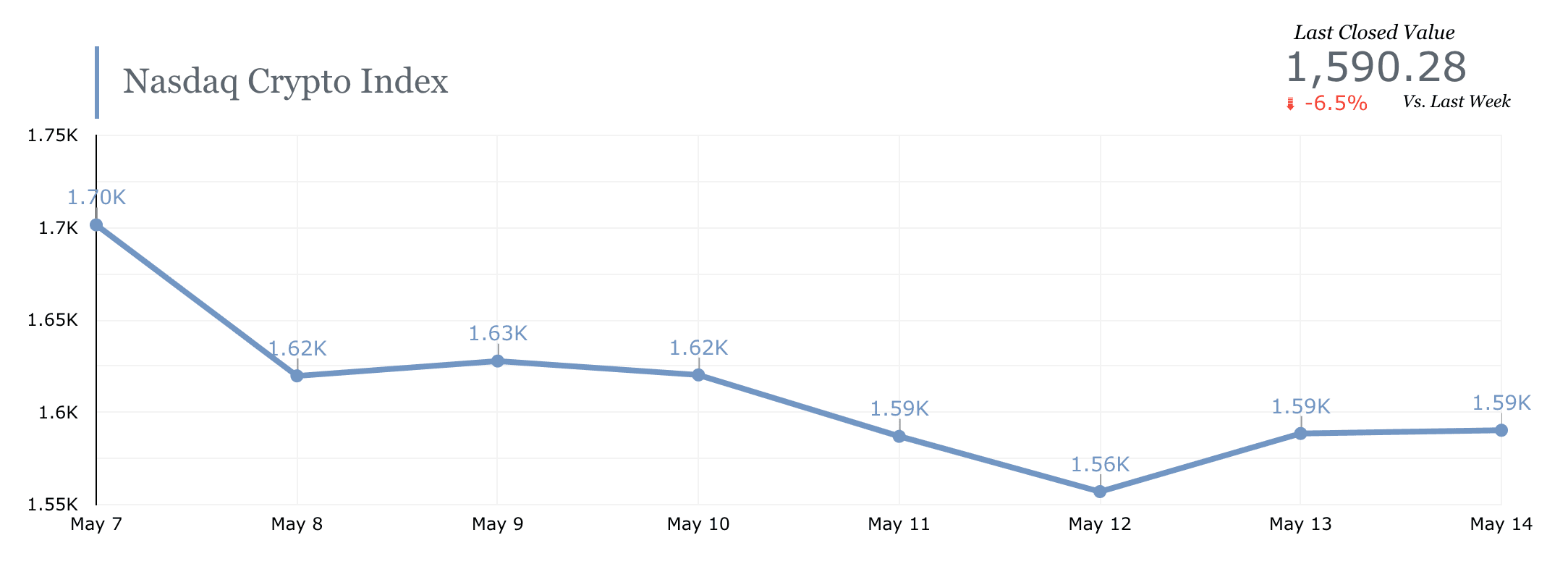

Last week, after a brief rally following another release of decreasing CPI number (4.9% over the last 12 months which is lower than expected) in the US, the Nasdaq Crypto IndexTM (NCITM) fell 6.5%, with bitcoin (BTC) experiencing a 6.9% correction and ether (ETH) outperforming in relative terms with a weekly decrease of 5.9%. This performance takes May into negative territory after a four-month positive streak. The price correction may have been an effect of decreased liquidity in crypto markets caused by the news that two of the largest crypto market makers will step back from the sector due to a lack of regulatory clarity.

Bitcoin falls below $27,000 as US regulatory crackdown pressures crypto's biggest market makers

Jane Street and Jump Trading, two prominent cryptocurrency trading firms, have scaled back their activities due to increased regulatory scrutiny in the United States. This demonstrates that regulatory challenges can affect larger institutions too, and investors should be prepared for potential shifts in trading strategies, impacting liquidity and market sentiment.

MetaMask introduces “Buy Crypto with Paypal”

MetaMask, Web3’s flagship digital wallet, just added PayPal as a payment option for US customers in its “buy crypto solution,” allowing users to purchase ETH and other currencies through the traditional digital payment service. This integration shows continued effort of bringing traditional services into crypto, easing the access of users to the digital asset space.

https://metamask.io/news/latest/metamask-and-paypal-all-you-need-to-know-about-buying-eth/

Number of validators on Ethereum resumes its uptrend

After three flat weeks post-Shanghai, the number of active validators on Ethereum has started going back up. This is a much expected consequence of the fact that, after the upgrade, ETH may now be unstaked, implying that investors can deposit their holdings in exchange for an annual yield with the confidence that this allocated capital can be redeemed back later on. As of writing, almost 50,000 validators are on the entry queue for Ethereum staking, while the backlog for validators exiting the network’s validation set is below 10 validators.

