Dear Investor,

July was an eventful month for the crypto ecosystem, particularly with regard to public policy developments. President Trump signed stablecoin legislation, the GENIUS Act, into law and later in the month his digital assets working group released their much anticipated report.

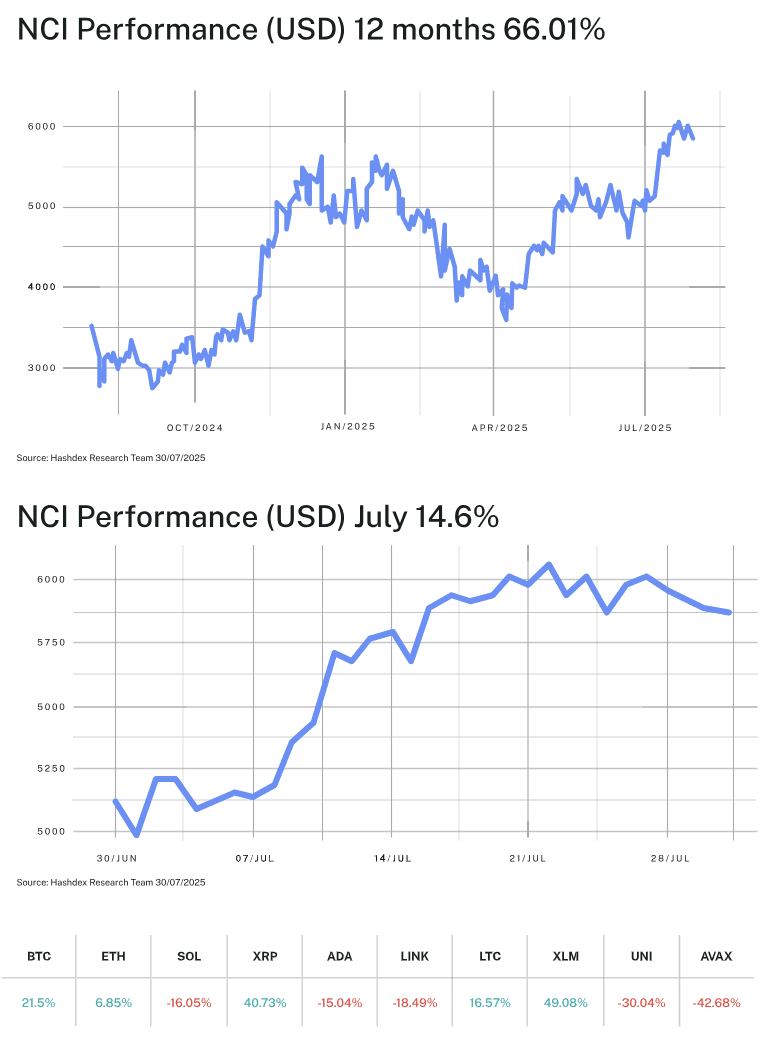

The Nasdaq Crypto IndexTM (NCITM) rose 14.6% in July, its strongest month this year, while the S&P 500 gained 0.6% while the Nasdaq-100 rose 1.3%. Ethereum (ETH) stood out in the NCITM, gaining 48.8% as ETH ETFs attracted over $2 billion in inflows.

Crypto markets benefited from increasing regulatory clarity, particularly the approval of the GENIUS Act. In his latest Notes from the CIO, Samir Kerbage covers why this new legislation is so important to the digital asset ecosystem.

As always, we are greatly appreciative of your trust in us and are here to answer any questions you may have.

-Your Partners at Hashdex

Market Review

July 2025 marked an important development for digital assets as President Trump signed the GENIUS Act into law on July 18, providing regulatory clarity the crypto industry had sought for years. The legislation's impact was notable: the NCITM rose 14.6%, its strongest monthly performance of 2025, while Ethereum gained 48.79% as institutional capital entered newly launched ETH ETFs. This regulatory development, combined with the IRS's removal of DeFi broker reporting requirements, contributed to a broad crypto market rally that outperformed traditional markets—the S&P 500 gained 0.6% while the Nasdaq-100 rose 1.3%.

The Federal Reserve's decision to hold rates steady at 4.25%-4.50% on July 30, despite presidential pressure for cuts, provided important context. While traditional assets faced policy uncertainty, crypto assets benefited from regulatory clarity. The dissent of two Fed governors voting for cuts—the first multiple-governor dissent since 1993—highlighted the complex macroeconomic environment, though crypto markets remained focused on other factors. Investors concentrated on the implications of the GENIUS Act, which positioned the United States prominently in digital asset regulation.

