This article has been published on Financial Advisor on August 23.

This summer has been a memorable one for crypto investors. A series of industry and regulatory updates showcases a maturation of the asset class, but the abundance of news has created a greater need for wealth managers to stay knowledgeable to best serve clients who are increasingly interested in allocating a portion of their portfolio to digital assets.

In early June, the SEC sued Coinbase, the largest U.S. crypto exchange, alleging that it violated securities laws by having certain digital assets on its platform. This came the day after the agency sued Binance, the largest exchange in the world, for operating an unregistered U.S. exchange, among other charges.

But the bigger—and more surprising—summer news came a week later when BlackRock filed for a spot bitcoin ETF. This monumental filing by the world’s largest asset manager was followed by similar applications from Fidelity, Invesco and several other massive asset managers.

While these ETF filings are part of longer-term secular institutional adoption, this trend picked up significant steam this summer: Deutsche Bank applied for a crypto custody license and Société Générale obtained France's first crypto custody and brokerage license; EDX Markets was launched, a crypto exchange backed by Citadel, Fidelity and Schwab; the Financial Times reported that Standard Chartered and Nomura are building crypto trading platforms to attract fund managers and institutional investors; and BNY Mellon, the oldest U.S. bank, confirmed it is building crypto custody and clearing services.

It’s clear many large institutions are increasingly optimistic about the long-term outlook for crypto, but we are also seeing a newfound spike in interest from wealth managers and their clients given bitcoin’s strong performance this year. So how should investment professionals view the paradox between regulatory scrutiny and broad adoption? We think there are three things wealth managers should consider.

1. Access is increasing. A well-known ETF analyst recently gave the chances of a spot bitcoin ETF being approved at “close to 100%.” This is now a question of “when” not “if” and in the meantime there are bitcoin futures ETFs that can help give investors price exposure to bitcoin. While we don’t know the exact timing of a spot ETF, BlackRock’s entrance has solidified the argument that investors are demanding exposure to bitcoin and the SEC cannot continue to ignore this demand. The specifics of what type of spot bitcoin ETF will be first to market is also unknown, but it’s clear that U.S. investors will have access to a spot ETF—just like investors in Europe, Canada, Brazil and many other countries—sooner than previously thought.

2. Bitcoin’s investment case is strengthening. Bitcoin’s investment thesis was tested this year during the banking crisis and the world’s first cryptocurrency passed with flying colors. Its store-of-value attributes led to increased investor demand as questions about Fed policy and bank solvencies took center stage. This is one of the reasons why BlackRock CEO Larry Fink spoke about bitcoin “digitizing gold” in a recent interview. As economic uncertainty persists, there is a strong argument to be made that bitcoin is a very attractive store-of-value asset within portfolios, which may be a key driving factor in BTC hitting another all-time-high in 2024.