Texas embraces greener Bitcoin mining with approval of flare gas emission bill

The Texas House and Senate have passed House Bill 591, paving the way for Bitcoin miners to use flare gas emissions. The bill “clarifies” the sale of flare emissions for use by mobile data centers, often including Bitcoin miners, lowering the cost of using this type of excess energy from oil and gas extraction. This news reassures the idea of using Bitcoin mining as a means to mitigate greenhouse gas emissions, repurposing energy that would otherwise be wasted.

Binance pauses Bitcoin withdrawals, blames network congestion

Early last week, Binance temporarily paused Bitcoin withdrawals citing network congestion. This decision comes amidst increased transaction activity and congestion on the Bitcoin network. The average Bitcoin transaction fee was near its highest point in almost two years. As mentioned on last week’s Hash insider, Bitcoin network activity has surged after the introduction of NFT projects and BRC-20 token on its network. This event highlights the importance of maintaining a safe custody of crypto assets to mitigate risks associated with centralized institutions.

https://decrypt.co/139228/binance-pauses-bitcoin-withdrawals-blames-network-congestion

From Hashdex:

On Wednesday, join CF Benchmarks CEO, Sui Chung, and our CIO, Samir Kerbage, for an enlightening conversation regarding the investment case for crypto, the wider digital asset class, and emerging trends in this space. You can register here.

What to watch this week:

Investors will keep an eye on US retail sales on Tuesday and Fed Chairman Jerome Powell will be on a panel with former chairman Bernanke on Friday.

____________________________

This material expresses Hashdex Asset Management Ltd. and its subsidiaries and affiliates (“Hashdex”)'s opinion for informational purposes only and does not consider the investment objectives, financial situation or individual needs of one or a particular group of investors. We recommend consulting specialized professionals for investment decisions. Investors are advised to carefully read the prospectus or regulations before investing their funds. The information and conclusions contained in this material may be changed at any time, without prior notice. Nothing contained herein constitutes an offer, solicitation or recommendation regarding any investment management product or service. This information is not directed at or intended for distribution to or use by any person or entity located in any jurisdiction where such distribution, publication, availability or use would be contrary to applicable law or regulation or which would subject Hashdex to any registration or licensing requirements within such jurisdiction. No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of Hashdex. By receiving or reviewing this material, you agree that this material is confidential intellectual property of Hashdex and that you will not directly or indirectly copy, modify, recast, publish or redistribute this material and the information therein, in whole or in part, or otherwise make any commercial use of this material without Hashdex’s prior written consent.

Investment in any investment vehicle and cryptoassets is highly speculative and is not intended as a complete investment program. It is designed only for sophisticated persons who can bear the economic risk of the loss of their entire investment and who have limited need for liquidity in their investment. There can be no assurance that the investment vehicles will achieve its investment objective or return any capital. No guarantee or representation is made that Hashdex’s investment strategy, including, without limitation, its business and investment objectives, diversification strategies or risk monitoring goals, will be successful, and investment results may vary substantially over time. Nothing herein is intended to imply that the Hashdex s investment methodology or that investing any of the protocols or tokens listed in the Information may be considered “conservative,” “safe,” “risk free,” or “risk averse.”

Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Hashdex, and Hashdex does not assume responsibility for the accuracy of such information. Hashdex does not provide tax, accounting or legal advice. Certain information contained herein constitutes forward-looking statements, which can be identified by the use of terms such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” “believe” (or the negatives thereof) or other variations thereof. Due to various risks and uncertainties, including those discussed above, actual events or results, the ultimate business or activities of Hashdex and its investment vehicles or the actual performance of Hashdex, its investment vehicles, or digital tokens may differ materially from those reflected or contemplated in such forward-looking statements. As a result, investors should not rely on such forward- looking statements in making their investment decisions. None of the information contained herein has been filed with the U.S. Securities and Exchange Commission or any other governmental or self-regulatory authority. No governmental authority has opined on the merits of Hashdex’s investment vehicles or the adequacy of the information contained herein