Dear Investor,

October, a month that has historically delivered solid returns for bitcoin and other digital assets, proved challenging for crypto, even as bitcoin (BTC) hit a new all-time high early in the month.

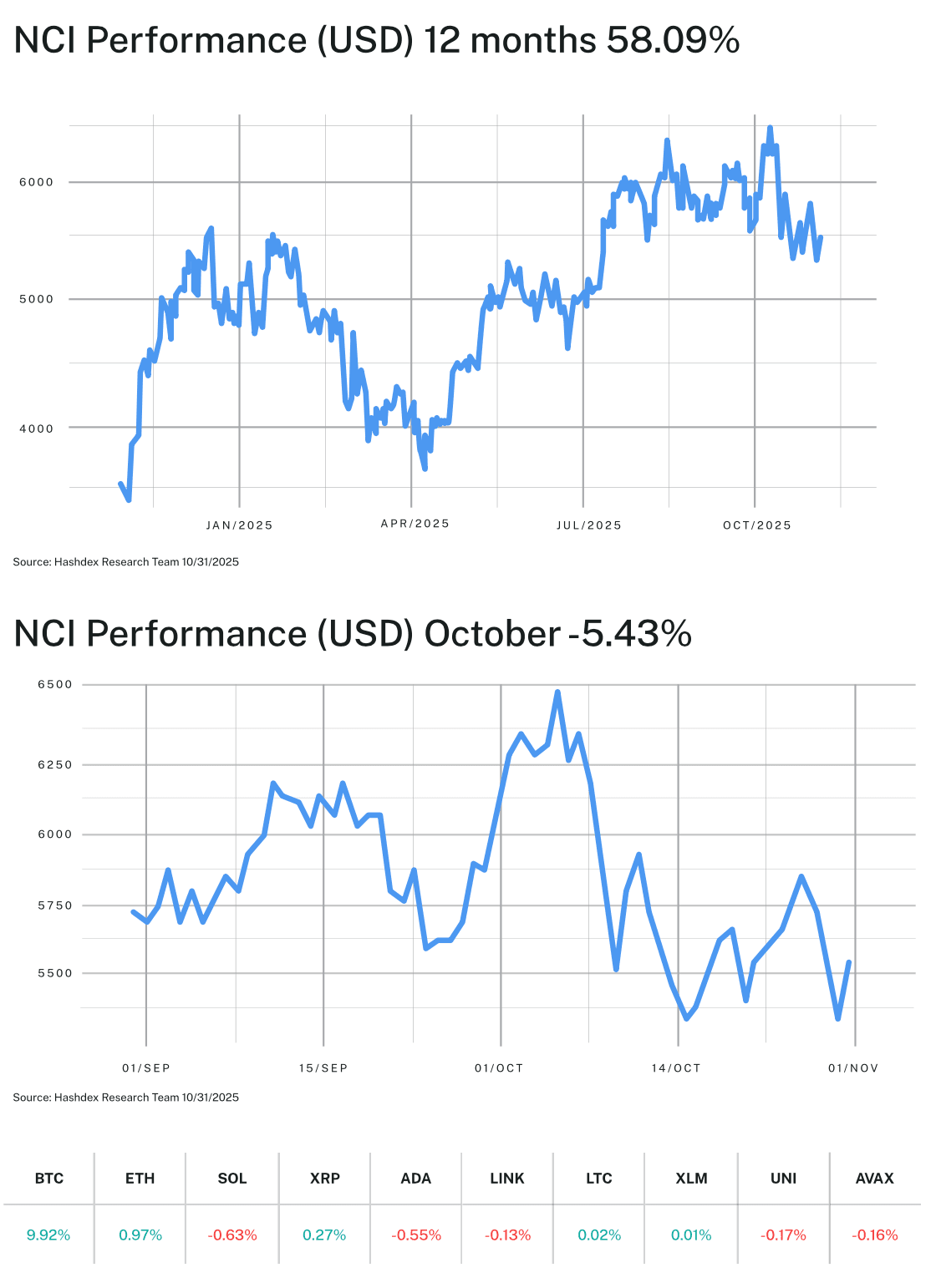

The Nasdaq Crypto IndexTM (NCITM) fell 5.43%, with BTC ending the month down 3.95%, Ethereum dropping 6.52%, and Solana falling 9.64%. Bitcoin’s all-time high of $126,223 was followed less than a week later by an 18% drop in the immediate wake of President Trump's October 10 announcement of 100% tariffs on Chinese imports.