Ethereum's 48.79% monthly gain reflected increased institutional interest. The Ethereum ETFs, which had seen limited adoption since their May launch, attracted $2.2 billion in net inflows during July—more than their previous three months combined. BlackRock's ETHA captured $987 million as institutional investors recognized Ethereum's role in the stablecoin ecosystem. Despite this substantial monthly gain, ETH remains down 12.0% year-to-date, reflecting both early-year challenges and the potential for market shifts when conditions change.

Bitcoin showed steady performance with an 8.6% gain, bringing its year-to-date return to 25.0%—demonstrating consistent performance among major cryptoassets. While Ethereum saw larger gains, Bitcoin continued to attract institutional interest, with MicroStrategy announcing its largest purchase of 27,200 BTC on July 22. Solana posted a solid 11.1% gain despite remaining negative year-to-date at -9.6%, benefiting from increased developer activity and the launch of several high-profile applications on its network.

The thematic indices showed strong collective performance. The Smart Contract Platform (Web3) index increased 31.8%, supported by Ethereum's gains and broader Layer-1 performance. DeFi indices gained 26.4%—their first significant recovery after months of regulatory uncertainty—following the IRS's removal of reporting requirements that had limited institutional participation. The Digital Culture (META) index rose 20.8%, while the Vinter Hashdex Risk Parity Momentum (HAMO) index gained 23.5%, validating its systematic approach during powerful trending markets.

The GENIUS Act Impact: Regulatory Clarity Drives Market Response

July 2025 demonstrated how regulatory clarity can shift market dynamics for digital assets. The GENIUS Act provided a framework that enabled various market participants to engage more directly. Permission for banks to custody stablecoins. Permission for corporations to issue payment tokens. Permission for asset managers to build DeFi products. Most critically, it provided permission for the $7 trillion money market fund industry to begin exploring blockchain-based yield products.

The data illustrates the market's response to regulatory developments. In the 10 trading days following the GENIUS Act signing:

-

Ethereum: +31.2% (institutional ETF flows accelerated)

-

DeFi tokens: +18.4% average gain (regulatory clarity removed overhang)

-

Stablecoin volume: +47% (USDC alone added $8 billion in circulation)

-

DEX volume: +122% (Uniswap processed record $4.1 billion daily volume)

In comparison, traditional markets showed modest movement following the Fed's decision: the S&P 500 gained 0.2% post-FOMC, while 10-year Treasury yields remained relatively stable. This divergence highlighted how regulatory clarity can influence crypto market dynamics differently than traditional assets.

Yield Comparison: Traditional Markets and DeFi

July showed initial signs of capital reallocation between traditional and decentralized finance. With money market funds yielding 4.75% but facing potential Fed cuts, institutional allocators began exploring DeFi's 6-8% stablecoin yields with fresh eyes. The GENIUS Act's explicit authorization of "qualified stablecoin lending protocols" opened doors that compliance departments had kept firmly shut.

Circle's announcement of USDC Yield—a regulated stablecoin lending product targeting 5.5% APY—attracted $500 million in institutional commitments within 48 hours. Aave's institutional arm, Aave Arc, onboarded three new billion-dollar asset managers. Even conservative players moved: Vanguard filed for a "Digital Asset Income Fund" that would allocate up to 10% to DeFi protocols.

This represents strategic capital allocation rather than speculative activity. The 30-day correlation between DeFi yields and Treasury yields turned negative for the first time, signaling that DeFi is becoming a distinct asset class rather than a high-beta risk proxy. July's 26.4% DeFi index gain, while impressive, may be just the beginning of a structural reallocation.

Market Dynamics: The Quality Paradox

An interesting pattern emerged in July's performance data: the highest-quality assets with the clearest use cases saw the strongest gains. Ethereum's smart contract dominance, combined with stablecoin settlement supremacy, drove its 48.79% surge. Bitcoin's digital gold narrative attracted steady institutional flows. Meanwhile, more speculative tokens lagged, with many mid-cap altcoins actually declining despite the broader rally.

This preference for established assets suggests evolving market dynamics. Institutional capital focused on infrastructure rather than speculative assets. Ethereum's substantial gains based on regulatory and institutional developments indicates a shift in how crypto markets respond to fundamental changes.

Year-to-date performance through July 31 shows varied results across asset classes:

-

NCI: +21.3% (diversified exposure captures both stability and upside)

-

Bitcoin: +25.0% (digital gold thesis intact and strengthening)

-

Gold: +27.7% (traditional hedge also performing, validating store-of-value demand)

-

Nasdaq-100: +8.3% (tech struggling with rate uncertainty)

-

S&P 500: +6.1% (broad market lagging alternative assets)

Looking Ahead: The Infrastructure Summer

As we enter August, three dynamics position crypto for continued strength:

-

Stablecoin Explosion: Major banks are racing to launch GENIUS-compliant stablecoins. JPMorgan's JPM Coin expansion, Bank of America's announced entry, and rumors of an "Amazon Pay Coin" could add $100+ billion to stablecoin market cap by year-end.

