach has historically been one of the most effective ways to enhance long-term returns.

Ultimately, the four-year cycle remains a helpful historical framework. But it is not, and has never been, an investment strategy. Market structure is evolving. Retail investors taking profits while institutions accumulate is very different from past cycle mechanics—and this alone may be a key reason why the current environment feels unfamiliar.

The principles for navigating this moment are simple: maintain a modest allocation, embrace a long-term horizon, and apply disciplined rebalancing. Crypto continues to offer a unique combination of innovation-driven growth and portfolio diversification. Regardless of whether the four-year cycle is ending or merely changing shape, these fundamentals remain unchanged.

_____________________________

This material expresses Hashdex Asset Management Ltd. and its subsidiaries and affiliates (“Hashdex”)'s opinion for informational purposes only and does not consider the investment objectives, financial situation or individual needs of one or a particular group of investors. We recommend consulting specialized professionals for investment decisions. Investors are advised to carefully read the prospectus or regulations before investing their funds.

The information and conclusions contained in this material may be changed at any time, without prior notice. Nothing contained herein constitutes an offer, solicitation or recommendation regarding any investment management product or ser vice. This information is not directed at or intended for distribution to or use by any person or entity located in any jurisdiction where such distribution, publication, availability or use would be contrary to applicable law or regulation or which would subject Hashdex to any registration or licensing requirements within such jurisdiction.

These opinions are derived from internal studies and do not have access to any confidential information. Please note that future events may not unfold as anticipated by our team’s research and analysis. No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of Hashdex.

By receiving or reviewing this material, you agree that this material is confidential intellectual property of Hashdex and that you will not directly or indirectly copy, modify, recast, publish or redistribute this material and the information therein, in whole or in part, or other wise make any commercial use of this material without Hashdex’s prior written consent.

Investment in any investment vehicle and crypto assets is highly speculative and is not intended as a complete investment program. It is designed only for sophisticated persons who can bear the economic risk of the loss of their entire investment and who have limited need for liquidity in their investment. There can be no assurance that the investment vehicles will achieve its investment objective or return any capital. No guarantee or representation is made that Hashdex’s investment strategy, including, without limitation, its business and investment objectives, diversification strategies or risk monitoring goals, will be successful, and investment results may var y substantially over time.

Nothing herein is intended to imply that the Hashdex s investment methodology or that investing any of the protocols or tokens listed in the Information may be considered “conservative,” “safe,” “risk free,” or “risk averse.” These opinions are derived from internal studies and do not have access to any confidential information. Please note that future events may not unfold as anticipated by our team’s research and analysis.

Certain information contained herein (including financial information) has been obtained from published and unpublished sources. Such information has not been independently verified by Hashdex, and Hashdex does not assume responsibility for the accuracy of such information. Hashdex does not provide tax, accounting or legal advice. Certain information contained herein constitutes for ward-looking statements, which can be identified by the use of terms such as “may,” “ will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” “believe” (or the negatives thereof ) or other variations thereof. Due to various risks and uncertainties, including those discussed above, actual events or results, the ultimate business or activities of Hashdex and its investment vehicles or the actual performance of Hashdex, its investment vehicles, or digital tokens may differ materially from those reflected or contemplated in such for ward-looking statements.

As a result, investors should not rely on such for ward- looking statements in making their investment decisions. None of the information contained herein has been filed with the U.S. Securities and Exchange Commission or any other governmental or self-regulator y authority. No governmental authority has opined on the merits of Hashdex’s investment vehicles or the adequacy of the information contained herein.

Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular digital asset or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any digital asset or any representation about the financial condition of a digital asset. Statements regarding Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate assets before investing. ADVICE FROM A FINANCIAL PROFESSIONAL IS STRONGLY ADVISED.