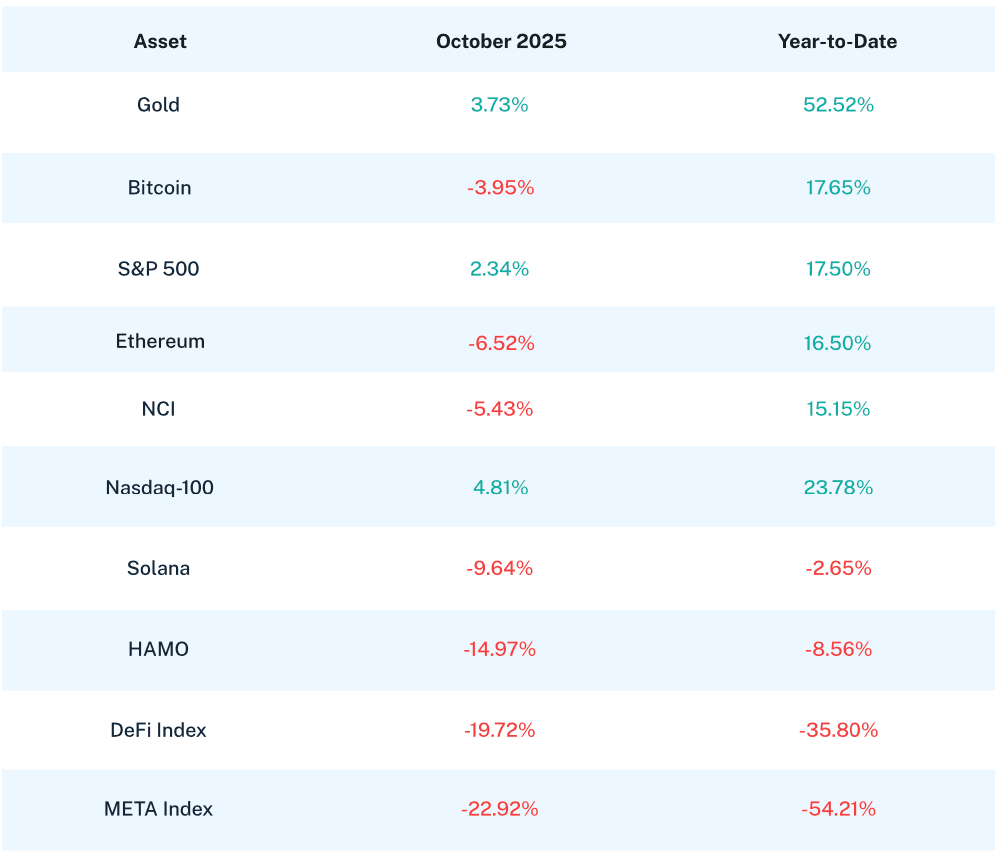

Despite the difficult month, BTC's 17.65% YTD return is slightly ahead of the S&P 500's 17.50% return, while the NCI's 15.15% performance demonstrates the value of market cap-weighted exposure that automatically adjusts to changing conditions.

In his latest Notes from the CIO, Samir Kerbage discusses the “discipline dividend” that rewards patient crypto investors over time. Our research team also released a report this month on why index investing in crypto can provide much-needed diversification benefits for investors.

As always, we are greatly appreciative of your trust in us and are here to answer any questions you may have.

