1. MARKET OBSERVATIONS

January 26, 2026 to February 1, 2026

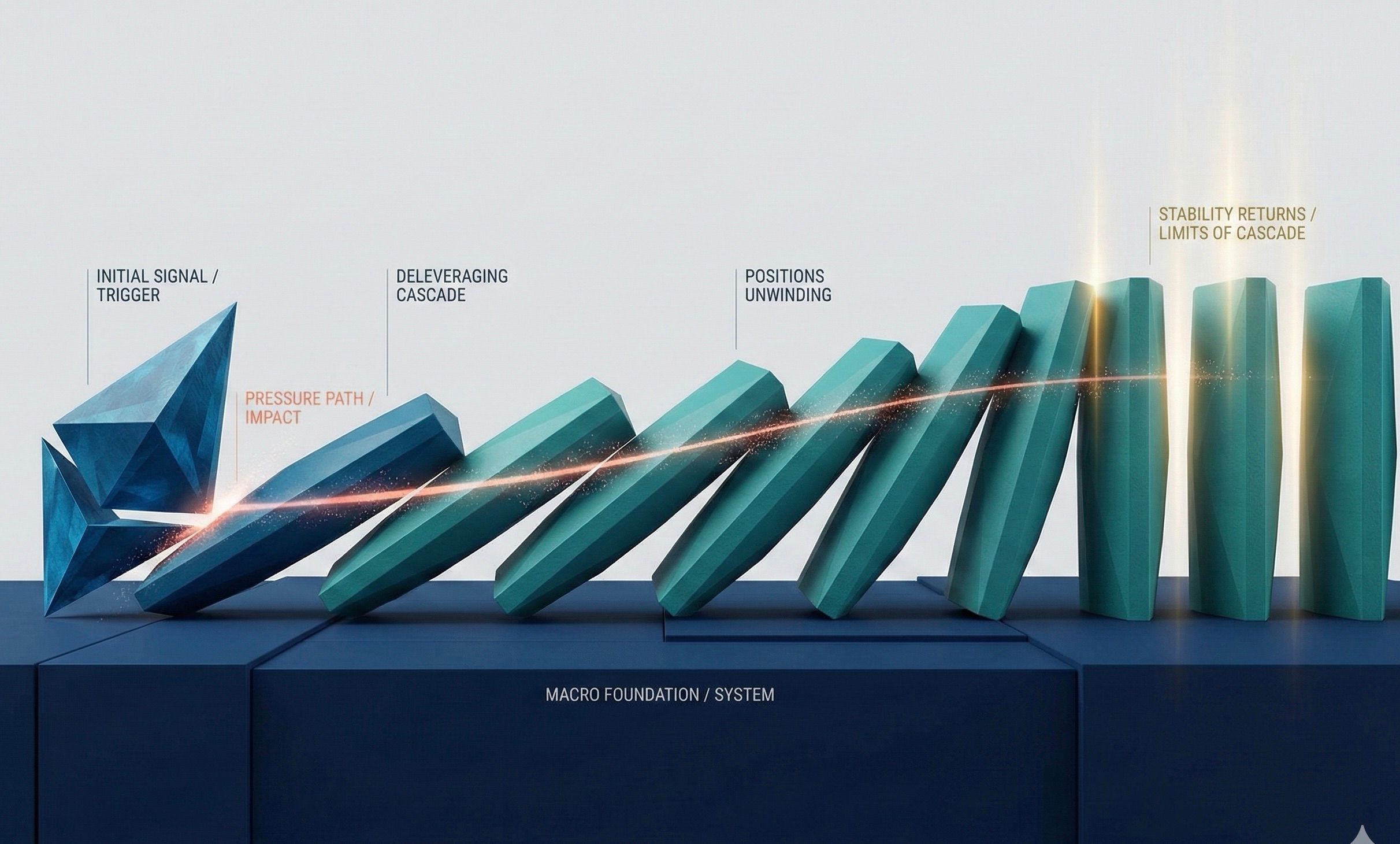

NCI Performance (Weekly): The Nasdaq CME CryptoTM Index fell 12.0% marking a second consecutive week of sharp declines, with BTC (-10.9%), ETH (-17.4%), and SOL (-14%) underperforming. ETF outflows, forced deleveraging ($1.7bn in liquidations), and weaker institutional risk appetite pressured prices despite improving regulatory and on-chain signals. Importantly, the move was part of a broader risk-off episode, with gold and silver also posting notable declines, suggesting macro forces — rather than crypto-specific factors — may have driven the sell-off.

BOJ hawkish signals deepen global risk-off

BOJ minutes pointed to further rate hikes as yen weakness fuels inflation, with markets pricing a faster move toward a 1% policy rate. The shift pressured risk assets, intensifying this week’s sharp crypto sell-off alongside broader markets.1

Crypto activity returns to all-time highs amid CLARITY Act revisions

Monthly active users and transactions in crypto have reached levels similar to the approval of the GENIUS Act, with a total of $4.2 billion transactions and 500k active users.2

U.S. crypto ETFs experienced the third worst month of outflows

U.S. regulated products including BTC and ETH ETFs, experienced $1.9 billion in outflows in January, a heavy reduction of crypto exposure by institutional investors.3