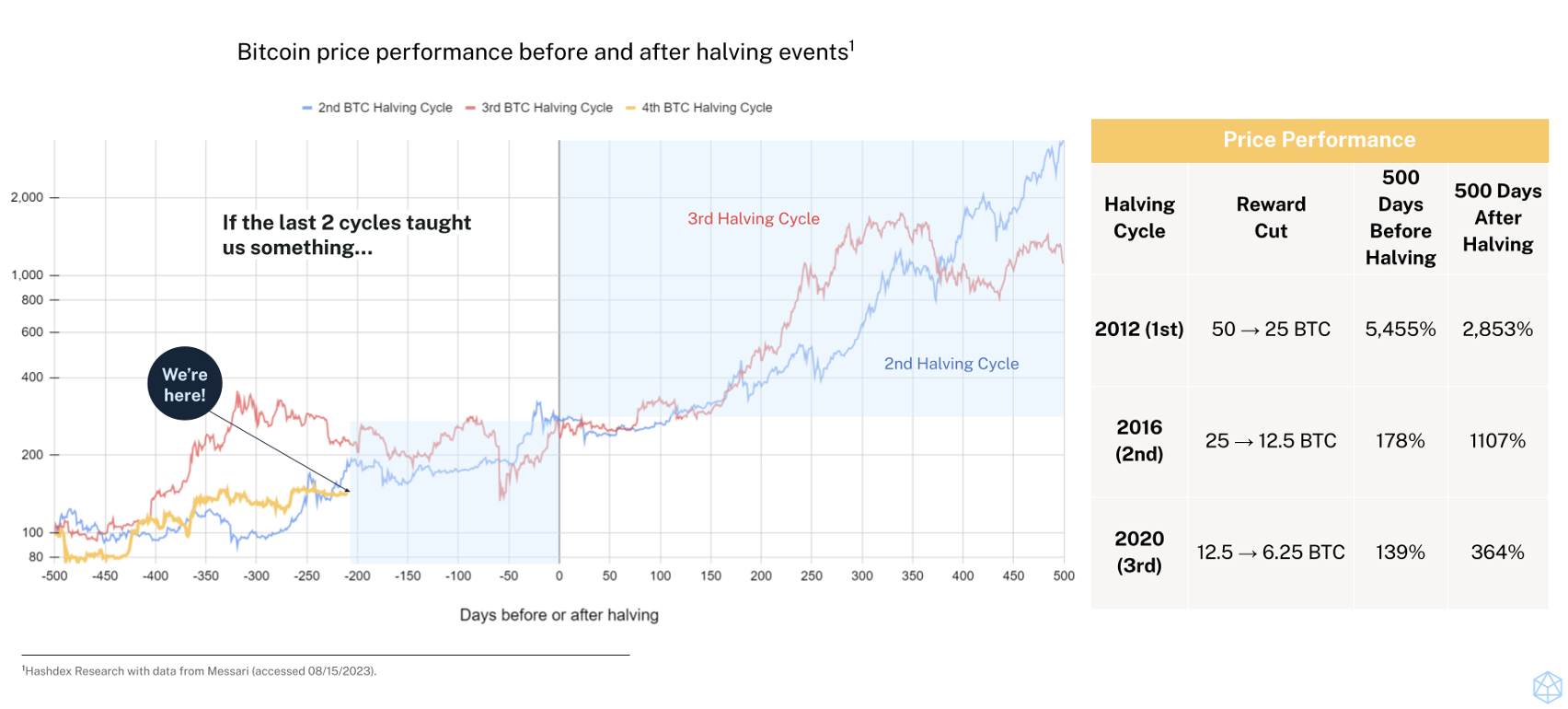

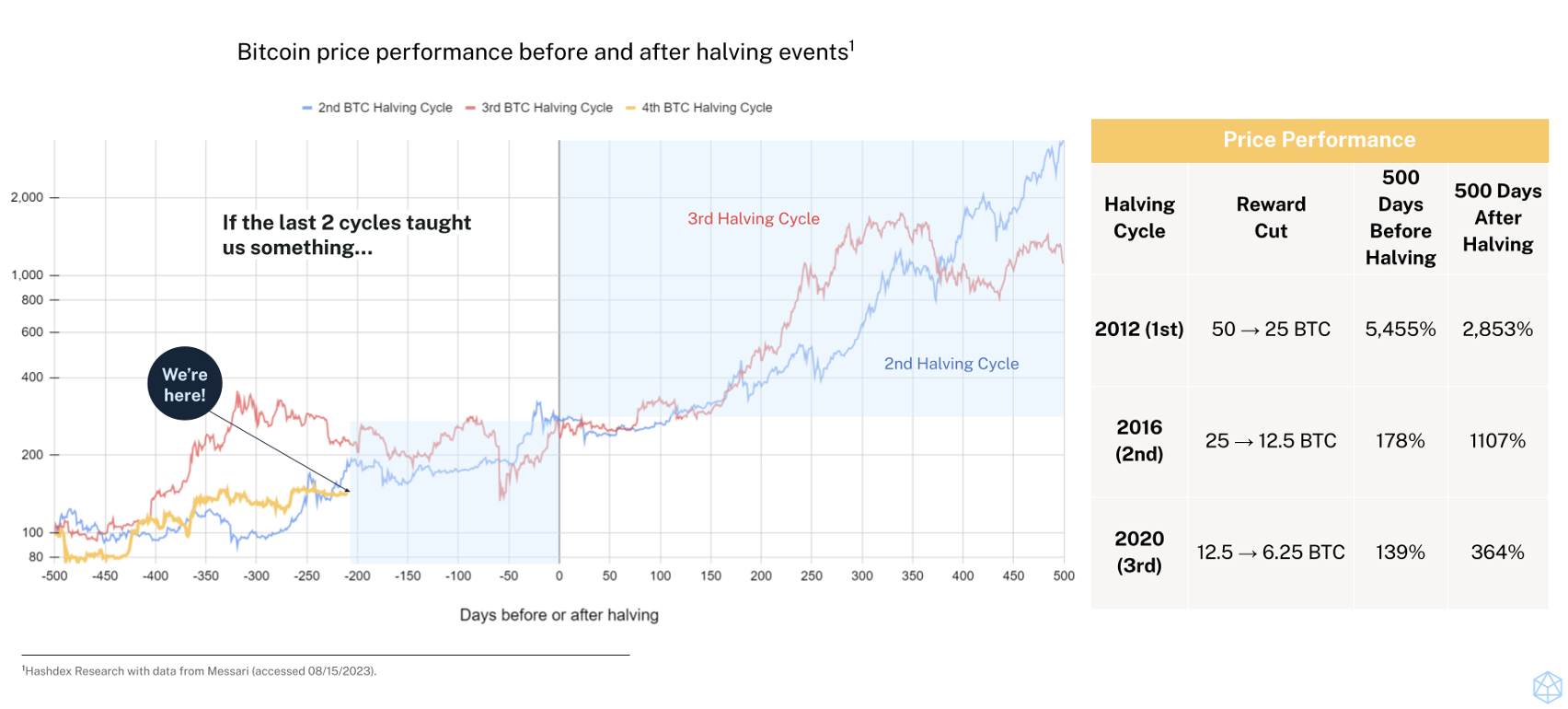

Additionally, in the last 12 months bitcoin’s fundamentals have significantly improved. In addition to its price rising over 60% this year, there are now over one million active bitcoin addresses, a metric that underscores its appeal from individuals. And Bitcoin’s next “halving” will take place in May 2024, a programmed event every four years to control BTC’s inflation rate and protect its scarcity. In the past, the 12–18-month period following each halving has led to strong price appreciation.

3. Regulatory clarity is on its way. How crypto projects and intermediaries will be regulated in the U.S. remains an outstanding question for the industry and investors. There are promising legislative efforts to create a framework for crypto assets and service providers in the U.S., but the industry will generally operate in an uncertain regulatory environment in the near- to mid-term. However, the largest and most liquid of these assets, bitcoin, enjoys a far greater level of regulatory clarity than other crypto assets given that it is viewed as strictly a commodity. This clarity, in our opinion, has made it easier for financial advisors to make portfolio allocations to bitcoin in the current environment. Growing bipartisan consensus around the importance of the industry indicates that broader legislation may come through in the upcoming months. When a regulatory framework is finalized in the U.S.—as it has been in Europe with the Markets in Crypto Assets (MiCA)—bitcoin investors will benefit from the clarity for custodians, exchanges, and other service providers.

As the manager of crypto funds since 2018, we have seen many ups and downs in price and sentiment. While questions remain about exactly how large-scale institutional adoption will unfold, one thing confirmed this summer is that the long-term institutional commitment to this space is here to stay. This commitment is only going to drive demand for BTC higher and an event like the approval of a spot bitcoin ETF could result in this happening very fast. For now, we are encouraging advisors and wealth managers to get exposure to bitcoin through regulated products like a ‘33 Act bitcoin futures ETF, while continuing to monitor the fast-changing regulatory landscape to stay ahead of the next level of institutional adoption.

___________________________________________________

This material expresses Hashdex Asset Management Ltd. and its subsidiaries and affiliates (“Hashdex”)'s opinion for informational purposes only and does not consider the investment objectives, financial situation or individual needs of one or a particular group of investors. We recommend consulting specialized professionals for investment decisions. Investors are advised to carefully read the prospectus or regulations before investing their funds. The information and conclusions contained in this material may be changed at any time, without prior notice. Nothing contained