-Your Partners at Hashdex

Market Review

October delivered crypto's most paradoxical month yet—record institutional accumulation coinciding with the worst October performance in over a decade. The Nasdaq CryptoTM Index (NCITM) declined 5.43%, yet beneath this surface turbulence, structural forces were reshaping crypto markets. Bitcoin hit an all-time high of $126,223 on October 5, only to crash 18% to $102,000 within nine hours of Trump's October 10 announcement of 100% tariffs on Chinese imports—triggering a $19 billion liquidation cascade that wiped out 1.62 million traders in 24 hours, the largest deleveraging event in crypto history.

Traditional markets navigated October's volatility with composure. The S&P 500 gained 2.34%, notching its sixth consecutive monthly advance, while the Nasdaq-100 rose 4.81%, powered by AI enthusiasm and robust earnings. Gold emerged as October's champion, surging 3.73% to extend its year-to-date gain to an extraordinary 52.52%, briefly touching a record $4,381 per ounce. The Federal Reserve's October 29 rate cut of 25 basis points to 3.75%-4.00% came with unexpectedly hawkish guidance, as Chairman Powell stated that a December cut is "not a foregone conclusion—far from it."

Bitcoin's 3.95% October decline masks extraordinary volatility and underlying strength. After the October 5 all-time high—accompanied by a record single-day ETF inflow of $1.21 billion—the October 10-11 tariff panic saw Bitcoin crash from $122,000 to $102,000 in just nine hours before stabilizing near $110,000. Spot accumulation continued throughout the volatility, with Bitcoin ETFs now holding 1.296 million BTC (6.5% of total supply), while MicroStrategy's holdings surpassed 640,000 BTC valued at over $47 billion.

Ethereum declined 6.52% despite significant positive catalysts. Approximately 1 million ETH were withdrawn from exchanges during October, with Binance alone seeing outflows of 820,000 ETH. This supply squeeze—exchange reserves hitting multi-year lows—occurred as 36.8 million ETH (30.2% of supply) remained staked, and ETF flows totaled $621.4 million. The October 28 confirmation of the Fusaka upgrade's December 3 launch, featuring PeerDAS for improved Layer 2 scaling, provided a technical tailwind markets seemed too distracted to appreciate.

Solana posted a 9.64% decline, though its year-to-date performance of -2.65% remains near breakeven. Thematic indices endured a particularly punishing month. The Digital Culture (META) index plunged 22.92%, extending its year-to-date decline to 54.21%. The Decentralized Finance (DeFi) index fell 19.72% (YTD: -35.80%), despite DeFi lending markets handling $100 billion without systemic failures. The Smart Contract Platform (Web3) index declined 17.09%, while the Vinter Hashdex Risk Parity Momentum (HAMO) index dropped 14.97%.

