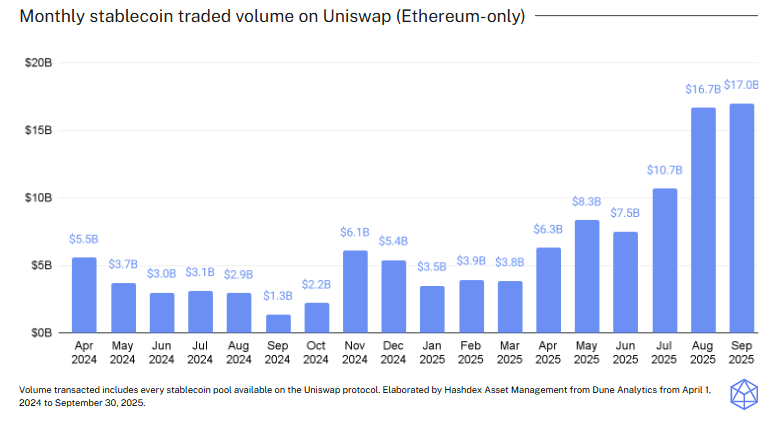

1. CHART OF THE WEEK

In previous editions, we highlighted the crucial role of stablecoins in the crypto ecosystem—particularly in powering applications and decentralized finance (DeFi)—and how they serve as a bridge between real-world liquidity and the digital economy.

Uniswap, the largest decentralized exchange, illustrates this dynamic well. Over the past 12 months, the volume of stablecoins traded on the platform has followed a strong upward trend. On Ethereum only, total swap volume surged from $1.3 billion in September 2024 to $16.9 billion last month, underscoring growing demand and activity not only on DeFi but for stablecoin usage in particular.

As regulatory frameworks for crypto and stablecoins continue to evolve, these figures could rise even further, reinforcing DeFi’s integration into the mainstream financial landscape.

2. MARKET HIGHLIGHTS

Crypto products see inflows despite shakeout

-

Even amid the largest historical crypto liquidation on Friday, US BTC and ETH ETFs registered US$ 3.2 billion of net inflows last week.

-

This happens as BTC ETFs have gathered $62.7 billion in net inflows since inception, while ETH products are reaching $15 billion of net new capital since their debut in July 2024.

Morgan Stanley opens crypto access to clients

-

Morgan Stanley will permit all clients—not just high-net-worth individuals—to access crypto funds, including retirement and trust accounts.

-

Allowing crypto in retirement accounts could channel a major share of large capital into digital assets—showcasing the rising institutional demand and evolving regulation for crypto, establishing it as a core asset class within diverse portfolios.