herein constitutes an offer, solicitation or recommendation regarding any investment management product or service. This information is not directed at or intended for distribution to or use by any person or entity located in any jurisdiction where such distribution, publication, availability or use would be contrary to applicable law or regulation or which would subject Hashdex to any registration or licensing requirements within such jurisdiction. No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of Hashdex. By receiving or reviewing this material, you agree that this material is confidential intellectual property of Hashdex and that you will not directly or indirectly copy, modify, recast, publish or redistribute this material and the information therein, in whole or in part, or otherwise make any commercial use of this material without Hashdex’s prior written consent.

Investment in any investment vehicle and cryptoassets is highly speculative and is not intended as a complete investment program. It is designed only for sophisticated persons who can bear the economic risk of the loss of their entire investment and who have limited need for liquidity in their investment. There can be no assurance that the investment vehicles will achieve its investment objective or return any capital. No guarantee or representation is made that Hashdex’s investment strategy, including, without limitation, its business and investment objectives, diversification strategies or risk monitoring goals, will be successful, and investment results may vary substantially over time. Nothing herein is intended to imply that the Hashdex s investment methodology or that investing any of the protocols or tokens listed in the Information may be considered “conservative,” “safe,” “risk free,” or “risk averse.”

Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Hashdex, and Hashdex does not assume responsibility for the accuracy of such information. Hashdex does not provide tax, accounting or legal advice. Certain information contained herein constitutes forward-looking statements, which can be identified by the use of terms such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” “believe” (or the negatives thereof) or other variations thereof. Due to various risks and uncertainties, including those discussed above, actual events or results, the ultimate business or activities of Hashdex and its investment vehicles or the actual performance of Hashdex, its investment vehicles, or digital tokens may differ materially from those reflected or contemplated in such forward-looking statements. As a result, investors should not rely on such forward- looking statements in making their investment decisions. None of the information contained herein has been filed with the U.S. Securities and Exchange Commission or any other governmental or self-regulatory authority. No governmental authority has opined on the merits of Hashdex’s investment vehicles or the adequacy of the information contained herein.