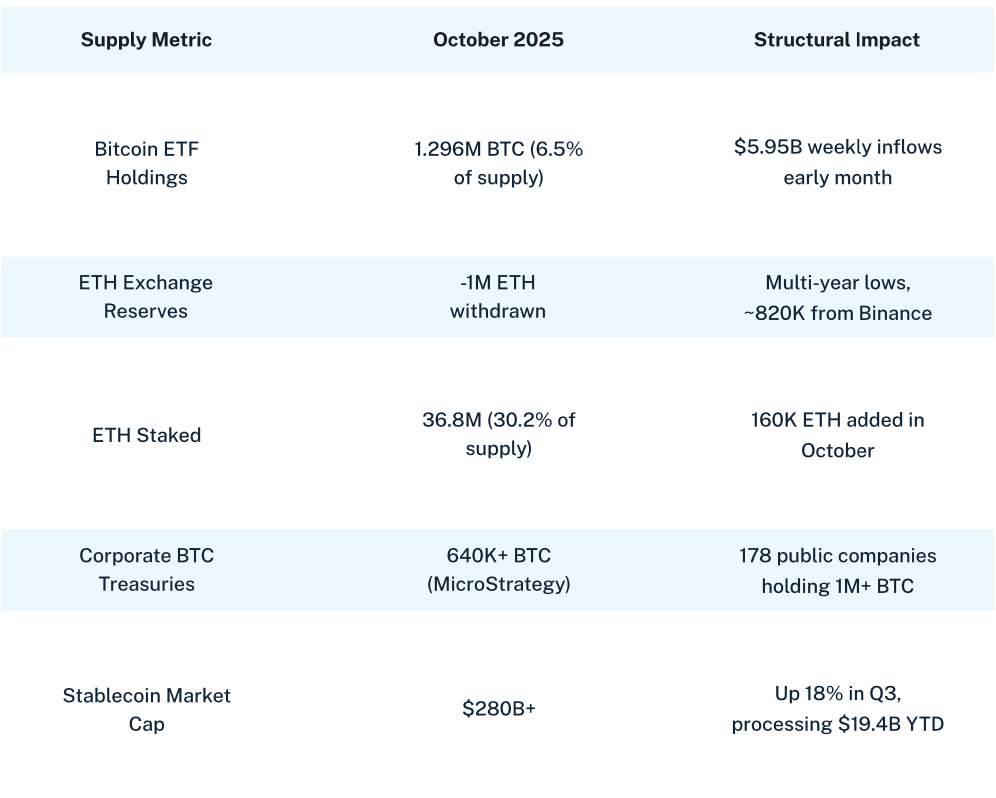

The Supply Mechanics: What Price Charts Don't Reveal

October's most important story wasn't visible in price charts but evident in on-chain metrics. While overleveraged positions were liquidated, patient capital accumulated at scale:

When 6.5% of Bitcoin's supply sits in ETF vehicles that rarely sell, when 30% of Ethereum is locked in staking contracts, when exchanges report the lowest balances since 2018—these conditions create asymmetric setups where modest demand increases can drive outsized price responses. The October 10 liquidation event—which wiped out $7 billion in the first hour alone—cleansed the market of excessive leverage, yet BlackRock's IBIT continued its march toward $100 billion in assets—the fastest ETF to reach this milestone in history.

Year-to-date returns through October 31 reveal crypto's resilience:

Bitcoin's 17.65% YTD return now matches the S&P 500's 17.50%, while Ethereum's 16.50% gain keeps pace with traditional equities. The NCI's 15.15% performance demonstrates the value of market cap-weighted exposure that automatically adjusts to changing conditions.

Market Cap-Weighted Indices: Protection During Volatility

October's conditions validated systematic exposure through market cap-weighted indices. Attempting to navigate between Bitcoin's 15% intramonth drawdown, Ethereum's supply squeeze dynamics, and the META index's 22.92% collapse would have required impossible foresight. The NCI's heavy Bitcoin allocation provided relative stability, declining 5.43% while smaller-cap sectors cratered by 15-23%. This downside protection preserves capital during drawdowns, allowing compounding during recoveries.

Looking Ahead: From Liquidation to Accumulation

Multiple catalysts position crypto markets for potential reversal. The October 30 Trump-Xi summit resulted in meaningful progress—fentanyl tariffs reduced from 20% to 10%, overall China tariff rates declining from 100% to approximately 47%. Exchange balances remain at multi-year lows while ETF holdings grow and staking ratios rise. Despite October's volatility, 59% of institutional investors now allocate 10%+ of portfolios to digital assets. The infrastructure for institutional participation is fully operational.

The disconnect between deteriorating prices and improving fundamentals creates asymmetric opportunities. October's lesson is clear: focus on structural forces over short-term volatility. The supply squeeze is real. The institutional adoption is accelerating. When adoption metrics and supply mechanics assert themselves in price discovery, investors with systematic exposure through vehicles like the NCI will be positioned to benefit.

Top Stories

Trump picks Michael Selig to lead CFTC

Selig, a former SEC crypto legal advisor, has a background in traditional markets and digital assets. The nomination could signal a potentially more crypto-friendly CFTC, paving the way for clearer rules on derivatives and market structure, further boosting adoption and innovation.