-

DeFi Institutional Products: Every major asset manager is now building or acquiring DeFi capabilities. The August launch window includes tokenized Treasury products from Franklin Templeton, yield aggregators from State Street, and automated market makers from Citadel Securities.

-

Fed Policy Divergence: Markets increasingly believe the Fed will cut in September despite July's hold. Lower rates would reduce traditional yield alternatives, potentially accelerating the rotation into crypto yields. The CME FedWatch tool shows 67% probability of a September cut.

The infrastructure developments underway are shaping future financial systems. July 2025 demonstrated how regulatory clarity can accelerate market development. For investors in diversified vehicles like the NCITM, these changes provide exposure to evolving digital asset markets.

Traditional finance and digital assets continue to converge, with increasing integration between these previously separate markets. July's performance reflected this ongoing trend toward greater institutional adoption and regulatory acceptance.

Top Stories

President’s Working Group releases digital assets report

The White House has released a report that endorses the potential of digital assets and blockchain technology to revolutionize the US financial system by encouraging the government to operationalize Trump’s promise to make America the “crypto capital of the world.”

SEC launches “Project Crypto”

The SEC is launching a commission-wide initiative to modernize securities rules and regulations for the crypto market, with the goal of enabling American financial markets to move "on-chain." It includes integrating tokenized securities with DeFi, and exploring an "innovation exemption" to allow firms to test business models.

UK allows retail access to crypto ETNs

The UK's Financial Conduct Authority (FCA) is set to allow retail investors access to crypto exchange-traded notes (ETNs). This provides a new, regulated avenue for UK retail investors to gain exposure to the crypto market.

_________________________

This material expresses Hashdex Asset Management Ltd. and its subsidiaries and affiliates (“Hashdex”)'s opinion for informational purposes only and does not consider the investment objectives, financial situation or individual needs of one or a particular group of investors. We recommend consulting specialized professionals for investment decisions. Investors are advised to carefully read the prospectus or regulations before investing their funds.

The information and conclusions contained in this material may be changed at any time, without prior notice. Nothing contained herein constitutes an offer, solicitation or recommendation regarding any investment management product or ser vice. This information is not directed at or intended for distribution to or use by any person or entity located in any jurisdiction where such distribution, publication, availability or use would be contrary to applicable law or regulation or which would subject Hashdex to any registration or licensing requirements within such jurisdiction.

These opinions are derived from internal studies and do not have access to any confidential information. Please note that future events may not unfold as anticipated by our team’s research and analysis. No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of Hashdex.

By receiving or reviewing this material, you agree that this material is confidential intellectual property of Hashdex and that you will not directly or indirectly copy, modify, recast, publish or redistribute this material and the information therein, in whole or in part, or other wise make any commercial use of this material without Hashdex’s prior written consent.

Investment in any investment vehicle and crypto assets is highly speculative and is not intended as a complete investment program. It is designed only for sophisticated persons who can bear the economic risk of the loss of their entire investment and who have limited need for liquidity in their investment. There can be no assurance that the investment vehicles will achieve its investment objective or return any capital. No guarantee or representation is made that Hashdex’s investment strategy, including, without limitation, its business and investment objectives, diversification strategies or risk monitoring goals, will be successful, and investment results may var y substantially over time.

Nothing herein is intended to imply that the Hashdex s investment methodology or that investing any of the protocols or tokens listed in the Information may be considered “conservative,” “safe,” “risk free,” or “risk averse.” These opinions are derived from internal studies and do not have access to any confidential information. Please note that future events may not unfold as anticipated by our team’s research and analysis.

Certain information contained herein (including financial information) has been obtained from published and unpublished sources. Such information has not been independently verified by Hashdex, and Hashdex does not assume responsibility for the accuracy of such information. Hashdex does not provide tax, accounting or legal advice. Certain information contained herein constitutes for ward-looking statements, which can be identified by the use of terms such as “may,” “ will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” “believe” (or the negatives thereof ) or other variations thereof. Due to various risks and uncertainties, including those discussed above, actual events or results, the ultimate business or activities of Hashdex and its investment vehicles or the actual performance of Hashdex, its investment vehicles, or digital tokens may differ materially from those reflected or contemplated in such for ward-looking statements.

As a result, investors should not rely on such for ward- looking statements in making their investment decisions. None of the information contained herein has been filed with the U.S. Securities and Exchange Commission or any other governmental or self-regulator y authority. No governmental authority has opined on the merits of Hashdex’s investment vehicles or the adequacy of the information contained herein.

Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular digital asset or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any digital asset or any representation about the financial condition of a digital asset. Statements regarding Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate assets before investing. ADVICE FROM A FINANCIAL PROFESSIONAL IS STRONGLY ADVISED.