Chart of the week

Previous iterations from the Hash Insider already highlighted the importance of user-driven applications to foster crypto adoption and the recent trend of stablecoins companies launching their own blockchain—Stripe’s Tempo launch and Circle’s Arc announcement—enquire if the main catalyst for said adoption isn’t already in place.

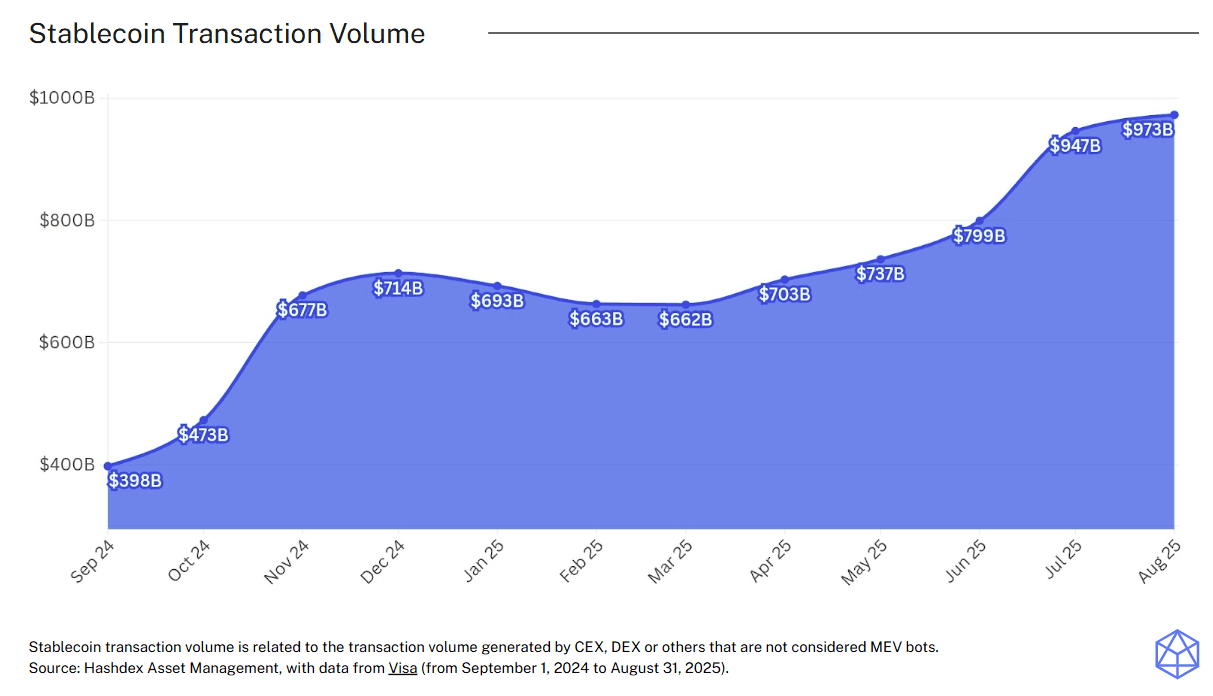

In the last 12 months, stablecoins transactions more than doubled, surging from $398B to almost a trillion dollars. This movement, most influenced by the approval of the GENIUS Act in mid July, showcases a growing interest in the stablecoin universe.

The liquidity bridge between traditional finance and the crypto universe, eased by the creation of stablecoins could be the starting point of a more in depth integration allowing mainstream crypto adoption.

Market Highlights

Stripe and Paradigm to launch Tempo

Financial technology giant Stripe and investment firm Paradigm have partnered to launch a new payments-focused blockchain called Tempo.

Tempo strives to address some of the scalability and efficiency challenges that have hindered the adoption of blockchain for mainstream financial services and to accelerate the integration of traditional finance and decentralized finance (DeFi).

Tether eyes gold investments

Tether, the company behind the world's largest stablecoin in market cap (USDT), is considering a significant investment in the gold supply chain.

Tether's potential expansion into gold could bridge the gap between the traditional commodities market and the digital asset world .

SEC & CFTC to harmonize regulatory landscape

The SEC and the CFTC have announced a joint effort to harmonize the US financial regulatory backbone.

This initiative aims to provide clarity to the markets and strengthen the nation's regulatory structure.

The agencies plan to explore harmonizing product and venue definitions, streamlining reporting and data standards, and aligning capital and margin frameworks.