JPMorgan to accept BTC and ETH as collateral

JPMorgan will let institutional clients pledge Bitcoin and Ethereum as collateral for loans, with assets held by third-party custodians. A new mainstream use for crypto could strengthen the link with TradFi, expanding BTC/ETH’s use as financial assets and reinforcing their long-term investment case.

Standard Chartered sees tokenization market hitting trillions

Standard Chartered projects tokenized real-world assets could grow to $2 trillion by 2028, mostly on Ethereum, driven by the tokenization of money-market funds, equities, and private assets. The forecast hints accelerating institutional adoption of blockchain infrastructure and signals Ethereum’s crucial role in tokenization, by reinforcing the investment case for crypto’s infrastructure layer.

_____________________________

This material expresses Hashdex Asset Management Ltd. and its subsidiaries and affiliates (“Hashdex”)'s opinion for informational purposes only and does not consider the investment objectives, financial situation or individual needs of one or a particular group of investors. We recommend consulting specialized professionals for investment decisions. Investors are advised to carefully read the prospectus or regulations before investing their funds.

The information and conclusions contained in this material may be changed at any time, without prior notice. Nothing contained herein constitutes an offer, solicitation or recommendation regarding any investment management product or ser vice. This information is not directed at or intended for distribution to or use by any person or entity located in any jurisdiction where such distribution, publication, availability or use would be contrary to applicable law or regulation or which would subject Hashdex to any registration or licensing requirements within such jurisdiction.

These opinions are derived from internal studies and do not have access to any confidential information. Please note that future events may not unfold as anticipated by our team’s research and analysis. No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of Hashdex.

By receiving or reviewing this material, you agree that this material is confidential intellectual property of Hashdex and that you will not directly or indirectly copy, modify, recast, publish or redistribute this material and the information therein, in whole or in part, or other wise make any commercial use of this material without Hashdex’s prior written consent.

Investment in any investment vehicle and crypto assets is highly speculative and is not intended as a complete investment program. It is designed only for sophisticated persons who can bear the economic risk of the loss of their entire investment and who have limited need for liquidity in their investment. There can be no assurance that the investment vehicles will achieve its investment objective or return any capital. No guarantee or representation is made that Hashdex’s investment strategy, including, without limitation, its business and investment objectives, diversification strategies or risk monitoring goals, will be successful, and investment results may var y substantially over time.

Nothing herein is intended to imply that the Hashdex s investment methodology or that investing any of the protocols or tokens listed in the Information may be considered “conservative,” “safe,” “risk free,” or “risk averse.” These opinions are derived from internal studies and do not have access to any confidential information. Please note that future events may not unfold as anticipated by our team’s research and analysis.

Certain information contained herein (including financial information) has been obtained from published and unpublished sources. Such information has not been independently verified by Hashdex, and Hashdex does not assume responsibility for the accuracy of such information. Hashdex does not provide tax, accounting or legal advice. Certain information contained herein constitutes for ward-looking statements, which can be identified by the use of terms such as “may,” “ will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” “believe” (or the negatives thereof ) or other variations thereof. Due to various risks and uncertainties, including those discussed above, actual events or results, the ultimate business or activities of Hashdex and its investment vehicles or the actual performance of Hashdex, its investment vehicles, or digital tokens may differ materially from those reflected or contemplated in such for ward-looking statements.

As a result, investors should not rely on such for ward- looking statements in making their investment decisions. None of the information contained herein has been filed with the U.S. Securities and Exchange Commission or any other governmental or self-regulator y authority. No governmental authority has opined on the merits of Hashdex’s investment vehicles or the adequacy of the information contained herein.

Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular digital asset or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any digital asset or any representation about the financial condition of a digital asset. Statements regarding Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate assets before investing. ADVICE FROM A FINANCIAL PROFESSIONAL IS STRONGLY ADVISED.